Coffee Commodity Elliott Wave Technical Analysis

Coffee prices are nearing the February 2022 highs, showing a strong recovery from the October 2023 lows. Since then, coffee has surged by approximately 75%, indicating a strong uptrend. However, this rally is now approaching a critical point where profit-taking and selling pressure could intensify.

Long-Term Chart Analysis

Coffee Elliott Wave Technical Analysis

Historically, coffee prices have moved within a wide trading range, with support levels between $40 and $55 and resistance levels between $276 and $337. The current bullish cycle began in May 2019. The initial phase of this uptrend peaked in February 2022, reaching key highs. This was followed by a corrective phase that bottomed out in January 2023. The ongoing third phase of this bullish cycle started after this low and is unfolding in what appears to be a corrective pattern within the broader Elliott wave structure.

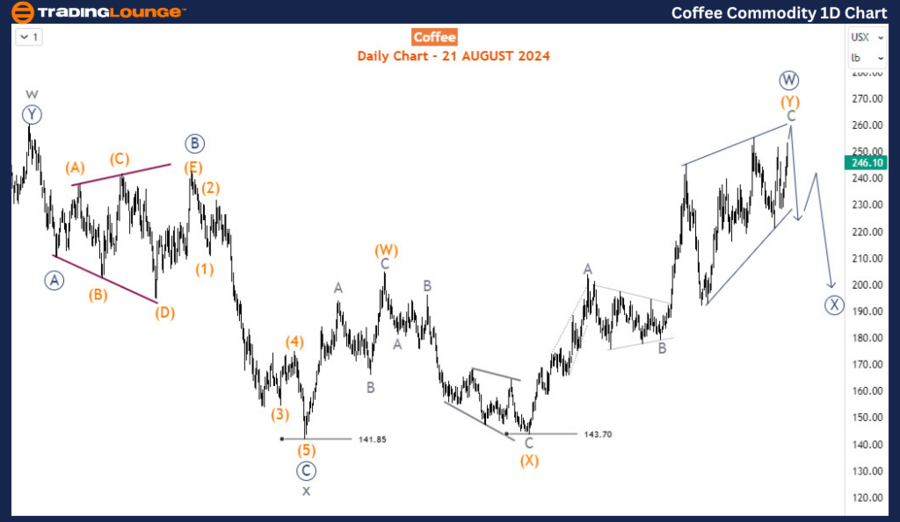

Coffee Commodity Daily Chart Analysis

The daily chart shows that the third phase of this recovery completed its first leg, labeled as wave (W), in April 2023. Afterward, coffee entered a three-wave corrective structure known as wave (X), which found support at 143.70 in October 2023. The current rally represents wave (Y) of the primary degree wave W (circled). Upon the completion of this move, a significant pullback in wave X (circled) is expected, signaling the beginning of the next correction. Given that wave (Y) is nearing the completion of wave W (circled), a major pullback may be imminent.

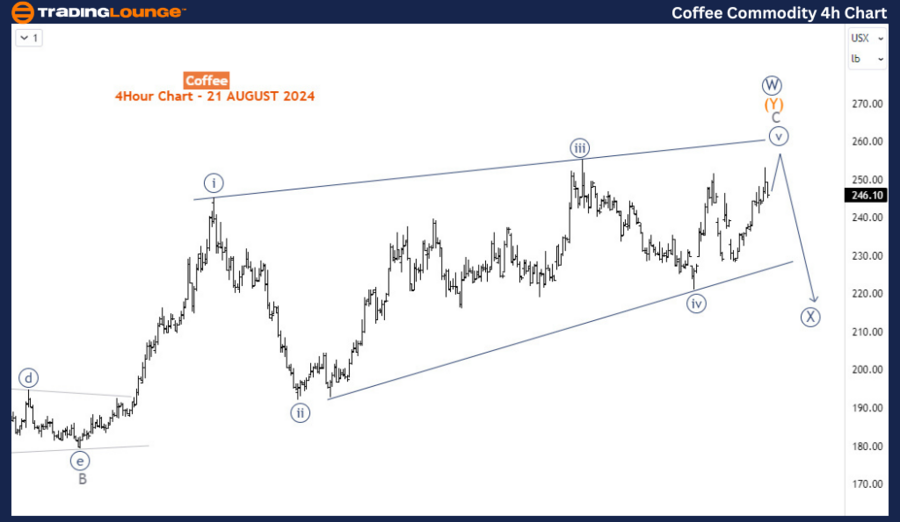

Coffee Commodity H4 Chart Analysis

On the H4 chart, wave (Y) of W (circled) is close to finishing, likely within an ending diagonal pattern, which often indicates trend exhaustion. This structure is expected to complete slightly above the 250 price level. If coffee encounters resistance around this level and fails to sustain rallies beyond 250, a corrective decline is anticipated in the coming weeks. This would align with the broader Elliott wave analysis, supporting the scenario of a multi-month correction as the market transitions into wave X (circled) of the higher-degree structure.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Soybean Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

This analysis underscores the potential for a significant reversal as coffee approaches key resistance levels, paving the way for a corrective phase ahead.