Silver Elliott Wave Analysis: Bullish Outlook Amid August Volatility

Silver has shown a mixed performance throughout August. The commodity initially dropped nearly 3% during the first week but quickly rebounded, gaining over $3.2 from a low just above $26.5. As the month progresses, Silver has managed a modest net gain, setting up potential rallies as we approach September.

Silver Elliott Wave Technical Analysis

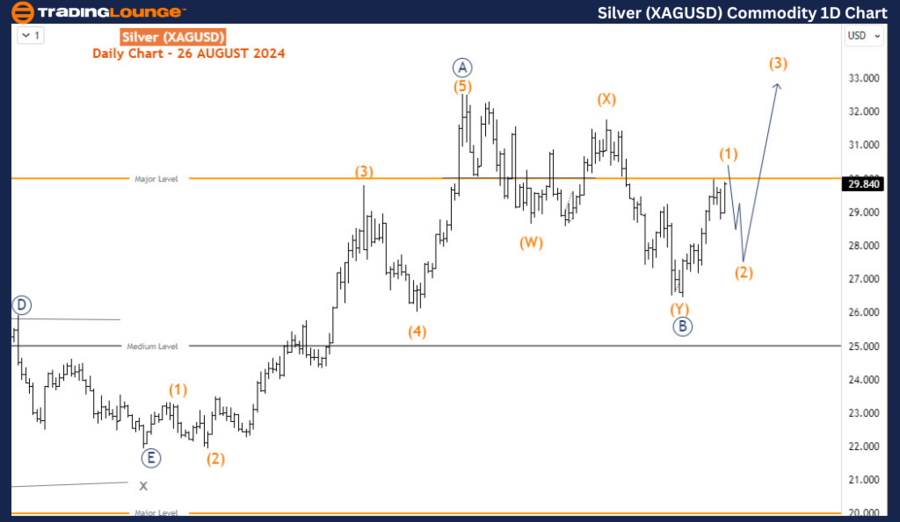

Silver Daily Chart Analysis

The daily chart indicates that Silver completed an impulsive wave sequence, labeled as wave A (circled), which started in January 2024 and ended in May 2024. This upward move was followed by a corrective pullback, labeled as wave B (circled), marking a temporary pause in the broader bullish trend. The wave B (circled) pullback seems to have taken the form of a double zigzag pattern, which suggests that the correction is nearing its conclusion.

With the completion of wave B (circled), the market is now likely entering wave C (circled), which is expected to be an impulse wave similar to wave A (circled). This wave C (circled) could drive prices above the $36 level. The initial leg of this upward movement, labeled wave (1), is currently in its final stages and is expected to complete around the $30 mark.

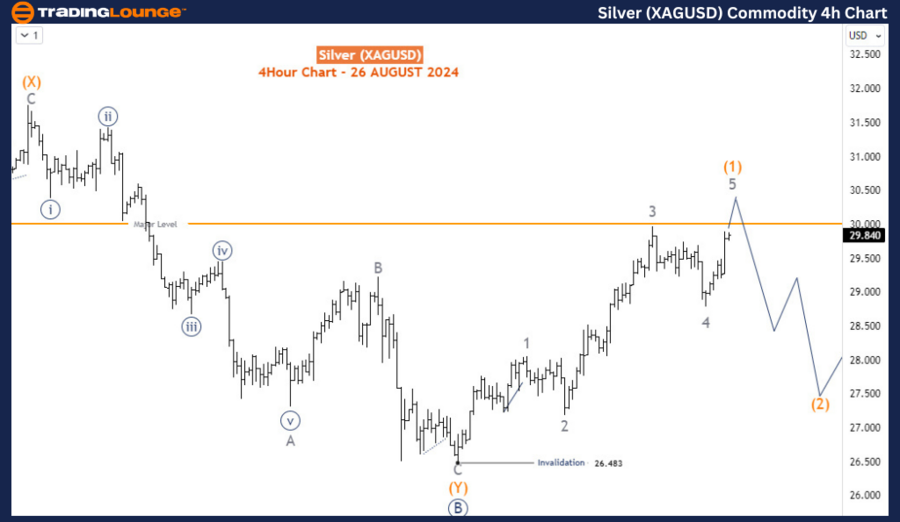

Silver H4 Chart Analysis

The 4-hour chart provides a closer look at the current wave structure. Wave (1) is unfolding as an impulse wave, with the market now advancing in wave 5 of (1). This wave 5 could push prices above the $30 threshold, potentially reaching as high as $30.5. However, traders should be aware that a corrective pullback in wave (2) is likely to follow once wave (1) concludes.

Despite the anticipated short-term corrections, the overall outlook for Silver remains bullish, with the price favoring a move toward $36 in the longer term. Along the way, two significant pullbacks are expected, offering traders opportunities to buy the dips after confirming the end of each correction.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Gold Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

In summary, while Silver may see some volatility and corrective moves in the near term, the broader trend remains upward. Traders should stay alert for potential entry points during the expected pullbacks, as the commodity remains well-positioned for a continued rally toward higher levels.