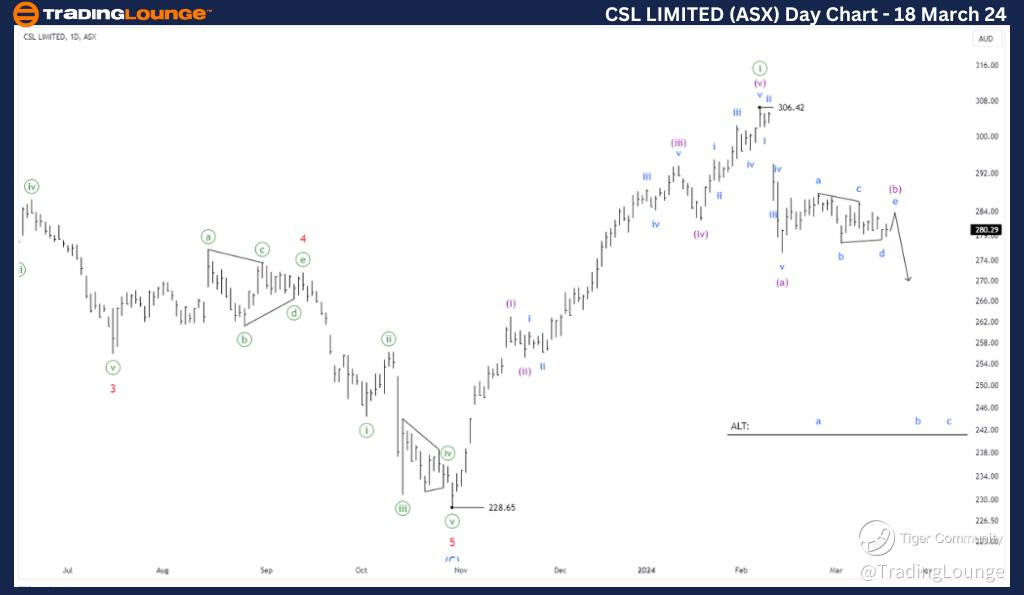

CSL LIMITED (ASX): CSL Elliott Wave Technical Analysis TradingLounge (1D Chart), March 18, 2024

Greetings, Our Elliott Wave analysis today updates the Australian Stock Exchange (ASX) with CSL Limited (CSL) shares. We have identified a Triangle correction pattern, indicating the potential for CSL to continue declining further.

CSL LIMITED (ASX): CSL Elliott Wave Technical Analysis

CSL LIMITED (ASX): CSL 1D Chart (Semilog Scale) Analysis

Function: Counter trend (Minute degree, green)

Mode: Corrective

Structure: Zigzag

Position: Wave (c)-purple of wave ((ii))-green

Details: Short-term outlook shows wave ((ii))-green unfolding with Zigzag correction, wave (a)-purple completed, wave (b) is unfolding with Triangle correction and will probably end soon with wave e-blue is about to peak, and this will be followed by wave (c)-purple returning lower. However a move higher than 287.77 would suggest an alternative wave count (ALT) is underway.

Invalidation point: 287.77

Confirmation point: Falling below the low at 277.54

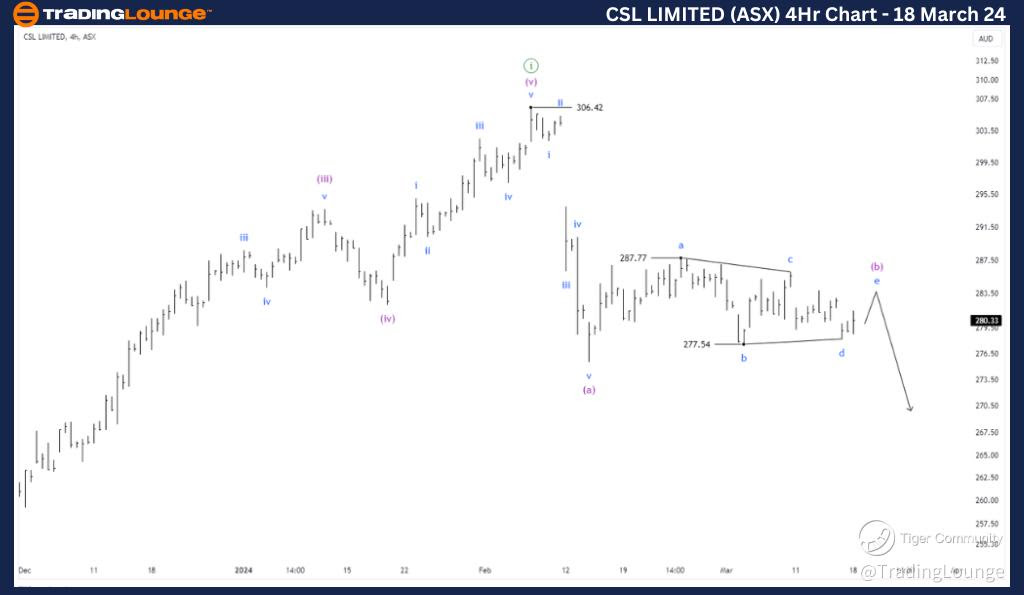

TradingLounge Elliott Wave Analysis for CSL LIMITED (ASX): CSL 4-Hour Chart, 18 March 24

CSL LIMITED (ASX): CSL Elliott Wave Technical Analysis

CSL LIMITED (ASX): CSL 4-Hour Chart Analysis

Function: Counter trend (Minuette degree, purple)

Mode: Corrective

Structure: Triangle

Position: Wave e-blue of Wave (b)-purple

Details: The short-term outlook on the 4-hour chart indicates that wave (b)-purple is unfolding within a Triangle pattern. It seems that wave d-blue has just concluded, and wave e-blue is continuing its process. A drop below 277.54 will show that the bear market is gaining more confidence, whereas a rise above 287.77 will suggest the invalidation of this Triangle correction, prompting a reassessment of the situation.

Invalidation point: 287.77

Confirmation point: Falling below the low at 277.54

Conclusion:

Our analysis, forecast of contextual trends, and short-term outlook for ASX: CSL LIMITED (CSL) provide readers with an idea of what the upcoming trends are in the market, and how to take advantage of them. to exploit the best positions. Furthermore, we provide specific prices that act as if the wave count was invalidated (we know how wrong we were) and prices that show confirmation for the wave count to increase confidence. for that prospect. Combining all of these factors gives readers the most objective and professional perspective and opinion on trends.

Technical Analyst: Cuong (Shane) Hua, CEWA-M

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

TradingLounge Once Off SPECIAL DEAL: Here > 1 month Get 3 months.