Visa Inc., Elliott Wave Technical Analysis

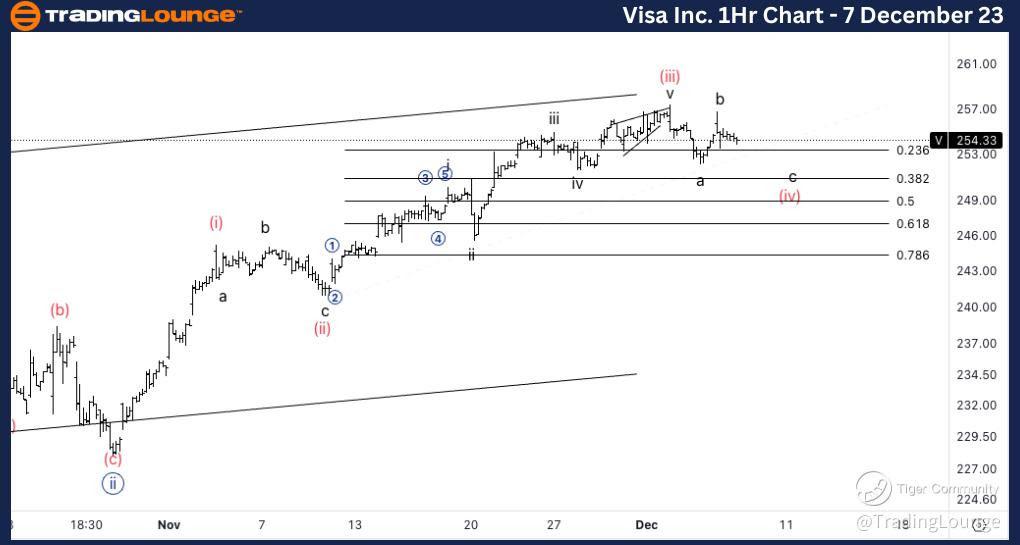

Visa Inc., (V:NYSE): 4h Chart 7 December 23

V Stock Market Analysis: We have been moving as expected from the previous update. We are looking for a wave (iv) to then resume higher. This wave (iv) could be sideways as wave (ii) was more of a sharp correction.

V Elliott Wave Count: Wave (iv) of {iii}.

V Technical Indicators: 20EMA as support.

V Trading Strategy: Looking for long into wave (v).

TradingLounge Analyst: Alessio Barretta

Source: Tradinglounge.com get trial here!

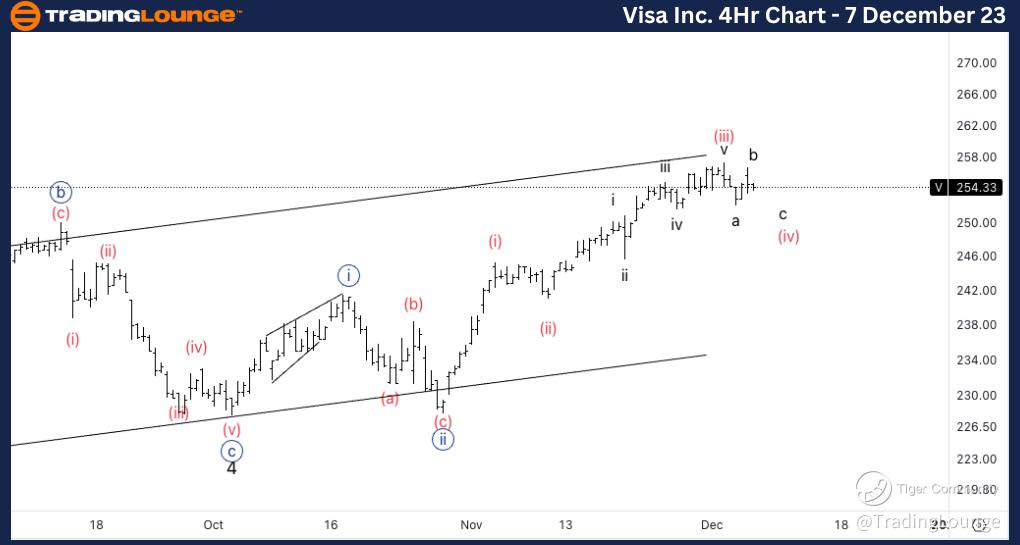

Visa Inc., V: 1-hour Chart 7 December 23

Visa Inc., Elliott Wave Technical Analysis

V Stock Market Analysis: Looking for another leg lower into wave c or else more of a sideways consolidating move. Looking to eventually find support on the 38.2% (iv) vs. (iii) at around 250$.

V Elliott Wave count: Wave c of (iv)

V Technical Indicators: 20EMA as support.

V Trading Strategy: Looking for longs into wave (v).