THETA/USD Elliott Wave Technical Analysis - TradingLounge – 1-Day Chart

THETA/USD (THETAUSD) Elliott Wave Technical Analysis

Function: Trend-following

Mode: Motive

Structure: Impulse

Position: Wave 5

Next Higher Degree Direction: Wave 5 of Impulse

Wave Cancelation Level: Not specified

Analysis Overview:

The ongoing price increase is part of Wave 5, aligning with the impulse structure.

THETA/USD Trading Strategy:

- The current correction follows a Triangle pattern, signaling trend continuation.

- The price is consolidating within a critical support level at $1.899, with an invalidation level at the same point.

- If the price remains above $2.000 and successfully breaches the resistance at $2.533, traders can consider a long position targeting $3.877, with a stop loss placed at $1.899.

Key Market Outlook:

- THETAUSD may continue its uptrend if the price breaks above $2.533, confirming the initiation of Wave (5).

- The potential price target remains at $3.877, while a price drop below $1.899 may signal a shift in the current structure.

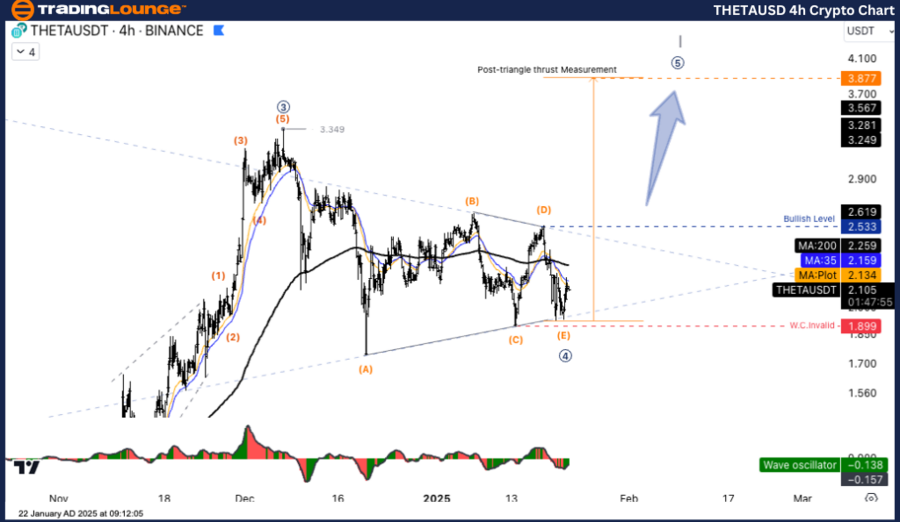

THETA/USD Elliott Wave Analysis – TradingLounge 4-Hour Chart

THETA/USD (THETAUSDT) Elliott Wave Technical Analysis

Function: Trend-following

Mode: Motive

Structure: Impulse

Position: Wave 5

Next Higher Degree Direction: Wave 5 of Impulse

Wave Cancelation Level: Not specified

Analysis Overview:

The price movement continues within Wave 5, confirming the ongoing impulse pattern.

THETA/USD Trading Strategy:

- The correction phase follows a Triangle pattern, indicating a continuation of the trend.

- The market remains within the Consolidation Zone, with strong support at $1.899 (wave cancellation level).

- If the price sustains above $2.000 and surpasses the resistance at $2.533, a long trade can be initiated with an upside target of $3.877, and a stop loss at $1.899.

Key Market Outlook:

- A breakout above $2.533 will validate the uptrend continuation towards $3.877 in Wave (5).

- A decline below $1.899 may suggest a reversal and invalidate the current wave structure.

Technical Analyst: Kittiampon Somboonsod

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: BTCUSD Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support