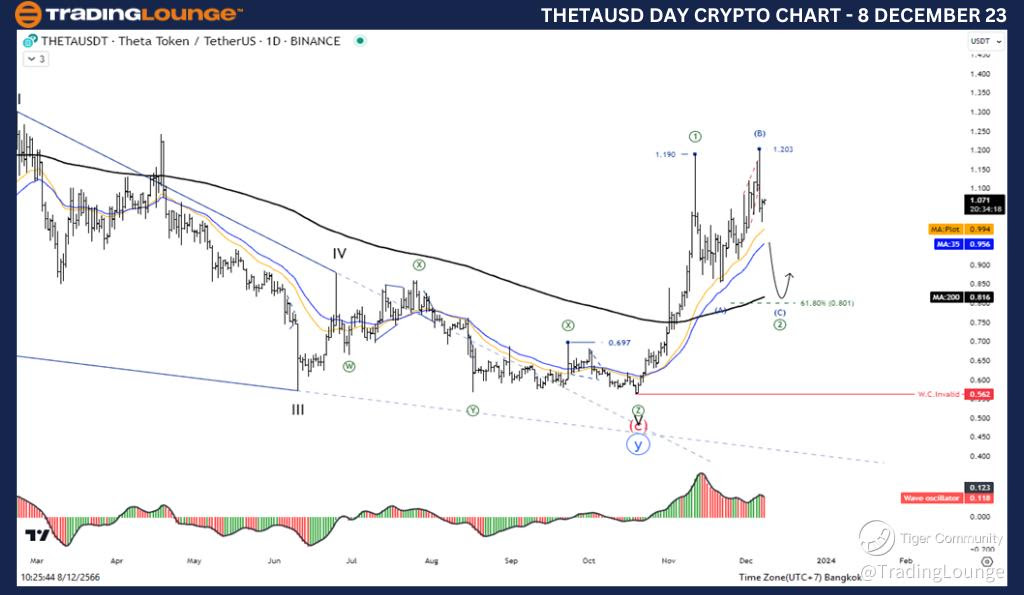

Elliott Wave Analysis TradingLounge Daily Chart, 8 December 23,

Theta Token/ U.S. dollar(THETAUSD)

THETAUSD Elliott Wave Technical Analysis

Function: Counter trend

Mode: Corrective

Structure: Flat

Position: Wave (2)

Direction Next higher Degrees: wave ((2)) of Impulse

Wave Cancel invalid Level:

Details: Retracement of wave ((2)) usually .50 or .618 x Length wave ((1))

Theta Token/ U.S. dollar(THETAUSD)Trading Strategy: Overall, Theta Token is still in an uptrend but is undergoing a correction in Wave 2, which we expect to be a flat correction. We are still missing one more move in the downside direction of Wave C. There is a trend. Support area 0.801.

Theta Token/ U.S. dollar(THETAUSD)Technical Indicators: The price is above the MA200 indicating an Uptrend, Wave Oscillators a Bullish Momentum.

TradingLounge Analyst: Kittiampon Somboonsod, CEWA

Source: Tradinglounge.com get trial here!

Elliott Wave Analysis TradingLounge 4H Chart, 8 December 23,

Theta Token/ U.S. dollar(THETAUSD)

THETAUSD Elliott Wave Technical Analysis

Function: Counter trend

Mode: Corrective

Structure: Flat

Position: Wave (2)

Direction Next higher Degrees: wave ((2)) of Impulse

Wave Cancel invalid Level:

Details: Retracement of wave ((2)) usually .50 or .618 x Length wave ((1))

Theta Token/ U.S. dollar(THETAUSD)Trading Strategy: Overall, Theta Token is still in an uptrend but is undergoing a correction in Wave 2, which we expect to be a flat correction. We are still missing one more move in the downside direction of Wave C. There is a trend. Support area 0.801.

Theta Token/ U.S. dollar(THETAUSD)Technical Indicators: The price is above the MA200 indicating an Uptrend, Wave Oscillators a Bullish Momentum.