Tesla Inc., Elliott Wave Technical Analysis

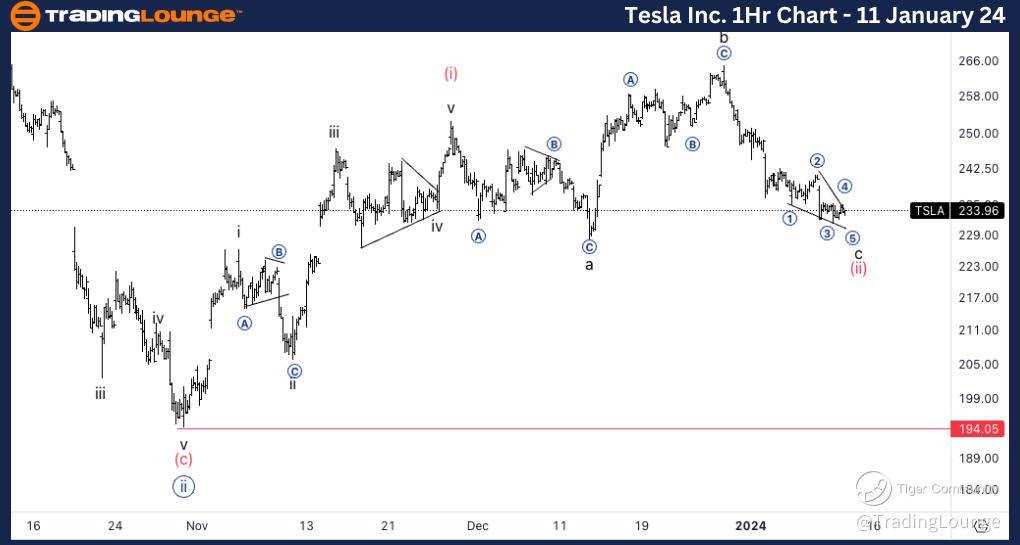

Tesla Inc., (TSLA:NASDAQ): 4h Chart 11 January 24

TSLA Stock Market Analysis: We have been looking this down move into wave c for a while now as we continue to prefer an overall bullish count for the time being. In order to actively look for longs we need the top of wave b to be broken.

TSLA Elliott Wave Count: Wave c of (ii).

TSLA Technical Indicators: Below all averages, volume starting to increase.

TSLA Trading Strategy: Looking for longs after a break of b.

TradingLounge Analyst: Alessio Barretta

Source : Tradinglounge.com get trial here!

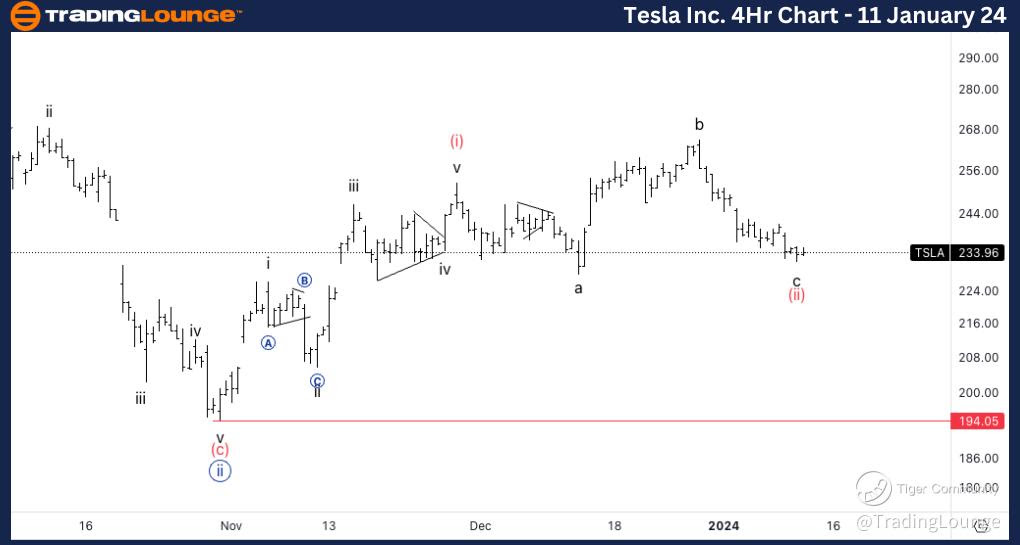

Tesla Inc., TSLA: 1-hour Chart 11 January 24

Tesla Inc., Elliott Wave Technical Analysis TSLA Stock Market Analysis: We are starting to see a series of overlapping wave within wave c which could make us think about and ending diagonal, as well as we are seeing RSI bullish divergence.

TSLA Elliott Wave count: Wave c of (ii).

TSLA Technical Indicators: Below all averages.

TSLA Trading Strategy: Looking for longs after a break of b.