ASX: ASX LIMITED – Elliott Wave Technical Analysis | TradingLounge

Elliott Wave Forecast for ASX LIMITED (ASX)

Welcome to today's Elliott Wave analysis for the Australian Stock Exchange (ASX LIMITED – ASX). Our updated technical outlook highlights strong bullish momentum, particularly in the third wave of the third wave, which indicates significant upside potential for ASX LIMITED. Below, we provide key trend insights and confirmation levels to monitor potential trend shifts.

ASX: ASX LIMITED – Daily (1D) Chart Analysis (Semilog Scale)

Trend Type: Major Trend (Minor Degree, Grey)

Wave Mode: Motive

Wave Structure: Impulse

Current Position: Wave ((iii)) - Navy of Wave 3 - Grey

Wave Analysis:

The third wave of the third wave continues to unfold as an Extended Wave, reinforcing a strong bullish trend. With Wave ((iii)) - Navy progressing higher, this movement suggests that ASX LIMITED is experiencing an aggressive upward trend, with further growth potential in sight.

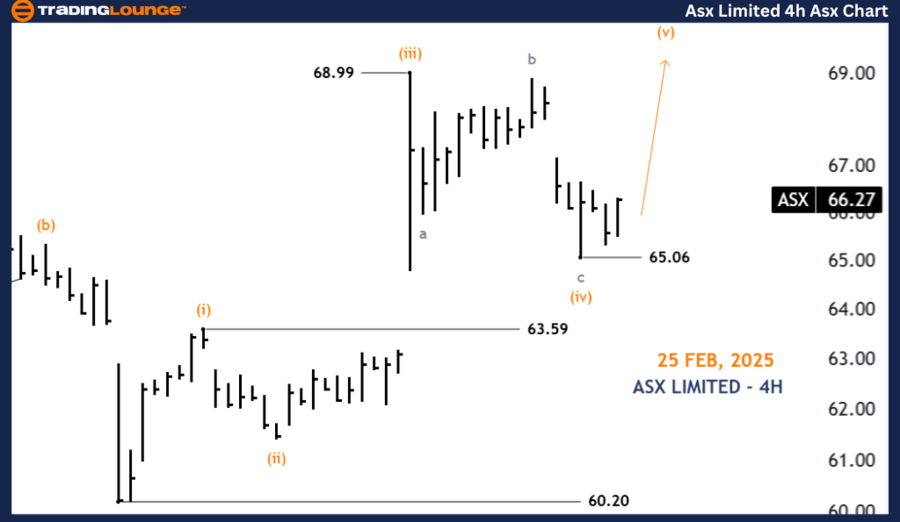

ASX: ASX LIMITED – 4-Hour Chart Analysis

Trend Type: Major Trend (Minor Degree, Grey)

Wave Mode: Motive

Wave Structure: Impulse

Current Position: Wave (v) - Orange of Wave ((iii)) - Navy

Wave Analysis:

On the 4-hour chart, the wave pattern has become clearer. It appears that Wave (iv) - Orange has completed, and Wave (v) - Orange is now pushing higher.

- Nearest Bullish Target: 68.99

- Key Support Level for Trend Continuation: 65.06

- Invalidation Level: 65.05 (A drop below this level could alter the current bullish outlook.)

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: JAMES HARDIE INDUSTRIES PLC Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion: Market Trend and Trading Outlook

Our Elliott Wave analysis for ASX LIMITED – ASX provides an in-depth market trend perspective with precise validation and invalidation levels to guide traders and investors. By closely monitoring these critical price points, we strengthen trade confidence and enhance market insights.

For professional traders and investors, our structured Elliott Wave forecast delivers data-driven market predictions, helping optimize investment decisions in the ASX LIMITED stock. Stay tuned for further updates on trend developments and wave progressions.