Soybeans Commodity Elliott Wave Analysis

Soybean prices have reached their lowest levels since September 2020, continuing a prolonged downtrend that started in June 2022. The latest decline began in May 2024, wiping out the gains made between February and March 2024. While a short-term corrective bounce may occur, the overall outlook suggests that soybeans are likely to continue their downward trend in the coming months.

Soybeans Daily Chart Analysis

The daily chart shows a significant bullish impulse wave starting in May 2019, peaking at 1785 in June 2022. Since then, prices have entered a corrective phase, adjusting the long-term upward trend. This decline from the 1785 peak follows a zigzag A-B-C (circled) pattern. Waves A and B (circled) were completed at 1249 (October 2023 low) and 1398 (November 2023 high), respectively. Wave C (circled) is currently unfolding downward, with waves (1) and (2) of 5 (circled) already formed, and wave 1 of (3) now in progress. The price is approaching the critical 1,000 level as it works to complete wave 1 of (3). A corrective move for wave 2 of (3) is anticipated soon.

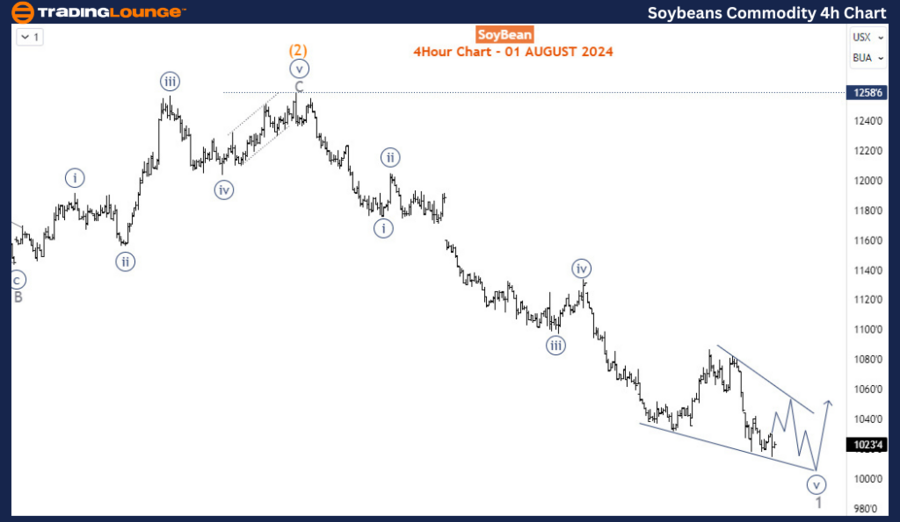

Soybeans 4-Hour Chart Analysis

The H4 chart suggests wave 1 is nearing the completion of an impulsive wave pattern, with the 5th sub-wave possibly forming an ending diagonal, which could indicate a reversal. Before any significant movement, a bullish confirmation for wave 2 is needed. The ideal trading strategy at this point is to wait for wave 2 to finish, then look for SHORT opportunities as wave 3 of (3) begins, provided the 1288 wave (2) high remains unbroken.

Conclusion

In conclusion, the Elliott Wave analysis of soybeans indicates that, despite the possibility of a short-term corrective bounce, the prevailing bearish trend is expected to continue. Traders should be on the lookout for SHORT opportunities following the expected wave 2 correction, especially around the key 1,000 level. The larger downtrend remains intact, and the completion of the current wave pattern will provide further insights into the commodity's future direction.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Silver (XAGUSD) Elliott Wave Technical Analysis