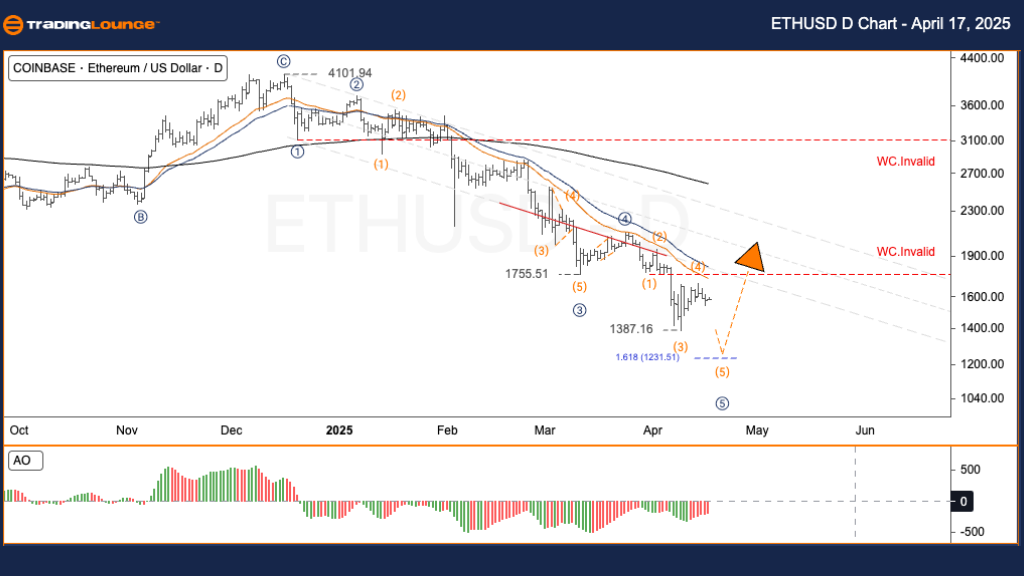

ETHUSD Elliott Wave Analysis - TradingLounge Daily Chart

Ethereum / U.S. Dollar (ETHUSD) Daily Chart Analysis

ETHUSD Elliott Wave Technical Analysis

Function: Trend Following

Mode: Motive

Structure: Impulse

Current Position: Wave 5

Direction of Next Higher Degree:

Wave Cancellation Level:

Ethereum / U.S. Dollar (ETHUSD) – Elliott Wave Trading Strategy

Ethereum is advancing through the final stages of its corrective ABC pattern, with wave C unfolding as sub-wave (4). The price is anticipated to move into sub-wave (5), targeting the $1,230–$1,250 zone — a region aligned with the 1.618 Fibonacci extension of sub-wave 1. This level is critical for identifying a potential trend reversal. Traders should look for bullish confirmation signals such as hammer candlesticks, divergence, or high-volume price reactions to confirm a new impulse wave.

Trading Strategies

Strategy Overview

✅ Swing Traders:

Watch for reversal setups within the $1,230–$1,250 Fibonacci extension zone before initiating positions.

Risk Management:

Detailed risk parameters are currently unspecified.

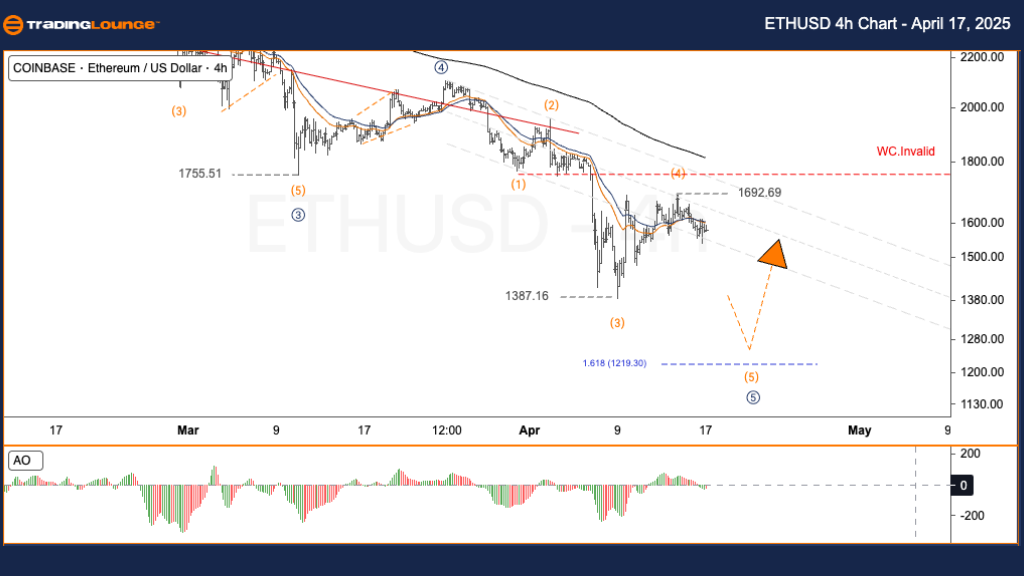

ETHUSD Elliott Wave Analysis - TradingLounge H4 Chart

Ethereum / U.S. Dollar (ETHUSD) 4-Hour Chart Analysis

ETHUSD Elliott Wave Technical Analysis

Function: Trend Following

Mode: Motive

Structure: Impulse

Current Position: Wave 5

Direction of Next Higher Degree:

Wave Cancellation Level:

Ethereum / U.S. Dollar (ETHUSD) – Elliott Wave Trading Strategy

Ethereum’s ABC corrective pattern is nearing its conclusion, with wave C developing into sub-wave (4). A continuation into sub-wave (5) is expected, targeting the $1,230–$1,250 region. This price zone coincides with the 1.618 Fibonacci extension of sub-wave 1 and may act as a support level for a bullish reversal. Traders should closely monitor for confirmation signals of a trend shift in this area.

Trading Strategies

Strategy Overview

✅ Swing Traders:

Anticipate a potential bottom within the $1,230–$1,250 range and wait for bullish reversal confirmation.

Risk Management:

Specific risk management strategies are not outlined.

Technical Analyst: Kittiampon Somboonsod, CEWA

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: SOLUSD Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support