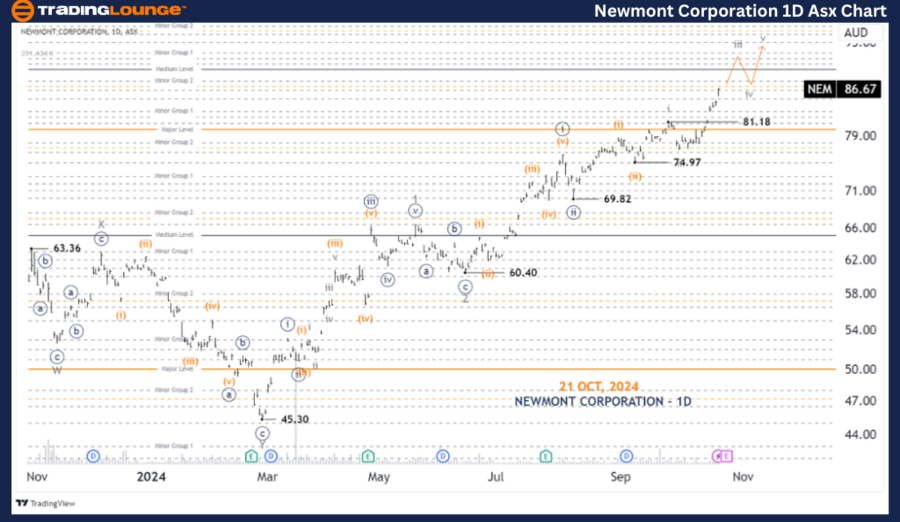

ASX: NEWMONT CORPORATION - TradingLounge 1D Chart

Greetings, Our Elliott Wave analysis today provides an update on the Australian Stock Exchange (ASX) for NEWMONT CORPORATION - NEM. We observe that NEM continues its upward momentum.

ASX: NEWMONT CORPORATION - NEM 1D Chart (Semilog Scale) Analysis

NEM Elliott Wave Technical Analysis

Function: Major trend (Minute degree, navy)

Mode: Motive

Structure: Impulse

Position: Wave iii-grey of Wave (iii)-orange of Wave ((iii))-navy of Wave 3-grey

Details: Wave iii-grey is still developing and pushing higher, potentially reaching 90.00. After this, wave iv-grey may pull back slightly before wave v-grey resumes its upward movement.

Invalidation Point: 81.18

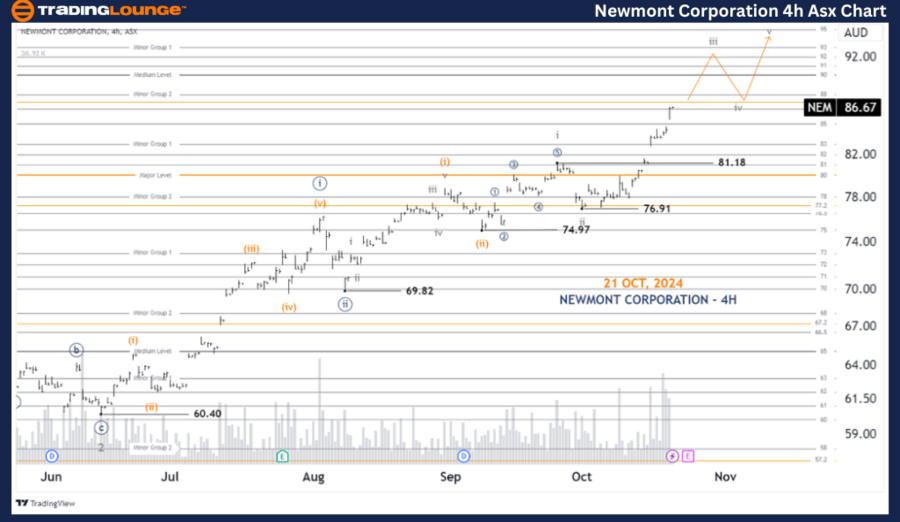

ASX: NEWMONT CORPORATION - NEM 4-Hour Chart Analysis

Function: Major trend (Subminuette degree, grey)

Mode: Motive

Structure: Impulse

Position: Wave iii-grey of Wave (iii)-orange of Wave ((iii))-navy

Details: Since the low at 76.91, wave iii-grey has been moving higher. It could potentially target the 90.00 level before wave iv-grey pulls back. Subsequently, wave v-grey is expected to continue the upward trajectory.

Invalidation Point: 81.18

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: CSL LIMITED Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

Our analysis of the current Elliott Wave structure for ASX: NEWMONT CORPORATION - NEM highlights key market trends and price points. These levels serve as validation or invalidation signals, giving traders enhanced confidence in their positions. By closely monitoring these points, traders can make more informed decisions in line with the broader market outlook.