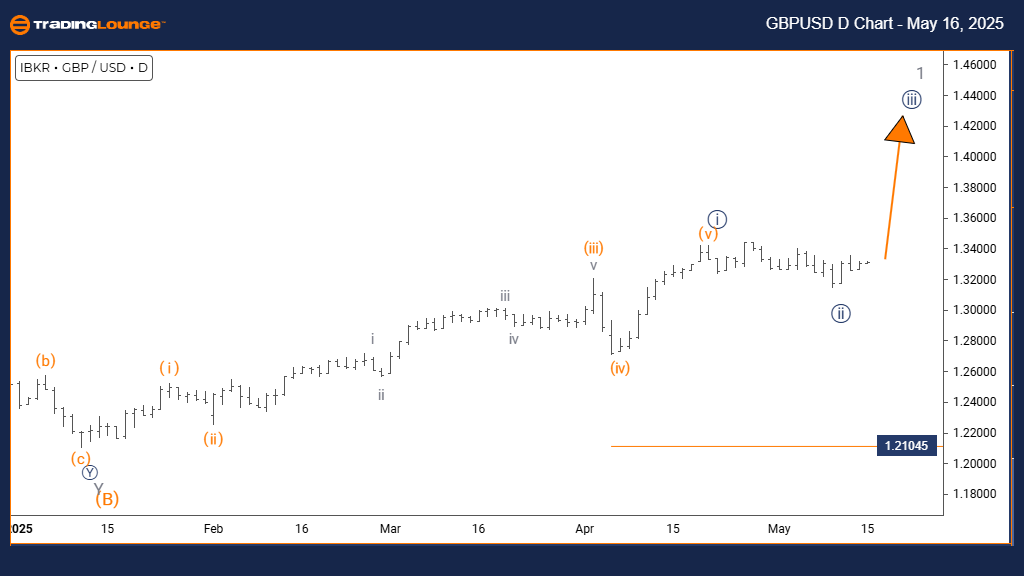

British Pound/ U.S. Dollar (GBPUSD) Elliott Wave Analysis | Trading Lounge Daily Chart

GBPUSD Elliott Wave Technical Outlook

Function: Bullish Market Trend

Wave Mode: Impulsive Wave Pattern

Wave Structure: Developing Navy Blue Wave 3

Current Position: Gray Wave 1 Phase

Next Higher Degree Projection: Navy Blue Wave 3 (In Progress)

Wave Invalidation Level: 1.21045

Market Summary:

The daily GBPUSD chart demonstrates a clearly defined bullish trend, reinforced by impulsive Elliott wave formations. The current pattern shows the development of navy blue wave 3, supported by the prior completion of navy blue wave 2. With gray wave 1 anchoring the new impulse, the chart indicates increasing bullish momentum as wave 3 unfolds—a phase known for delivering strong price advances.

Key insight reveals that navy blue wave 2 is likely finalized, giving way to the active rally in wave 3. As part of this upward Elliott Wave cycle, the trend implies sustained buying interest. Technical validation remains intact unless price dips below the 1.21045 level, which would challenge the current wave count and potentially shift the market narrative.

British Pound/ U.S. Dollar (GBPUSD) Elliott Wave Analysis | Trading Lounge 4 Hour Chart

GBPUSD Elliott Wave Technical Outlook

Function: Bullish Price Action

Wave Mode: Impulsive Formation

Wave Structure: Building Orange Wave 1

Current Position: Within Navy Blue Wave 3

Next Higher Degree Projection: Orange Wave 1 (Ongoing)

Wave Invalidation Level: 1.21045

Market Summary:

The GBPUSD 4-hour chart supports a bullish scenario with impulsive wave patterns taking shape. Orange wave 1 is advancing within the broader navy blue wave 3, signaling that the correction from wave 2 has ended and a new bullish leg is underway. This structure typically initiates the start of a strong upward push.

Following the completion of navy blue wave 2, orange wave 1's rise highlights growing momentum. This early-stage bullish wave indicates renewed market interest and possible long-term upside. A drop below 1.21045 would disrupt the current count, signaling the need for structural reevaluation.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: USDJPY Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support