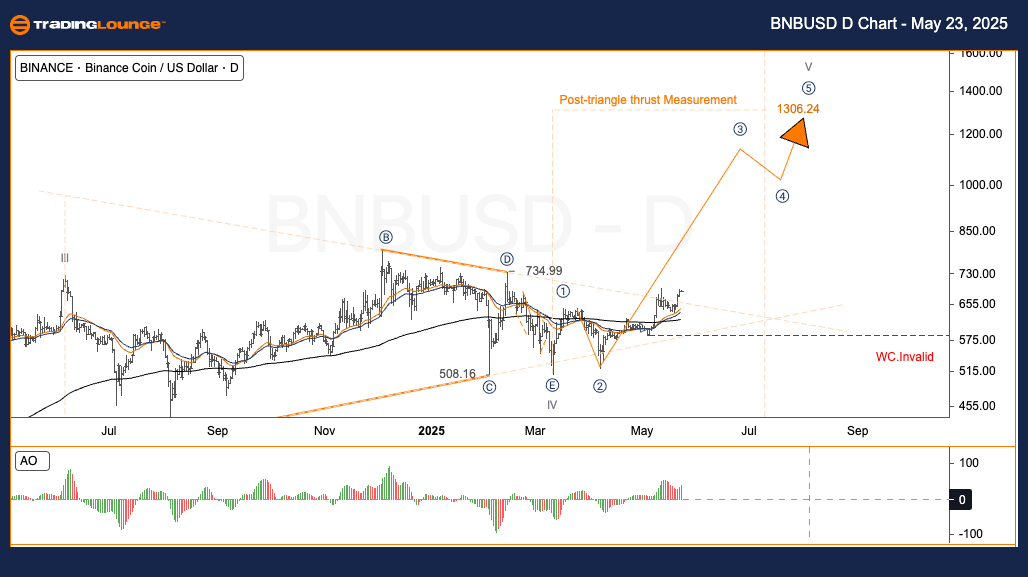

BNBUSD Elliott Wave Analysis – TradingLounge Daily Chart,

Binance / U.S. Dollar (BNBUSD) Daily Chart Analysis

BNBUSD Elliott Wave Technical Analysis

Function: Trend Continuation

Mode: Motive

Structure: Impulsive Wave

Current Wave Position: Advancing in Wave 3

Next Major Direction: Anticipated movement into Wave IV (Impulse Cycle)

Wave Invalidation Level: To be confirmed

BNBUSD Trading Strategy – Daily Chart Overview

BNBUSD has shown a strong bullish move after breaking out of a defined Triangle IV consolidation pattern. The clear breakout beyond the resistance trendline (E–D–C–B–A) indicates the beginning of Wave (3), typically the most powerful segment within an impulsive Elliott Wave cycle.

Binance Trading Opportunities

✅ For Swing Traders:

- Monitor sub-wave 4 pullbacks within the ongoing Wave (3) for potential long entries.

- Target Price Range: $1,306.24, aligned with the thrust projection following the triangle breakout.

🟥 Risk Management:

Recommended Stop Loss Zone: Between $605 and $625 to manage position risk amid market volatility.

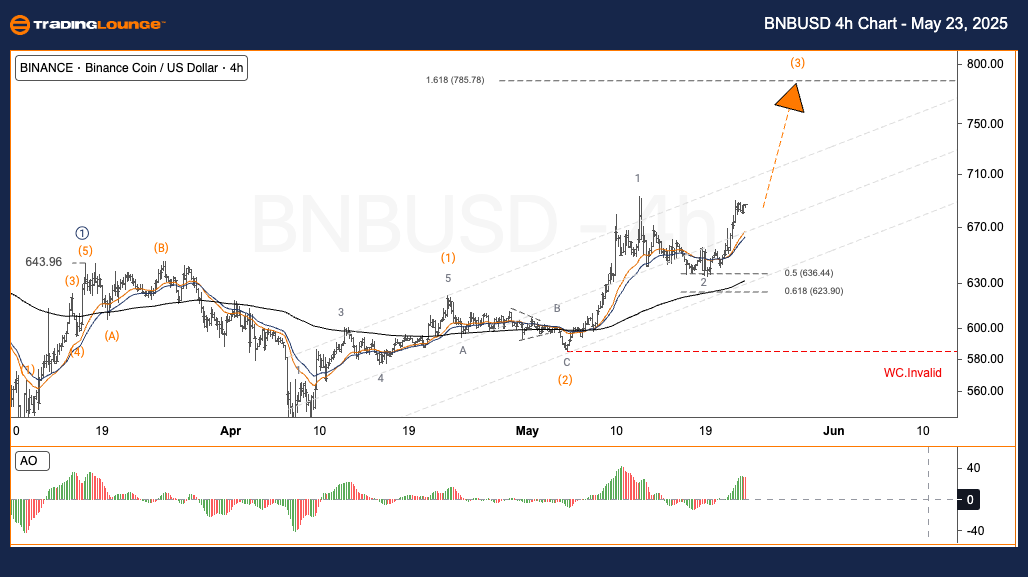

Binance / U.S. Dollar Elliott Wave Analysis – TradingLounge H4 Chart,

Binance / U.S. Dollar (BNBUSD) 4-Hour Chart Analysis

BNBUSD Elliott Wave Technical Analysis

Function: Trend Continuation

Mode: Motive

Structure: Impulse Wave

Current Wave Position: In progression of Wave 3

Next Major Direction: Targeting Wave IV of Impulse

Wave Invalidation Level: Unspecified

BNBUSD Trading Strategy – H4 Chart Perspective

BNBUSD completed its Wave (2) correction near the key Fibonacci retracement levels (0.5–0.618), which lies between $636 and $624. Following this, the asset surged, initiating a robust Wave (3) movement with a confirmed breakout above the upper channel resistance.

BNBUSD Trading Opportunities

✅ For Swing Traders:

- Use the $640–$650 price zone as an optimal entry point during Wave (3) developments.

- Profit Target Zone: Between $750 and $785, based on Fibonacci extension projections.

🟥 Risk Management:

Suggested Stop Loss Placement: Below the $620 level to safeguard against market pullbacks.

Technical Analyst: Kittiampon Somboonsod, CEWA

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: THETAUSD Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support