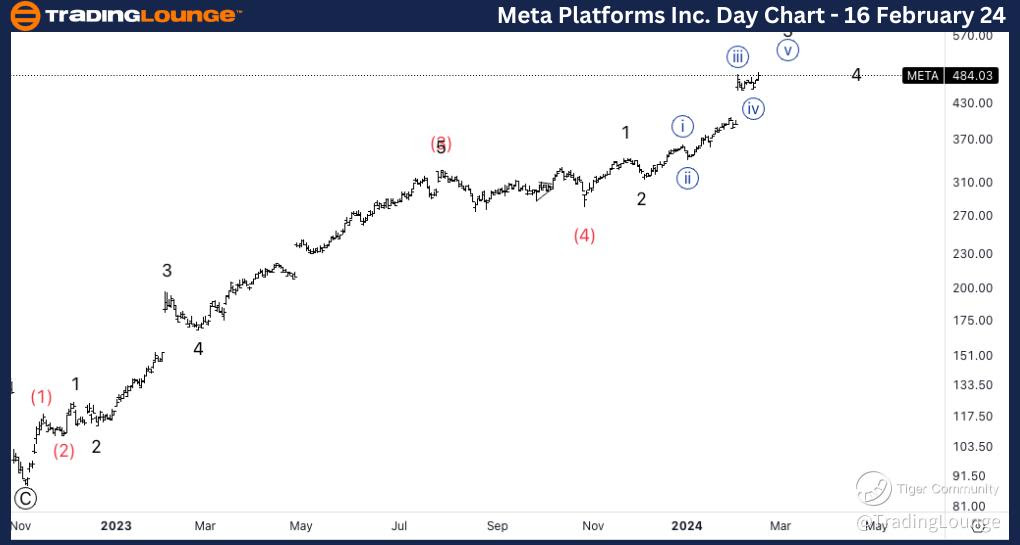

META Elliott Wave Analysis Trading Lounge Daily Chart, 16 February 24

Welcome to our META Elliott Wave Analysis Trading Lounge, your ultimate source for comprehensive insights into Meta Platforms Inc. (META) using Elliott Wave Technical Analysis. As of the Daily Chart on 16th February 2024, we explore significant trends guiding the market.

Meta Platforms Inc., (META) Daily Chart

META Elliott Wave Technical Analysis

In terms of wave dynamics, we identify a dominant impulse function with a motive structure. The current position is in Minute wave {v} of 3, indicating a potential topping in wave {v} of 3. We observe a robust upward movement from the $80 lows. Our analysis considers the possibility of wave (5) being in place, or alternatively, wave (3) and (4) could signify higher degree wave 1 and 2, suggesting the onset of higher degree wave 3.

FUNCTION: Trend

MODE: Impulse

STRUCTURE: Motive

POSITION: Minute wave {v} of 3.

DIRECTION: Topping in wave {v} of 3.

Examining the price action, there's a notable uptrend from the $80 lows, indicating significant bullish momentum. However, it's crucial to note that wave (5) might already be in place, or what's labeled as wave (3) and (4) could represent higher degree waves 1 and 2, suggesting the onset of a higher degree wave 3.

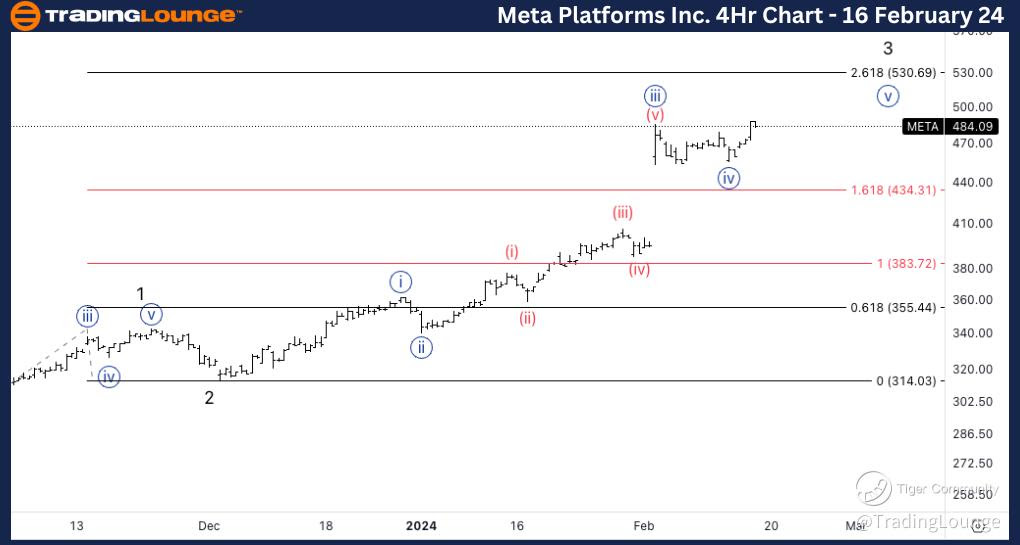

META Elliott Wave Analysis Trading Lounge 4Hr Chart, 16 February 24

Meta Platforms Inc., (META) 4Hr Chart

META Elliott Wave Technical Analysis – 4Hr Chart

Here, the wave function remains impulsive with a motive structure. The present position is in Wave (i) of {v}, signaling a continuation higher towards the wave 3 target. The wave 3 target is anticipated to be at least $500, intersecting with TL5. Additionally, there's a Fib relationship of 2.618 between wave 3 and wave 1 at $530. Overall, we expect the $500 target to be reached before witnessing significant downside pressure in the market.

FUNCTION: Trend

MODE: Impulsive

STRUCTURE: Motive

POSITION: Wave (i) of {v}.

DIRECTION: Continuation higher towards wave 3 target.

Analyzing the details, the wave 3 target is projected to reach at least $500, intersecting a significant TL5. Furthermore, a Fibonacci relationship of 2.618 between waves 3 and 1 points to a potential target of $530. Overall, there's an expectation for the $500 target to be attained before witnessing significant downside pressure in the market.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: The Walt Disney Company (DIS)

In conclusion, Meta Platforms Inc. (META) presents intriguing opportunities for traders, as evidenced by its compelling Elliott Wave patterns. With a thorough understanding of the current wave structures and price dynamics, traders can make informed decisions to capitalize on potential price movements.