Wheat Elliott Wave Analysis

Wheat Elliott Wave Technical Analysis

Function - Trend

Mode - Trend

Structure - Impulse for wave (A)

Position - Wave 5 of (A)

Direction - Wave (B)

Details - Wave 5 of (A) could be completed with an ending diagonal. Pullback for (B) should begin afterwards.

Since March 2024, wheat prices have shown a notable recovery, moving higher progressively. However, a potential slowdown and downward correction could occur soon. Despite this short-term correction, the overall recovery trend is expected to persist. The initial recovery from the March low of 523 is anticipated to reach the 840-940 range in the medium term. Yet, the long-term bearish trend might resume in the year's last quarter.

Daily Chart Analysis

The daily chart shows a bearish impulse wave starting at 1364 in March 2022, concluding at 523 in March 2024, marking a two-year sell-off. The subsequent recovery from 523 is approaching the completion of an impulse wave. This implies we should expect at least an (A)-(B)-(C) bullish correction continuing towards higher price levels, likely in the 842-942 range, corresponding to the 38.2-50% Fibonacci retracement zone. Prices might even move higher. This bullish corrective cycle is projected to extend until the year's last quarter. Currently, focus on the completion of wave (A) and anticipate a retracement in wave (B).

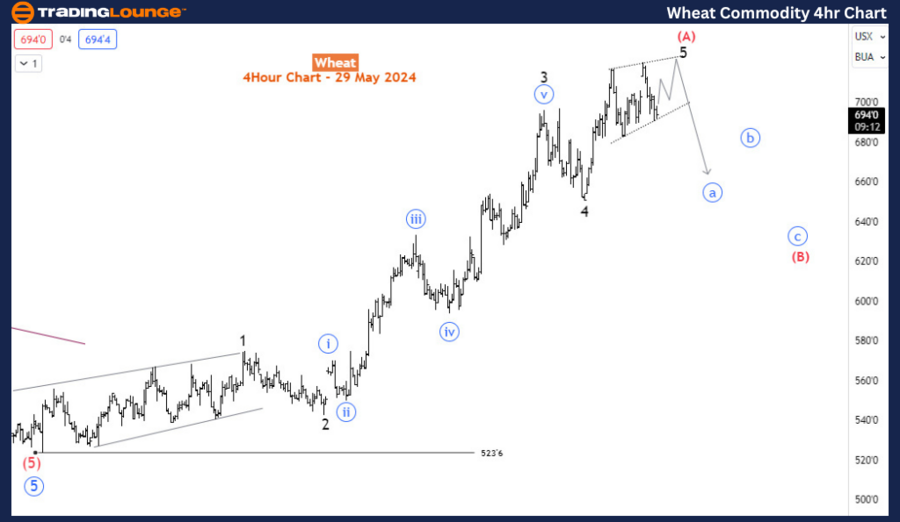

H4 Chart Analysis

The H4 chart reveals wave (A) nearing completion, forming an ending diagonal for wave 5. A bearish retracement for wave (B) is expected to start soon. The prudent strategy is to wait for wave (B) to complete before considering long positions in wave (C), provided wave (B) does not breach the 523 low.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Gold (XAUUSD) Elliott Wave Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support

In summary, while wheat prices have been on an upward trajectory since March 2024, we may soon experience a short-term correction. However, the broader recovery trend is expected to persist, with prices potentially reaching the 840-940 range. Traders should monitor the progression of wave (A) and prepare for the likely retracement in wave (B). By closely observing the key level of 523, traders can ensure that the bearish wave (B) does not invalidate the recovery trend. If wave (B) remains above this level, the subsequent wave (C) could present a favorable opportunity for long positions, aligning with the projected medium-term bullish correction before the resumption of the long-term bearish trend later in the year.