ASX: XERO LIMITED - XRO Elliott Wave Technical Analysis TradingLounge

Our updated Elliott Wave analysis for XERO LIMITED (ASX:XRO) focuses on its current trajectory within the Australian Stock Exchange (ASX). Based on our technical insights, ASX:XRO is projected to climb further as it progresses through an unfolding Diagonal pattern.

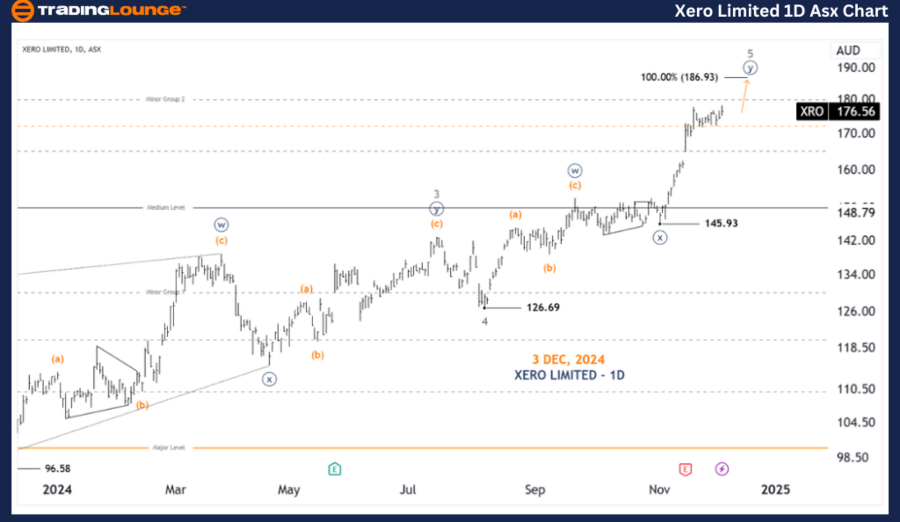

ASX: XERO LIMITED - XRO 1D Chart (Semilog Scale) Analysis

Function: Major trend (Minor degree, gray)

Mode: Motive

Structure: Diagonal

Position: Wave ((y))-navy of Wave 5-grey

Key Details:

- The price action is within the 5-grey wave, part of a larger Diagonal labeled from 1-grey to 5-grey.

- The internal structure of this wave follows a 3-3-3-3-3 subwave pattern.

- The 5-grey wave is projected to climb higher, targeting approximately 186.93, forming a double zigzag labeled ((w))((x))((y))-navy.

- Invalidation point: 145.93. If the price falls below this level, the current wave count becomes invalid.

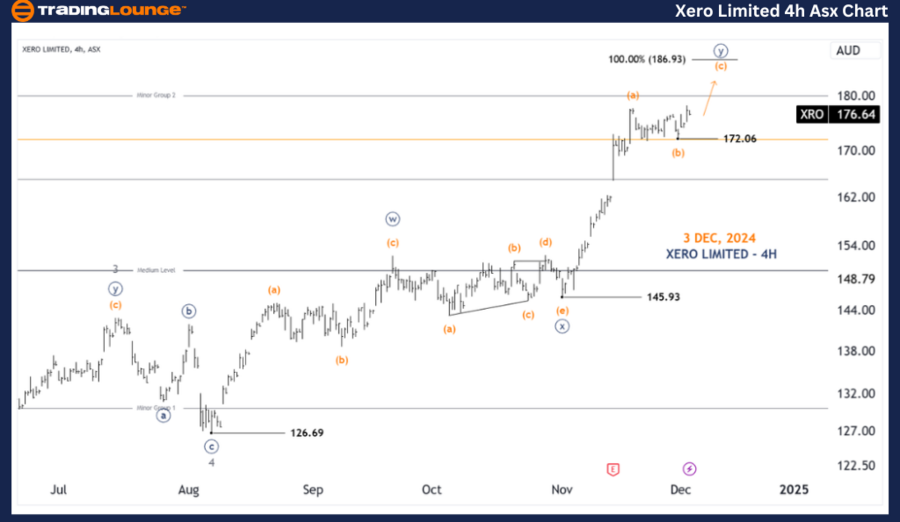

ASX: XERO LIMITED - XRO 4-Hour Chart Analysis

Function: Major trend (Minute degree, navy)

Mode: Motive

Structure: Diagonal

Position: Wave (c)-orange of Wave ((y))

Key Details:

- Within the 5-grey wave, a closer examination reveals it as a Double Zigzag labeled ((w))((x))((y))-navy.

- The ((y))-navy wave, being part of this zigzag, is itself subdivided into (a)(b)(c)-orange.

- The (c)-orange wave is likely to continue its upward movement toward the 186.93 area.

- Invalidation point: 172.06. Should the price exceed this level, it would signal a shift away from the Diagonal pattern into an alternative wave count scenario.

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: ASX: WOOLWORTHS GROUP LIMITED - WOW Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

Our analysis of ASX: XERO LIMITED (ASX:XRO) provides a detailed outlook on both long-term trends and short-term movements. By highlighting specific price targets like 186.93 and key invalidation points such as 145.93 and 172.06, we aim to offer actionable insights for traders. These critical levels validate or refute the wave count, improving the reliability of our technical perspective. Our goal remains to deliver the most accurate and professional analysis of market trends for informed decision-making.