EURUSD Elliott Wave Analysis Trading Lounge 4 Hour Chart, 7 February 24

Euro/U.S.Dollar(EURUSD) 4 Hour Chart

EURUSD Elliott Wave Technical Analysis

FUNCTION: Trend

MODE: Impulsive

STRUCTURE: blue wave 1

POSITION: Black wave 3

DIRECTION NEXT HIGHER DEGREES: blue wave 1 (started)

DETAILS: blue wave y of 2 looking completed at 1.07132 . Now blue wave 1 of 3 looking started . Wave Cancel invalid level: 1.04499

The "EURUSD Elliott Wave Analysis Trading Lounge 4 Hour Chart" dated 7 February 24, provides a comprehensive Elliott Wave Technical Analysis for the Euro/U.S. Dollar (EURUSD) currency pair.

The identified "FUNCTION" is "Trend," indicating that the analysis is oriented towards understanding and trading in the direction of the prevailing market trend. This suggests a focus on potential opportunities aligned with the broader upward movement in the market.

The specified "MODE" is "Impulsive," implying that the current market structure is exhibiting characteristics of an impulsive wave. Impulsive waves are typically associated with strong, directional price movements in the direction of the prevailing trend.

The "STRUCTURE" is defined as "Blue wave 1," signaling that the market is in the early stages of a new impulsive wave. This is a key element for traders using Elliott Wave principles to anticipate and capitalize on directional moves.

The "POSITION" is labeled as "Black wave 3," indicating the current position within the broader wave count. Black wave 3 is particularly significant, as third waves are often the longest and most powerful within the Elliott Wave sequence.

In terms of "DIRECTION NEXT HIGHER DEGREES," the analysis points to "Blue wave 1 (started)," suggesting that the broader Elliott Wave count anticipates the initiation of a significant upward movement.

The "DETAILS" section highlights that "blue wave y of 2" is considered completed at 1.07132. The analysis now indicates that "blue wave 1 of 3" has started, signaling the potential beginning of a strong upward impulse.

The "Wave Cancel invalid level" is specified as "1.04499." This level serves as a critical reference point, and any breach of this level may prompt a reevaluation of the current wave count and market outlook.

In summary, the EURUSD Elliott Wave Analysis for the 4 Hour Chart on 7 February 24, suggests an impulsive structure with the initiation of blue wave 1 of 3. Traders are advised to closely monitor the market dynamics, especially the specified invalidation level at 1.04499, for potential shifts in the market sentiment.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

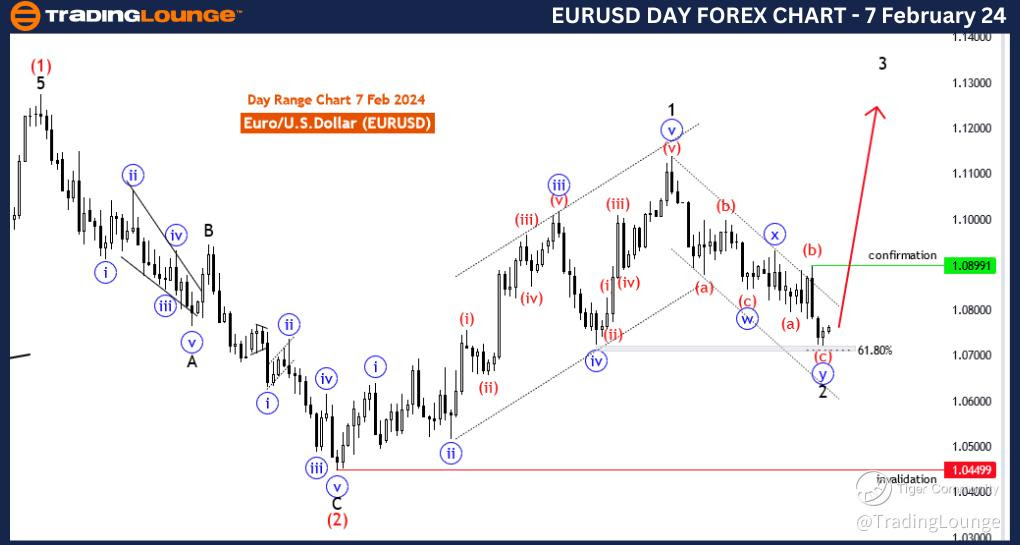

EURUSD Elliott Wave Analysis Trading Lounge Day Chart, 7 February 24

Euro/U.S.Dollar(EURUSD) Day Chart

EURUSD Elliott Wave Technical Analysis

FUNCTION: Trend

MODE: Impulsive

STRUCTURE: black wave 3

POSITION: Red wave 3

DIRECTION NEXT HIGHER DEGREES: black wave 3 (started)

DETAILS: blue wave y of black wave 2 looking completed at 1.07132 . Now subwaves of black wave 3 looking started . Wave Cancel invalid level: 1.04499

The "EURUSD Elliott Wave Analysis Trading Lounge Day Chart" dated 7 February 24, provides an in-depth analysis of the Euro/U.S. Dollar (EURUSD) currency pair using Elliott Wave principles.

The identified "FUNCTION" is "Trend," emphasizing a focus on understanding and potentially capitalizing on the prevailing market trend. This suggests an alignment of trading strategies with the broader directional movement in the market.

The specified "MODE" is "Impulsive," indicating that the current market structure exhibits characteristics of an impulsive wave. Impulsive waves are typically strong and directional, representing significant moves in the direction of the overall trend.

The "STRUCTURE" is defined as "Black wave 3," signifying the current wave within the larger Elliott Wave sequence. Wave 3 is often the strongest and longest wave in the sequence, making it a crucial phase for traders seeking to capitalize on significant market moves.

The "POSITION" is labeled as "Red wave 3," providing insight into the subwave count within the broader black wave 3. This level of detail is important for traders using Elliott Wave analysis to navigate and anticipate market movements.

In terms of "DIRECTION NEXT HIGHER DEGREES," the analysis points to "Black wave 3 (started)," indicating that the broader wave count anticipates the commencement of a powerful upward move.

The "DETAILS" section highlights that "blue wave y of black wave 2" is considered completed at 1.07132. The analysis now indicates that subwaves of "black wave 3" have started, suggesting the potential beginning of a strong and sustained upward impulse.

The "Wave Cancel invalid level" is specified as "1.04499." This level serves as a critical reference point, and a breach of this level may prompt a reevaluation of the current wave count and market outlook.

In summary, the EURUSD Elliott Wave Analysis for the Day Chart on 7 February 24, suggests an impulsive structure with the initiation of subwaves of black wave 3. Traders are advised to closely monitor the market dynamics, especially the specified invalidation level at 1.04499, for potential shifts in the market sentiment.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: AUDUSD