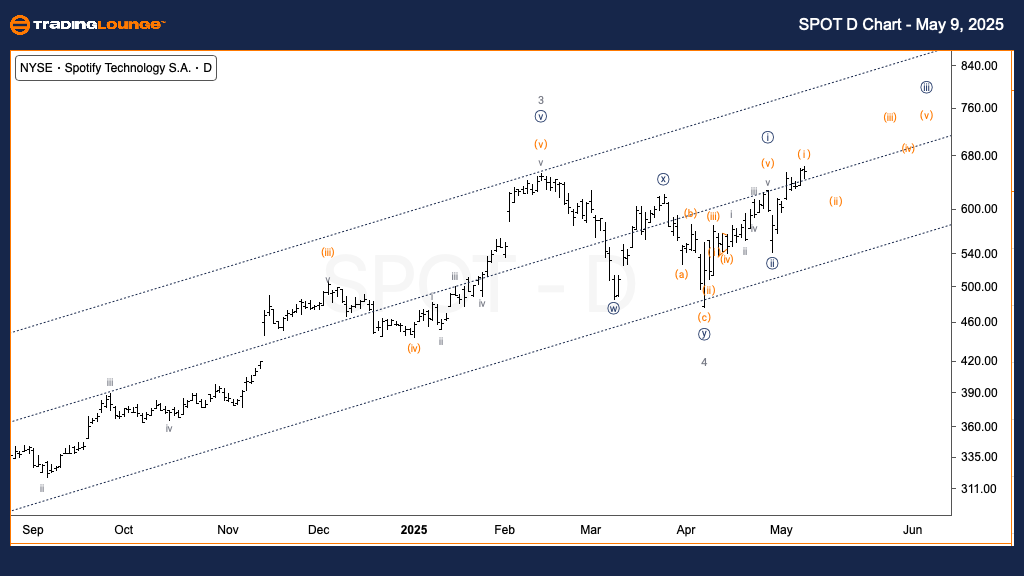

Spotify Technology S.A. (SPOT) Elliott Wave Analysis - TradingLounge Daily Chart

SPOT Elliott Wave Technical Analysis

FUNCTION: Trend

MODE: Impulsive

STRUCTURE: Motive

POSITION: Wave {iii} of 5

DIRECTION: Upside in wave {iii}

DETAILS: Wave 4 seems complete, setting the stage for upward momentum in wave {iii} of 5. A breakout above the key resistance at $650 would likely confirm the continuation of the bullish trend.

Daily Chart Analysis Overview

Spotify stock's daily Elliott Wave setup indicates a bullish continuation pattern. The completion of wave 4 aligns with the start of wave {iii} of 5—a typically aggressive leg in Elliott Wave structures. The $650 price zone is a key level to watch for validation.

A successful move above this level would confirm the uptrend and suggest additional gains in line with the projected wave count. Investors and technical traders focused on SPOT should monitor for signals pointing to this bullish scenario.

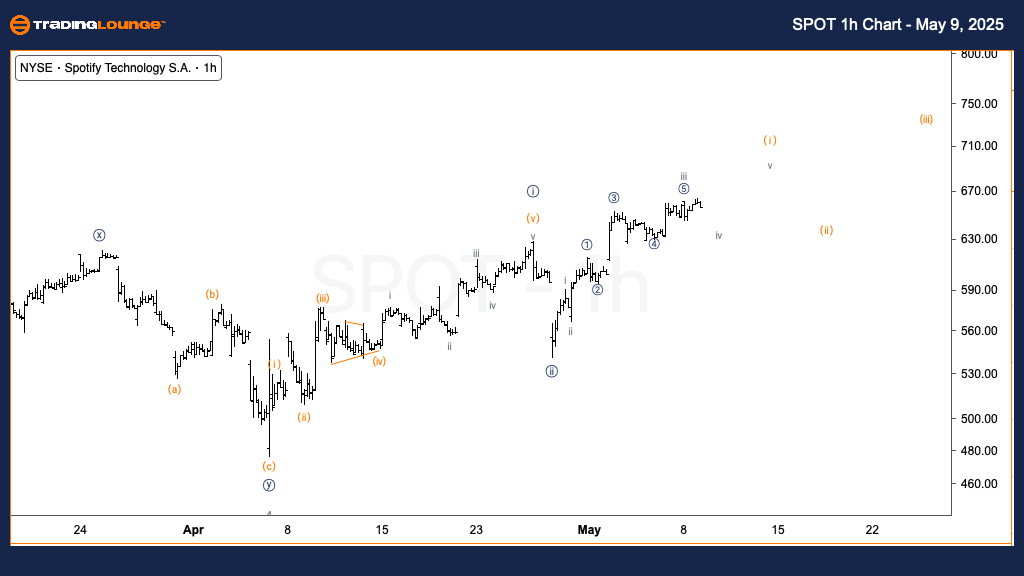

Spotify Technology S.A. (SPOT) Elliott Wave Analysis - TradingLounge 1H Chart

SPOT Elliott Wave Technical Analysis

FUNCTION: Trend

MODE: Impulsive

STRUCTURE: Motive

POSITION: Wave v of (i)

DIRECTION: Upside in wave (i)

DETAILS: On the hourly chart, the stock is progressing within wave {iii}. Current price movement may be part of wave (i) or continuing as part of wave {iii}. A higher extension would imply the development of wave {v}.

1-Hour Chart Summary

The intraday Elliott Wave analysis for Spotify supports the bullish outlook on the daily timeframe. Wave (i) of {iii} appears to be developing, with price action pointing to a potential match in length to wave {i}. A confirmed breakout could lead to wave {v}, pushing prices higher in the short term.

Technical traders analyzing SPOT should closely observe intraday momentum for signs of upward continuation and possible alignment with the larger trend.

Technical Analyst: Alessio Barretta

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: QUALCOMM Inc. (QCOM) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

Across both the daily and hourly charts, Spotify (SPOT) stock displays signs of entering a fresh bullish cycle. Key confirmation lies near the $650 resistance level. A strong move beyond this point would reinforce the wave count and present strategic long entry opportunities in alignment with Elliott Wave principles.