Elliott Wave Analysis: ASX JAMES HARDIE INDUSTRIES PLC (JHX) - Market Outlook

Greetings,

Our Elliott Wave technical analysis provides an updated forecast for JAMES HARDIE INDUSTRIES PLC (ASX: JHX). Based on our evaluation, JHX stock is likely to extend its decline in the medium-term, suggesting that traders should exercise caution with long positions due to prevailing risk factors. This analysis outlines key price levels and market trends, helping traders assess the technical outlook using both quantitative and pattern-based strategies.

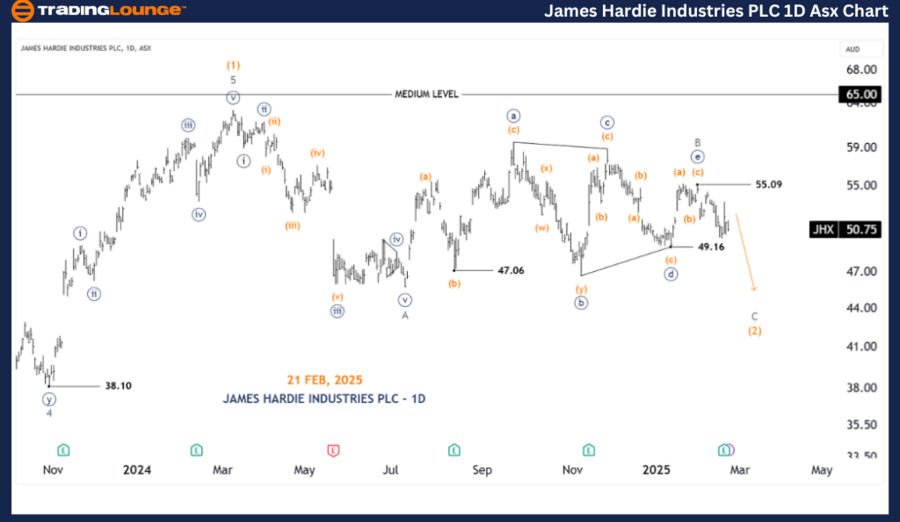

JAMES HARDIE INDUSTRIES PLC (JHX) Elliott Wave Technical Analysis 1D Chart (Semilog Scale)

Function: Major Trend (Intermediate Degree, Orange)

Mode: Motive

Structure: Impulse

Position: Wave C - Grey of Wave (2) - Orange

Technical Breakdown:

✔ Wave (2) - Orange remains incomplete, forming a classic Zigzag pattern.

✔ The recent sideways movement has shaped a Triangle labeled Wave B - Grey, which has now concluded.

✔ Wave C - Grey is expected to decline further, with a likely break below 49.16 USD, confirming a bearish structure.

✔ Invalidation Level: If the price surpasses 55.09 USD, this bearish scenario will be negated.

🔹 Key Price Level: 49.16 USD

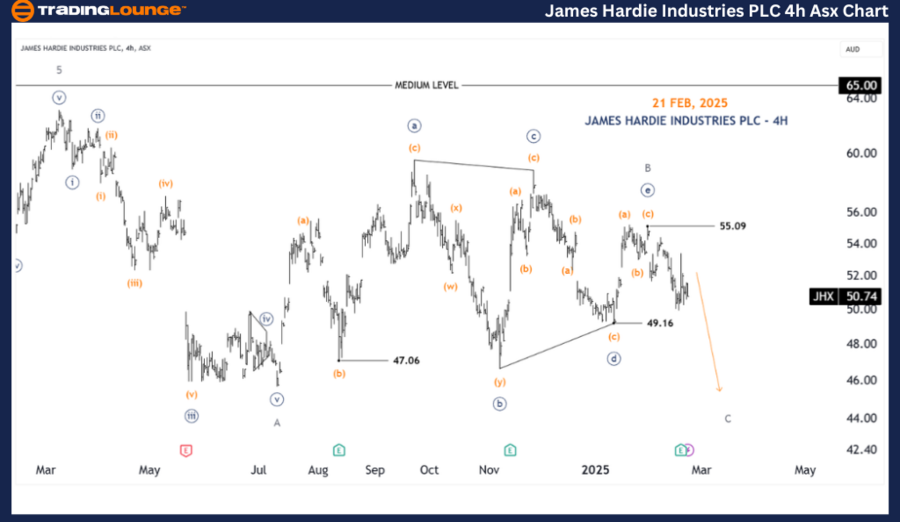

JAMES HARDIE INDUSTRIES PLC (JHX) 4-Hour Chart Analysis

Function: Major Trend (Intermediate Degree, Orange)

Mode: Motive

Structure: Impulse

Position: Wave C - Grey of Wave (2) - Orange

Technical Breakdown:

✔ A detailed wave analysis indicates that Wave ((e)) - Navy of Wave B - Grey has formed a three-wave Zigzag, concluding at 55.09 USD.

✔ With this corrective structure completed, the bearish outlook remains dominant, suggesting continued downside potential.

✔ Invalidation Level: If the price rises above 55.09 USD, this bearish forecast will be reconsidered.

🔹 Key Price Level: 49.16 USD

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: RIO TINTO LIMITED Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion: JAMES HARDIE INDUSTRIES PLC (JHX) Elliott Wave Forecast

Our Elliott Wave forecast for JHX stock provides a comprehensive market outlook, equipping traders with key technical insights. By identifying validation and invalidation price levels, we enhance confidence in our wave count predictions. This structured technical analysis offers a professional and data-driven approach to predicting JHX price movements, assisting traders in making well-informed decisions.