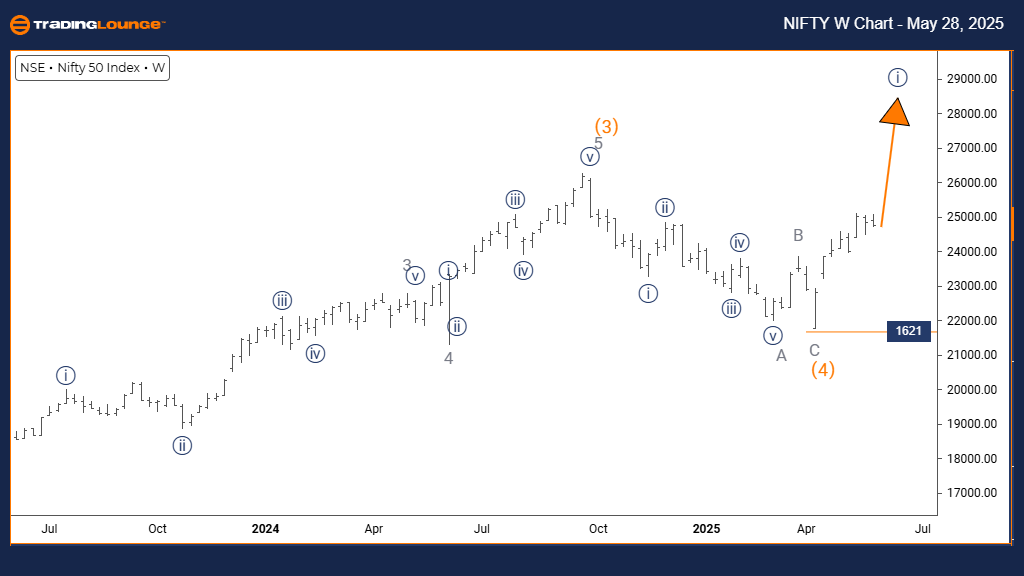

NIFTY 50 INDEX Elliott Wave Analysis – Trading Lounge Day Chart

NIFTY 50 INDEX Day Chart Analysis

NIFTY 50 Index Elliott Wave Technical Analysis

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Orange Wave 3

POSITION: Navy Blue Wave 1

DIRECTION (NEXT HIGHER DEGREES): Orange Wave 3 (initiated)

DETAILS: Orange wave 2 has concluded; orange wave 3 is now unfolding.

Wave Cancel Invalid Level: 1621

The daily Elliott Wave analysis for Nifty 50 signals a firm bullish trend currently underway. Orange wave 3 has begun developing within the broader impulsive wave cycle of navy blue wave 1. The completed orange wave 2 confirms the shift into this critical growth segment of the Elliott Wave pattern.

The transition confirms intensified buying activity, supporting the continuation of the bullish outlook. With the market structure nested inside navy blue wave 1, the Nifty 50 shows strong upward momentum. The critical invalidation threshold is 1621. If the index dips below this level, the current wave setup would be reevaluated for possible trend reversal or deeper correction.

This wave formation offers traders a precise technical roadmap, pointing to a potentially accelerated gain phase. As orange wave 3 progresses, it supports the broader bullish narrative and enhances investor confidence. The next forecast in higher wave degrees includes further progression of orange wave 3 within navy blue wave 1’s framework.

Key Takeaways:

- Orange wave 3 active, suggesting increased bullish momentum

- Wave 2 to 3 transition confirms strong buying behavior

- Invalidation level at 1621 remains crucial to maintain outlook

- Watch for breakout signals within orange wave 3 for trend confirmation

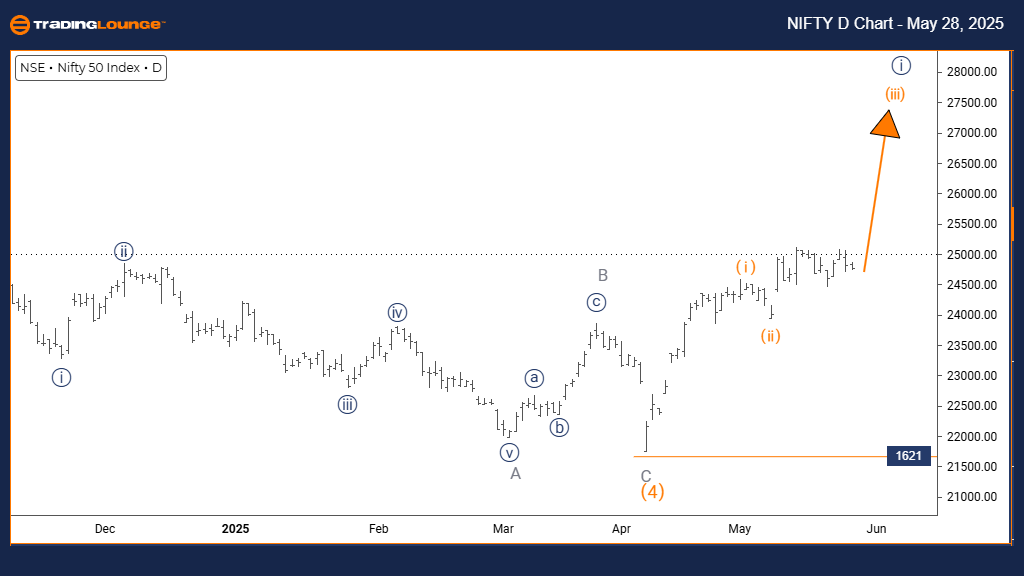

NIFTY 50 INDEX Elliott Wave Analysis – Trading Lounge Weekly Chart

NIFTY 50 Index Elliott Wave Technical Analysis

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Navy Blue Wave 1

POSITION: Gray Wave 1

DIRECTION (NEXT HIGHER DEGREES): Navy Blue Wave 1 (initiated)

DETAILS: Orange wave 4 is likely complete; navy blue wave 1 of gray wave 1 is now forming.

Wave Cancel Invalid Level: 1621

The weekly Elliott Wave forecast for Nifty 50 supports a continued bullish outlook, driven by the emergence of navy blue wave 1 within the larger trend of gray wave 1. The conclusion of orange wave 4 marks the end of corrective movement and the beginning of a new impulsive wave.

This development from corrective wave 4 to impulsive wave 1 implies a fresh phase of market strength. The chart suggests increasing institutional activity, often seen at the start of new bullish trends. The 1621 support level is key; falling below this threshold would challenge the current wave projection.

From a long-term perspective, navy blue wave 1 signifies the initial move within gray wave 1’s structure, hinting at a sustained rally in the coming sessions. The next projected move continues the navy blue wave 1 development inside the ongoing bullish cycle.

Key Takeaways:

- Weekly trend confirms a bullish wave start post-correction

- Transition into navy blue wave 1 suggests fresh market strength

- 1621 is a critical invalidation point to monitor

- Long-term structure aligns with continued upside momentum

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: Hang Seng Index Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support