ASX - SANTOS LIMITED (STO): Elliott Wave Analysis TradingLounge (Daily Chart)

Greetings, Our Elliott Wave analysis today updates the Australian Stock Exchange (ASX) with SANTOS LIMITED (STO) shares. We observe that STO may continue to rise further, with the setup of the third wave within the third wave.

ASX - SANTOS LIMITED (STO) Elliott Wave Technical Analysis

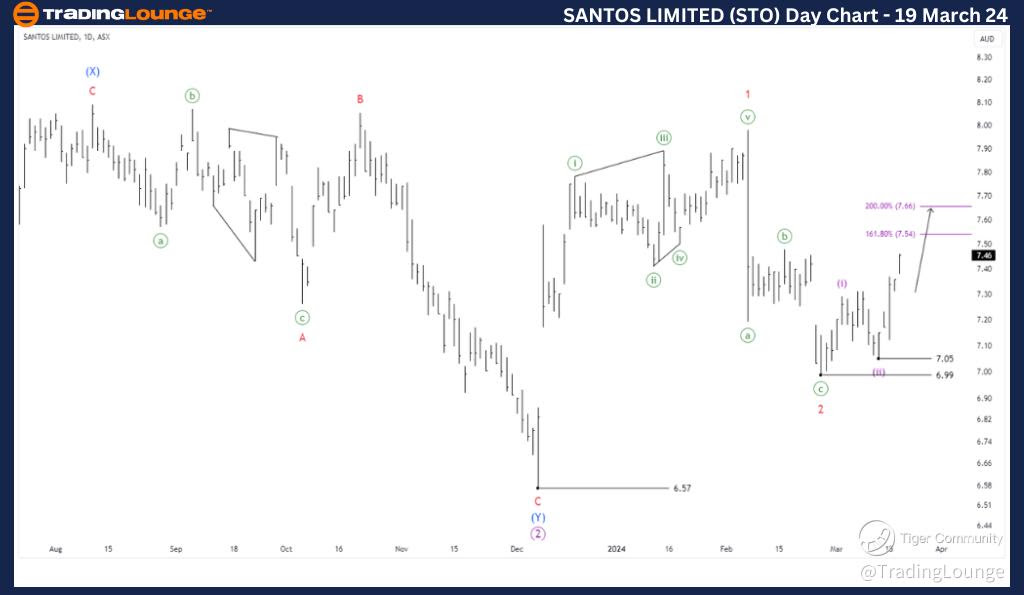

ASX - SANTOS LIMITED (STO): STO 1D Chart Analysis

Function: Major trend (Primary degree, purple)

Mode: Motive

Structure: Impulse

Position: Wave ((3))-purple

Details: The broader context suggests that waves ((1))-purple and ((2))-purple have concluded, and wave ((3))-purple is now unfolding to move higher. Wave ((2)) appears to have retraced without strong sharpness, despite following a Diagonal, so it's premature to conclude that STO will continue to rise. We will need to continue monitoring, but an upward movement in the medium term is feasible.

Invalidation point: 6.57

ASX - SANTOS LIMITED (STO): Elliott Wave Analysis TradingLounge (4-Hour Chart),

ASX - SANTOS LIMITED (STO): STO 4-Hour Chart Analysis

Function: Major trend (Minor degree, red)

Mode: Motive

Structure: Impulse

Position: Wave (iii)-purple of Wave 3-red

Details: The shorter-term outlook indicates that waves 1-red and 2-red have concluded, and wave 3-red is now unfolding to move higher. Wave (iii)-purple is expected to continue rising further, with an immediate target at 7.54. A move beyond this high would extend towards 7.66, while prices are expected to maintain levels higher than the low at 7.30.

Invalidation point: 6.99

Conclusion:

Our analysis and forecast of contextual trends, along with the short-term outlook for ASX: Santos Limited (STO), aim to provide readers with insights into upcoming market trends and how to capitalize on them by identifying optimal positions. Additionally, we offer specific price points that act as invalidation levels for the wave count (acknowledging potential inaccuracies) and confirmation levels to enhance confidence in the wave count. By integrating these elements, we aim to offer readers the most objective and professional perspective and opinion on market trends.

Elliott Wave Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation)

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: CSL LIMITED (ASX)

TradingLounge Once Off SPECIAL DEAL: Here > 1 month Get 3 months.