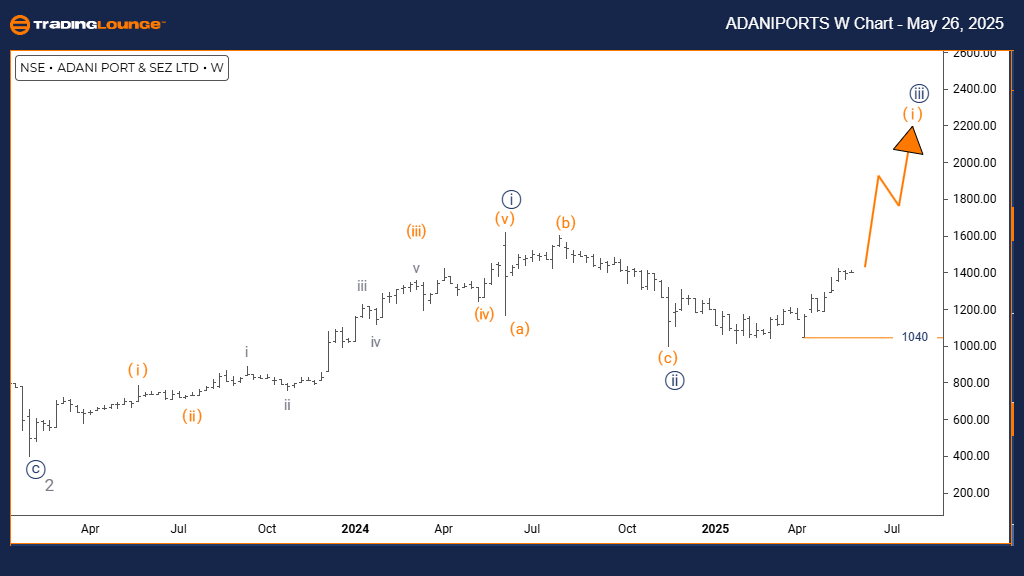

ADANI PORTS & SEZ – Elliott Wave Analysis | Trading Lounge Day Chart

ADANIPORT Elliott Wave Technical Analysis

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Gray Wave 3

POSITION: Orange Wave 1

DIRECTION NEXT LOWER DEGREES: Gray Wave 4

DETAILS: Gray Wave 2 appears to have completed, and Gray Wave 3 of 1 is currently unfolding.

Invalidation Level: 1040

The daily Elliott Wave chart for Adani Ports & SEZ shows an active bullish trend supported by impulsive wave development. This analysis marks the initiation of Gray Wave 3 within Orange Wave 1, suggesting that the corrective stage of Gray Wave 2 has likely ended and the trend is gaining strength.

Gray Wave 3 usually introduces a strong upside move, supported by increased market participation. Being part of Orange Wave 1, this wave phase indicates extended upward potential. A break below 1040 would invalidate this wave count and could indicate a deeper correction or trend reassessment.

This technical structure provides traders with clear direction in the current market phase. A minor correction — Gray Wave 4 — is anticipated after the ongoing rally, so active monitoring of trend continuation signals is advised. Traders should adjust their risk strategy as this bullish phase evolves.

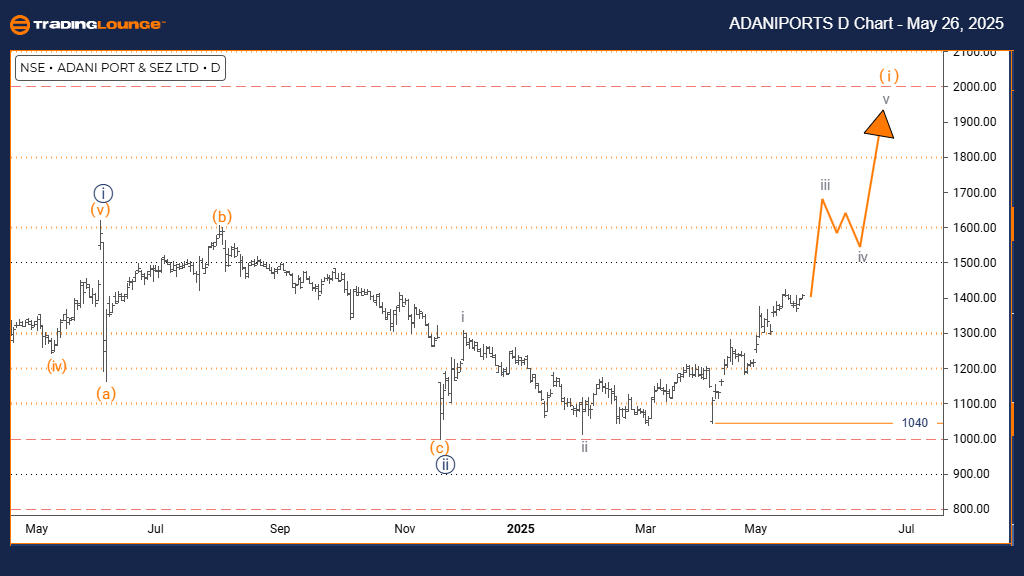

ADANI PORTS & SEZ – Elliott Wave Analysis | Trading Lounge Weekly Chart

ADANIPORT Elliott Wave Technical Analysis

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Orange Wave 1

POSITION: Navy Blue Wave 3

DIRECTION NEXT LOWER DEGREES: Orange Wave 2

DETAILS: Navy Blue Wave 2 appears complete, and Orange Wave 1 of 3 is unfolding.

Invalidation Level: 1040

The weekly chart for Adani Ports & SEZ supports a strong long-term bullish outlook. Current wave formation indicates Orange Wave 1 is progressing within the larger Navy Blue Wave 3, with Navy Blue Wave 2 likely completed.

Orange Wave 1 often reflects rising demand and early-stage price strength within an extended bullish trend. As part of Navy Blue Wave 3 — a commonly powerful move in the Elliott sequence — this wave structure hints at continued growth potential. A drop below 1040 would invalidate the present wave count and suggest a potential trend reevaluation.

This analysis positions Adani Ports & SEZ for a sustained uptrend, with Orange Wave 2 projected as the next corrective step. Investors focused on India’s infrastructure sector may find the current structure favorable for strategic entries or continuation setups.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: Bovespa Index Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support