Elliott Wave Analysis – AAVE/USD – Daily Charts by TradingLounge

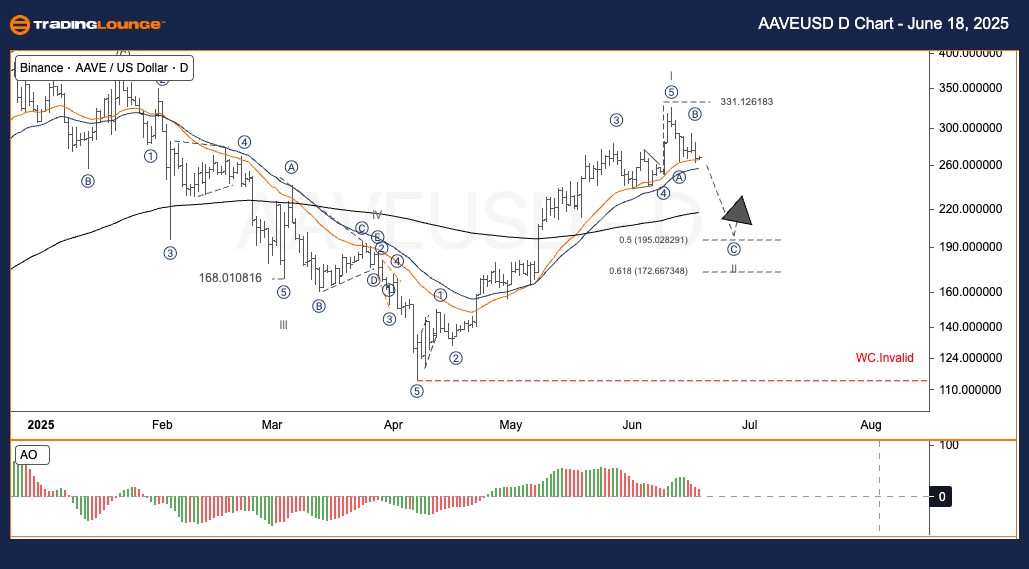

AAVE/USD Elliott Wave Technical Analysis (Daily Chart)

Function: Counter Trend

Mode: Corrective

Structure: Not Applicable

Position: Wave 2

Invalidation Level: $116

Analysis Summary:

AAVE/USD concluded its Wave V downtrend within the $50–$60 support zone during April, initiating a bullish reversal. This led to a completed five-wave impulse structure topping at $331.12, marking Wave I. The ongoing price decline signals the likely formation of Wave II, a corrective phase typically preceding a stronger bullish Wave III. This aligns with standard Elliott Wave principles and suggests a medium-term AAVE price correction within an overall upward trend.

AAVE/USD Trading Strategy (Daily Chart)

- Short-Term Swing Trade Strategy:

✅ Monitor the $195–$172 price zone for bullish reversal patterns. This area offers a favorable entry point for traders positioning for the anticipated Wave III uptrend.

🟥 As long as AAVE/USD maintains support above $116, the bullish Elliott Wave scenario remains valid.

Elliott Wave Analysis – AAVE/USD – 4H Charts by TradingLounge

AAVE/USD Elliott Wave Technical Analysis (H4 Chart)

Function: Counter Trend

Mode: Corrective

Structure: Not Applicable

Position: Wave 2

Invalidation Level: $116

Analysis Summary:

On the H4 timeframe, AAVE/USD ended its final Wave V leg near $50–$60 before advancing in a clear impulsive sequence that peaked at $331.12, completing Wave I. The current corrective retracement indicates the development of Wave II. This aligns with a typical pullback setup seen prior to a continuation move in Wave III, reinforcing bullish AAVE forecasts in the short term.

AAVE/USD Trading Strategy (H4 Chart)

✅ Focus on reversal signals between $195 and $172. Confirmation in this range could support a strategic long position targeting Wave III.

🟥 The current wave interpretation remains intact provided price does not fall below $116.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: ETHUSD Elliott Wave Technical Analysis

VALUE Offer - $1 for 2 Weeks then $29 a month!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support