ASX: NEWMONT CORPORATION - NEM Elliott Wave Forecast & Technical Analysis TradingLounge

Hello Traders,

This Elliott Wave forecast for Newmont Corporation (ASX: NEM) analyzes the current trend using the daily chart. The ongoing price movement suggests a developing Wave Three advance. Below, we outline key Elliott Wave target zones and invalidation levels that traders can use to evaluate the sustainability of this bullish phase.

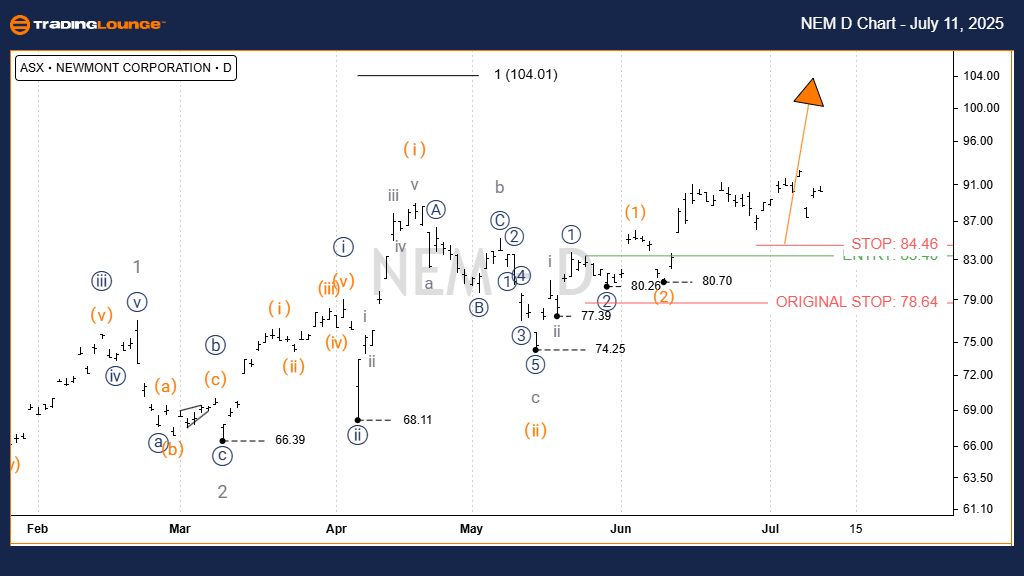

ASX: NEWMONT CORPORATION - NEM Elliott Wave Forecast & 1D Chart Analysis

NEWMONT CORPORATION 1D Chart (Semilog Scale) Overview

Function: Identifying the dominant trend (Minor degree, grey)

Wave Mode: Motive

Wave Structure: Impulse

Wave Position: Wave iii) - orange within Wave iii)) - navy under Wave 3 - grey

Wave Analysis:

Wave ii) - orange completed around 74.25, likely forming a zigzag correction. From that low, Wave iii) - orange has begun moving upward, currently targeting the 100.00 level.

Key Invalidation Level: 74.25

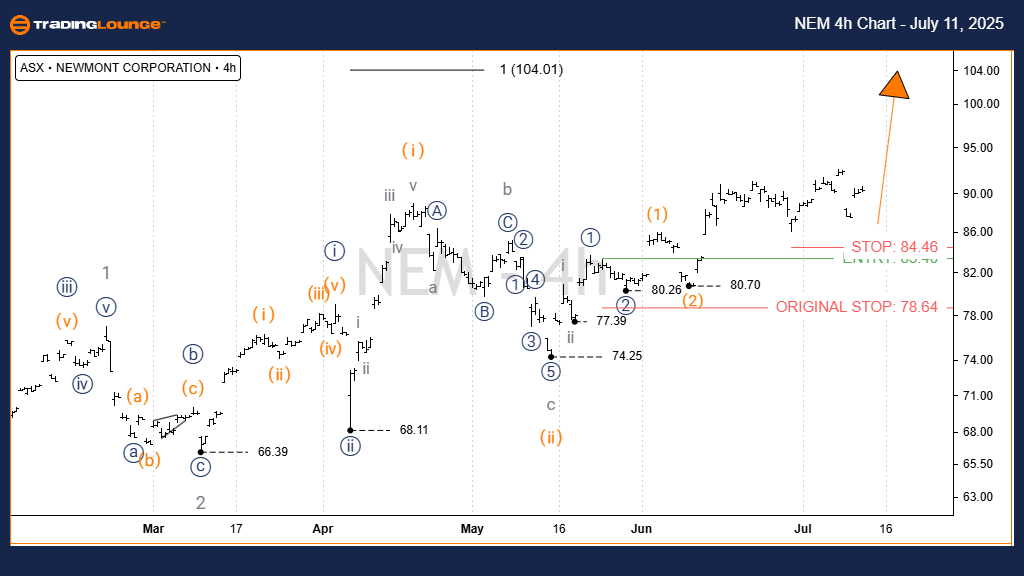

ASX: NEWMONT CORPORATION - NEM Elliott Wave Forecast TradingLounge (4-Hour Chart)

4-Hour Chart Technical Analysis Overview

Function: Tracking short- to mid-term trend (Minor degree, grey)

Wave Mode: Motive

Wave Structure: Impulse

Wave Position: Wave iii) - orange within Wave ((iii)) - navy of Wave 3 - grey

Short-Term Outlook:

The 4-hour chart confirms the daily Elliott Wave count. Wave iii) - orange is still progressing higher, with a near-term price objective at 90.00 and a mid-range goal set at 100.00.

Key Invalidation Level: 74.25

Technical Analyst: Hua (Shane) Cuong, CEWA‑M (Certified Elliott Wave Analyst – Master Level)

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: AMCOR PLC – AMC Elliott Wave Technical Analysis

VALUE Offer - $1 for 2 Weeks then $29 a month!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

This technical analysis for ASX: NEM (Newmont Corporation) combines long-term Elliott Wave trends with actionable short-term insights. Clear target and invalidation levels help validate the bullish scenario and support more confident decision-making for traders seeking a structured market approach.