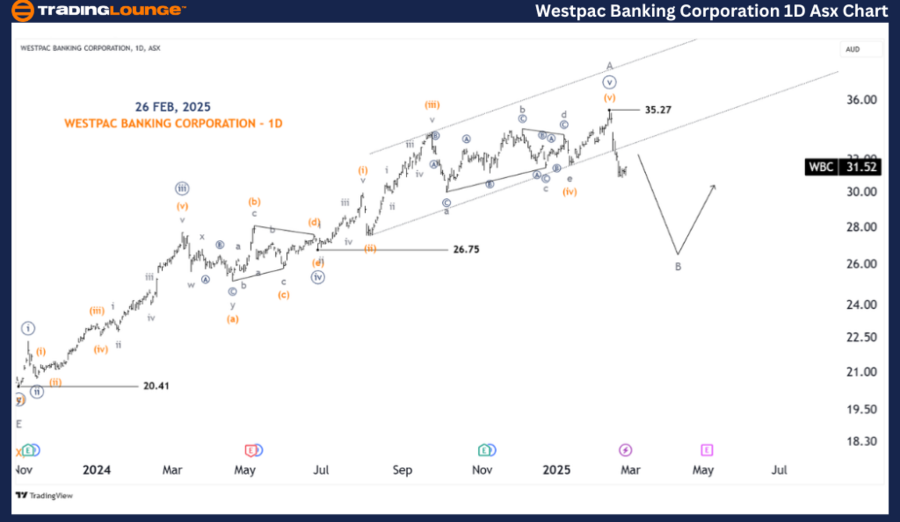

ASX: WESTPAC BANKING CORPORATION – WBC Elliott Wave Technical Analysis

Greetings,

Today's Elliott Wave analysis focuses on the Australian Stock Exchange (ASX) and WESTPAC BANKING CORPORATION (WBC).

We observe bearish weakness in ASX:WBC, suggesting a medium-term downtrend. This analysis highlights potential trend movements and key price levels where a trend reversal may occur.

ASX: WESTPAC BANKING CORPORATION – WBC Elliott Wave Technical Analysis (1D Chart – Semilog Scale)

Analysis:

- Function: Major Trend (Minute Degree, Green)

- Mode: Motive

- Structure: Impulse

- Position: Wave B (Grey) of Wave (Y) (Orange)

Details:

- Wave A (Grey) completed at 35.27, and Wave B (Grey) is declining, targeting 26.75.

- This suggests further downside potential, making long positions riskier.

Invalidation Point:

ASX: WESTPAC BANKING CORPORATION – WBC Elliott Wave Technical Analysis (4-Hour Chart)

ASX: WBC 4-Hour Chart Analysis

Analysis:

- Function: Major Trend (Minute Degree, Navy)

- Mode: Motive

- Structure: Impulse

- Position: Wave ((a)) (Navy) of Wave B (Grey) of Wave (Y) (Orange)

Details:

- Since the peak at 35.27, Wave B (Grey) is unfolding with strong downward momentum.

- A zigzag pattern is developing as ((a))((b))((c)).

- Wave ((a)) (Navy) is nearing completion, suggesting a short-term retracement in Wave ((b)) (Navy) before the final downward move in Wave ((c)) (Navy).

Invalidation Point:

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: ASX LIMITED Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

Our Elliott Wave forecast for ASX: WESTPAC BANKING CORPORATION (WBC) offers valuable insights for traders seeking to understand market trends and trading opportunities.

By pinpointing validation and invalidation price levels, we aim to enhance trading confidence and strategic decision-making. Our goal is to deliver objective, data-driven, and professional Elliott Wave analysis for WBC's price movements.