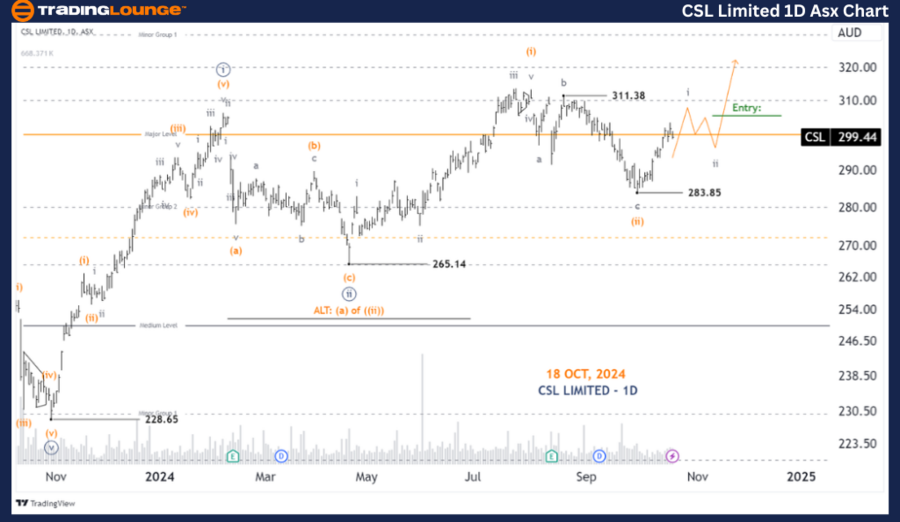

ASX: CSL LIMITED - Elliott Wave Analysis TradingLounge (1D Chart)

Greetings, in today's Elliott Wave analysis, we update our outlook for CSL LIMITED (ASX: CSL). We observe bullish momentum developing in wave iii-grey, but we need to wait for the completion of wave ii-grey before making any definitive moves.

ASX: CSL LIMITED - 1D Chart (Semilog Scale) Analysis

CSL LIMITED Elliott Wave Technical Analysis

Function: Major Trend (Minute Degree, Navy)

Mode: Motive

Structure: Impulse

Position: Wave i-grey of Wave (iii)-orange of Wave ((iii))-navy

Details: The daily chart offers a clearer perspective compared to the weekly chart. It suggests that wave (ii)-orange may have ended, and wave (iii)-orange is poised to begin moving upward. A Long Trade Setup will be considered once the price tests the Major Level 100.00 as support.

Invalidation Point: 283.35

ASX: CSL LIMITED - 4-Hour Chart Analysis

Function: Major Trend (Minute Degree, Navy)

Mode: Motive

Structure: Impulse

Position: Wave ((4))-navy of wave i-grey of Wave (iii)-orange

Details: From the low at 283.85, a five-wave structure is emerging, possibly indicating we are in wave ((4))-navy. Once wave ((5))-navy completes, it will mark the end of i-grey. Following this, wave ii-grey should push lower, and a Long Trade Setup will be sought after the price confirms support at the Major Level 300.00 by staying above it.

Invalidation Point: 283.85

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Fisher & Paykel Healthcare Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

Our analysis of CSL LIMITED (ASX: CSL) provides insight into both long-term and short-term market trends, highlighting key levels and wave structures. We emphasize price points that serve as validation or invalidation markers to strengthen confidence in our wave count. By offering this comprehensive analysis, we aim to help traders identify profitable opportunities while maintaining an objective and professional approach to market trends.