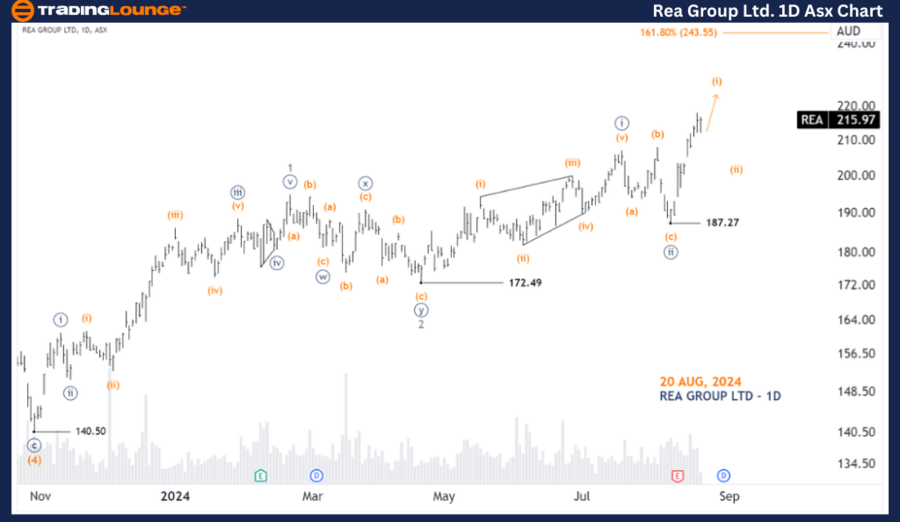

ASX: REA GROUP LTD – REA Elliott Wave Technical Analysis (1D Chart)

Greetings, today's Elliott Wave analysis provides an update on REA GROUP LTD (ASX: REA) on the Australian Stock Exchange. Our analysis suggests that REA.ASX may experience a rise, driven by wave ((iii))-navy development.

ASX: REA GROUP LTD – REA Elliott Wave Technical Analysis

ASX: REA GROUP LTD – REA 1D Chart (Semilog Scale) Analysis

Function: Major Trend (Minor degree, gray)

Mode: Motive

Structure: Impulse

Position: Wave (i)-orange of Wave ((iii))-navy

Details: Wave ((iii))-navy is currently unfolding, signaling a potential upward movement. This wave is subdividing into wave (i)-orange, which is expected to push higher. A significant decline following this movement may indicate the onset of wave (ii)-orange, suggesting a potential downward correction before wave (iii)-orange resumes its upward trajectory.

Invalidation Point: 187.27

ASX: REA GROUP LTD – REA Elliott Wave Analysis (4-Hour Chart)

ASX: REA GROUP LTD – REA 4-Hour Chart Analysis

Function: Major Trend (Minute degree, navy)

Mode: Motive

Structure: Impulse

Position: Wave (i)-orange of Wave ((iii))-navy

Details: Since reaching the low of 172.49, waves ((i)) and ((ii))-navy have completed their formation. The ((iii))-navy wave has begun developing from the low of 187.27, which is subdividing into the (i)-orange wave. This wave is expected to push slightly higher, potentially targeting the 222.90 level. However, given the considerable progress of the (i)-orange wave, it may conclude at any point. A drop below the 207.58 level would indicate the beginning of the (ii)-orange wave.

Invalidation Point: 187.27

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: WiseTech Global Limited (WTC) Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

Our Elliott Wave analysis of ASX: REA GROUP LTD (REA) aims to provide valuable insights into current market trends and strategies to capitalize on them. We offer specific price points that serve as validation or invalidation signals for our wave count, enhancing confidence in our analysis. By integrating these elements, we aim to deliver an objective and professional perspective on the market trends affecting REA.ASX.