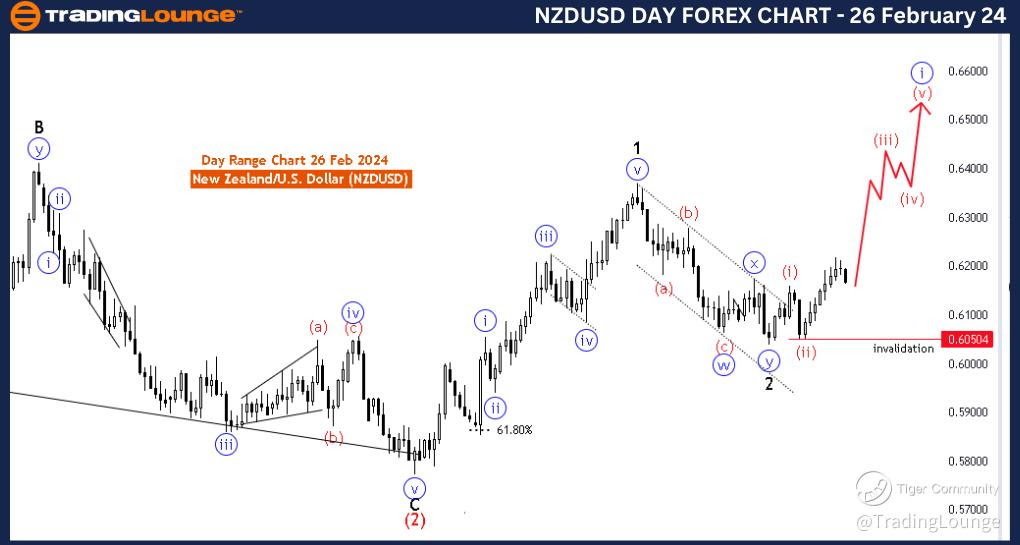

NZDUSD Elliott Wave Analysis Trading Lounge, 26 February 24

New Zealand Dollar/U.S.Dollar Day Chart Analysis

NZDUSD Elliott Wave Technical Analysis

FUNCTION: Trend

MODE: Impulsive

STRUCTURE: Blue wave 1

POSITION: Black Wave 3

DIRECTION NEXT LOWER DEGREES: Blue wave 2

DETAILS: black wave 2 looking completed at 0.60363. Now blue wave 1 of black wave 3 is in play. Wave Cancel invalid level: 0.60512

The "NZDUSD Elliott Wave Analysis Trading Lounge Day Chart" dated 26 February 24, provides a comprehensive analysis of the New Zealand Dollar/U.S. Dollar (NZDUSD) currency pair on a daily timeframe, employing Elliott Wave principles to discern potential market movements.

The designated "FUNCTION" is "Trend," indicating the primary objective is to identify and capitalize on the prevailing market direction. In this context, the focus is on capturing impulsive waves that define the strength and persistence of the overarching trend.

The specified "MODE" is "Impulsive," signaling a market environment characterized by strong, forceful, and directional price movements. This suggests that the current phase in the market is conducive to identifying and participating in the primary trend.

The described "STRUCTURE" is "Blue wave 1," denoting the specific wave within the Elliott Wave hierarchy. Blue wave 1 represents the initial phase of a larger impulsive move, typically marking the beginning of a new trend.

The identified "POSITION" is "Black wave 3," indicating the current position within the broader Elliott Wave pattern. Wave 3 is often the most dynamic and extended wave in the sequence, reflecting a powerful surge in the direction of the dominant trend.

In terms of "DIRECTION NEXT LOWER DEGREES," the analysis emphasizes "Blue wave 2," suggesting the anticipated corrective phase following the completion of black wave 3.

The "DETAILS" section notes that "black wave 2 looking completed at 0.60363. Now blue wave 1 of black wave 3 is in play." This suggests the conclusion of a corrective phase (black wave 2) and the initiation of the next impulsive move (blue wave 1 of black wave 3).

The "Wave Cancel invalid level" is set at 0.60512, serving as a critical reference point. A breach beyond this level would invalidate the current wave count and prompt a reevaluation of the analysis.

In summary, the NZDUSD Elliott Wave Analysis for the daily chart on 26 February 24, indicates a continuation of the impulsive move, with blue wave 1 of black wave 3 in progress. Traders are advised to monitor the unfolding of blue wave 1 and consider the invalidation level at 0.60512.

NZDUSD Elliott Wave Analysis Trading Lounge, 26 February 24

New Zealand Dollar/U.S.Dollar (NZDUSD) 4 Hour Chart Analysis

NZDUSD Elliott Wave Technical Analysis

FUNCTION: Trend

MODE: Impulsive

STRUCTURE: red wave 3

POSITION: Blue wave 1

DIRECTION NEXT LOWER DEGREES: red wave 4

DETAILS: red wave 2 of blue wave 1 looking completed at 0.60512. Now red wave 3 of blue wave 1 is in play. Wave Cancel invalid level: 0.60512

The "NZDUSD Elliott Wave Analysis Trading Lounge 4 Hour Chart" dated 26 February 24, presents a detailed analysis of the New Zealand Dollar/U.S. Dollar (NZDUSD) currency pair using Elliott Wave principles. The focus is on a 4-hour chart, allowing for a more granular examination of price movements.

The identified "FUNCTION" is "Trend," indicating that the analysis aims to capture the prevailing direction in the market. This suggests an interest in identifying and riding the impulsive waves that contribute to the overall trend.

The specified "MODE" is "Impulsive," signaling that the current market conditions are characterized by strong, forceful, and directional price movements. Impulsive waves typically indicate the primary trend's strength and persistence.

The described "STRUCTURE" is "Red wave 3," highlighting the current position within the larger Elliott Wave pattern. Wave 3 is often the strongest and longest phase of the Elliott Wave cycle, representing a powerful surge in the direction of the dominant trend.

The designated "POSITION" is "Blue wave 1," indicating the specific wave within the Elliott Wave hierarchy. Blue wave 1 represents the initial phase of the larger trend cycle and marks the beginning of a new impulsive move.

In terms of "DIRECTION NEXT LOWER DEGREES," the analysis emphasizes "Red wave 4," suggesting the anticipated correction or consolidation phase following the completion of red wave 3.

The "DETAILS" section notes that "red wave 2 of blue wave 1 looking completed at 0.60512. Now red wave 3 of blue wave 1 is in play." This indicates the conclusion of a corrective phase (red wave 2) and the commencement of the next impulsive move (red wave 3 of blue wave 1).

The "Wave Cancel invalid level" is set at 0.60512. This level serves as a crucial reference point, beyond which the current wave count would be considered invalid.

In summary, the NZDUSD Elliott Wave Analysis for the 4-hour chart on 26 February 24, suggests a continuation of the impulsive move, with red wave 3 of blue wave 1 in progress. Traders are advised to monitor the unfolding of red wave 3 and consider the invalidation level at 0.60512.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: U.S.Dollar /Canadian Dollar(USD/CAD)