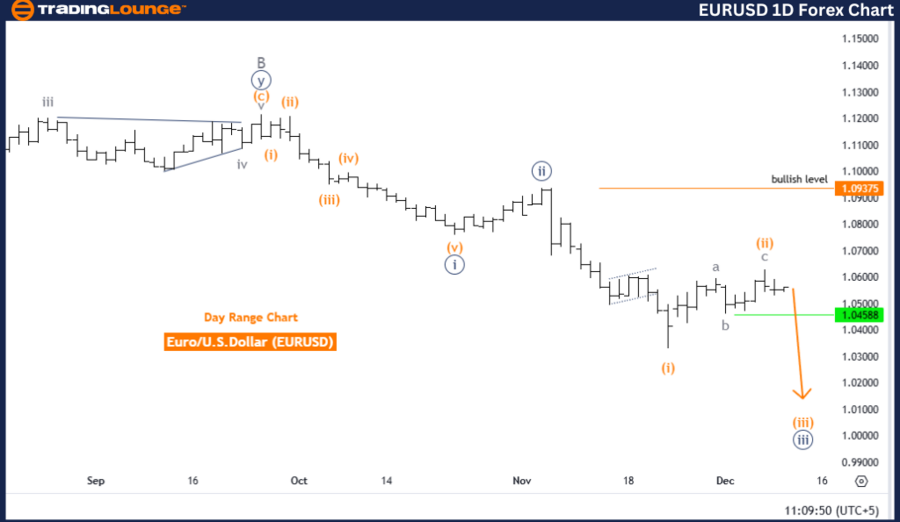

Euro/U.S. Dollar (EURUSD) Elliott Wave Analysis Trading Lounge – Day Chart Analysis

Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Impulsive

Structure: Orange Wave 3

Position: Navy Blue Wave 3 of C

Direction in Lower Degrees: Orange Wave 3 (in progress)

Details: Orange Wave 2 appears completed, and Orange Wave 3 within Navy Blue Wave 3 is now active.

Wave Cancel Invalidation Level: 1.09375

Analysis Summary

The EURUSD daily chart presents an Elliott Wave analysis focused on a counter-trend movement. This wave structure identifies orange wave 3 as part of an impulsive sequence within navy blue wave 3 of wave C, highlighting a corrective phase amidst the larger market trend.

Key Insights

-

Completion of Orange Wave 2:

The preceding orange wave 2 likely reached its conclusion.

-

Progression of Orange Wave 3:

The orange wave 3, a key component of navy blue wave 3, signifies a strong directional movement in the ongoing counter-trend corrective phase.

-

Invalidation Level:

The wave cancelation level is set at 1.09375.

- A break above this level invalidates the current wave structure and calls for reevaluation of the counter-trend outlook.

Trading Perspective

This analysis provides a structured framework for understanding the counter-trend correction in the EURUSD pair. The active orange wave 3 confirms the continuation of the corrective trend, adhering to the impulsive sequence.

Traders should closely monitor the invalidation level and observe the directional patterns within the wave structure. This phase points toward further development of the corrective trend, offering key insights for strategic decision-making.

Euro/U.S. Dollar (EURUSD) Elliott Wave Analysis Trading Lounge – 4-Hour Chart Analysis

Elliott Wave Technical Analysis

Function: Bearish Trend

Mode: Impulsive

Structure: Orange Wave 3

Position: Navy Blue Wave 3

Direction in Lower Degrees: Orange Wave 3 (in progress)

Details: Orange Wave 2 seems to have completed, and Orange Wave 3 within Navy Blue Wave 3 is now active.

Wave Cancel Invalidation Level: 1.09375

Analysis Summary

The EURUSD 4-hour chart emphasizes a bearish trend through Elliott Wave analysis. The wave structure underlines the orange wave 3 within navy blue wave 3, signaling ongoing downward market pressure.

Key Insights

-

Completion of Orange Wave 2:

The earlier orange wave 2 seems to have concluded.

-

Development of Orange Wave 3:

The orange wave 3, part of navy blue wave 3, showcases strengthening bearish momentum.

-

Invalidation Level:

The wave cancelation level is identified at 1.09375.

- Any movement above this level invalidates the current wave structure and requires a reassessment of the bearish trend.

Trading Perspective

This analysis offers a structured insight into the bearish trend for EURUSD. The ongoing orange wave 3 aligns with the downward momentum expected in the impulsive sequence per Elliott Wave Theory.

Key invalidation points and directional trends provide actionable guidance for traders. The active orange wave 3 phase suggests continued potential for declines, reinforcing the overall bearish outlook for the pair.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: GBPUSD Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support