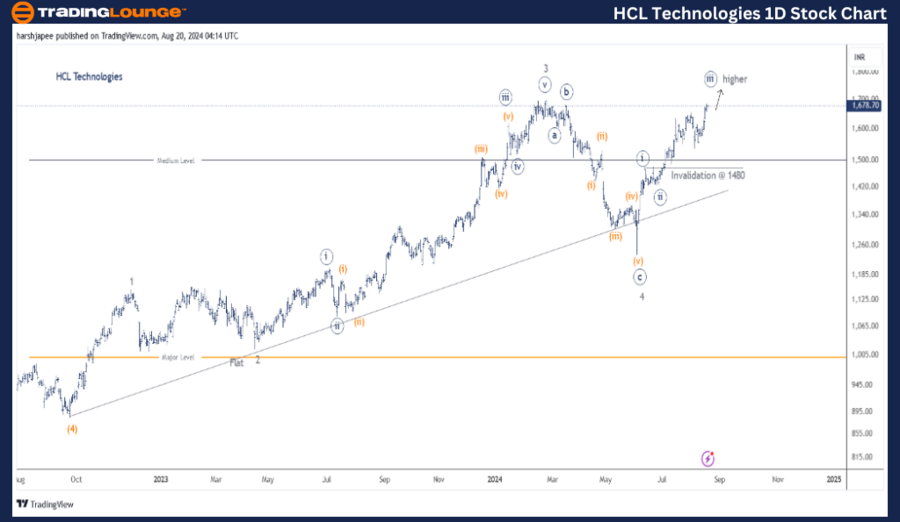

HCL Technologies – HCLTECH Elliott Wave Analysis (1D Chart)

Function: Larger Degree Trend Higher (Intermediate degree, orange)

Mode: Motive

Structure: Impulse

Position: Minute Wave ((iii)) Navy

Details: Minute Wave ((iii)) is advancing higher within Minor Wave 5 against the 1480 level.

Invalidation Point: 1480

HCLTECH Elliott Wave Technical Analysis

HCL Technologies Daily Chart Technical Analysis and Elliott Wave Counts

The HCL Technologies daily chart suggests the stock is progressing within Minor Wave 5, targeting the 1230 level in the medium term. The current pattern is an impulse wave, with Minute Wave ((iii)) likely unfolding now.

The stock bottomed around the 880 mark in September 2022, completing Intermediate Wave (4). Since then, a potential five-wave rally appears to be in progress. Minor Wave 4 concluded at 1230, and the trend remains bullish above this low.

Last week, the stock rallied over 100 points from the 1560-70 range up to 1680, as projected. In the coming days, prices are expected to gain momentum and move towards the 1700-50 range, with the 1480 level as a key support, marking the high of Minute Wave ((i)).

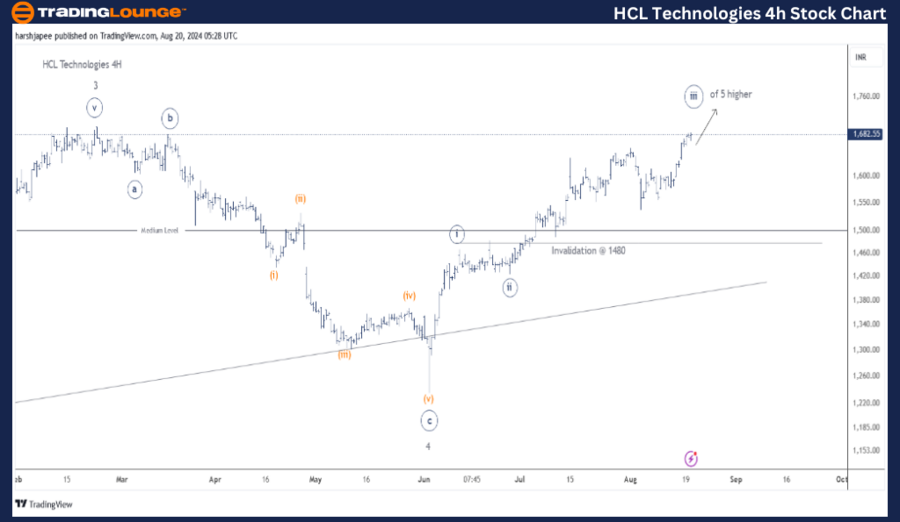

HCL Technologies – HCLTECH Elliott Wave Technical Analysis (4H Chart)

Function: Larger Degree Trend Higher (Minute degree, Wave ((iii)) Grey)

Mode: Motive

Structure: Impulse

Position: Minute Wave ((iii)) Navy

Details: Minute Wave ((iii)) is advancing higher within Minor Wave 5 against the 1480 level.

Invalidation Point: 1480

HCL Technologies 4H Chart Technical Analysis and Elliott Wave Counts

The HCL Technologies 4H chart showcases Minor Wave 4 forming as a flat (3-3-5) between the 1670-75 range and the 1230-40 low. Following this, Minor Wave 5 is likely advancing higher as an impulse, with projections suggesting it could rally beyond the 1750 high in the near term.

Additionally, Minute Waves ((i)) and ((ii)) are complete near the 1480 and 1420 levels. If these levels hold, the price is expected to continue rising, staying above 1480, to complete the proposed impulse wave. Currently, Minute Wave ((iii)) appears to be underway.

Immediate price support is around 1537, potentially marking the low of Minuette Wave (ii). If correct, prices should remain above this level as Minuette Wave (iii) continues to develop.

Technical Analyst: Harsh Japee

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: ADANI ENTERPRISES LTD Elliott Wave Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

HCL Technologies seems set to push towards the 1750 zone in the upcoming trading sessions as Minute Wave ((iii)) continues to unfold within Minor Wave 5, targeting the 1230-40 level.