ASX: Newmont Corporation (NEM) Elliott Wave Technical Analysis – TradingLounge

Introduction

Welcome to today’s Elliott Wave analysis for Newmont Corporation (NEM) on the Australian Stock Exchange (ASX). This report highlights the long-term upside potential in ASX:NEM shares based on a detailed Elliott Wave assessment.

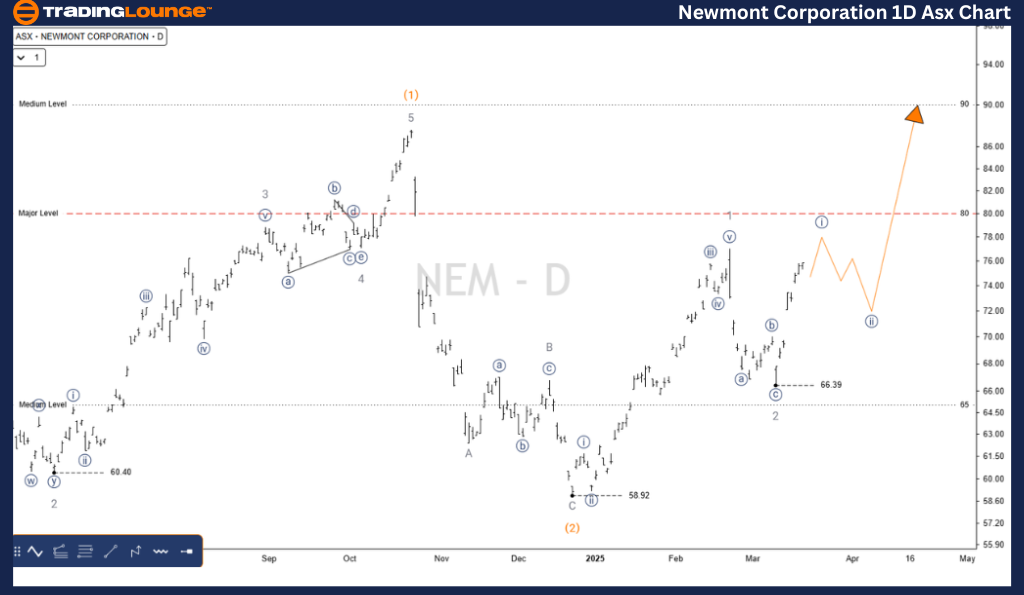

ASX: Newmont Corporation (NEM) Elliott Wave Technical Analysis – 1D Chart (Semilog Scale)

Function: Major Trend (Intermediate Degree, Orange)

Mode: Motive

Structure: Impulse

Position: Wave 3-Grey of Wave (3)-Orange

Analysis Overview

- The wave count has been revised from the previous week to enhance probability.

- Correction Wave (2)-Orange has been completed at the low of 58.92, signaling the emergence of Wave (3)-Orange, which is moving upward.

- The subwave structure confirms:

Wave 1-Grey has already completed.

Wave 2-Grey appears completed, setting up the next upward movement.

Wave 3-Grey is now projected to rise higher, targeting the 100.00 price level.

🔹 Invalidation Point: 66.39

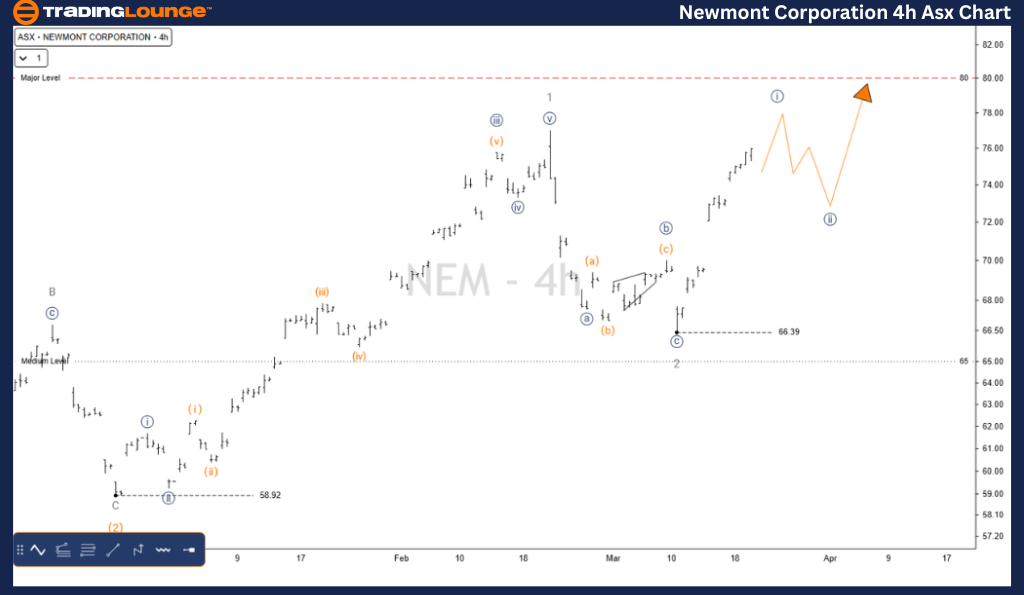

ASX: Newmont Corporation (NEM) 4-Hour Chart Analysis

Function: Major Trend (Minor Degree, Grey)

Mode: Motive

Structure: Impulse

Position: Wave ((i))-Navy of Wave 3-Grey

Analysis Overview

The 4-hour chart offers a closer perspective:

- Wave ((i))-Navy is approaching completion from the 66.39 level.

- A temporary pullback in Wave ((ii))-Navy is expected, likely forming an ABC correction.

- Once completed, Wave ((iii))-Navy is anticipated to move significantly higher.

🔹 Invalidation Point: 66.39

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: BLOCK INC Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

This Elliott Wave analysis delivers a clear outlook on ASX:NEM, combining trend forecasts and short-term market insights. By pinpointing key price levels for validation and invalidation, traders can confidently navigate potential trading opportunities.

Our strategic approach enhances trading decisions, providing an objective and professional perspective on market movements.