SPOT Elliott Wave Analysis: Spotify Technology S.A. (SPOT) – Daily and 1-Hour Chart Overview

This analysis explores the technical movements of Spotify Technology S.A. (SPOT) based on both the daily and 1-hour charts. Using the Elliott Wave Theory, this evaluation focuses on current market trends and potential future price shifts.

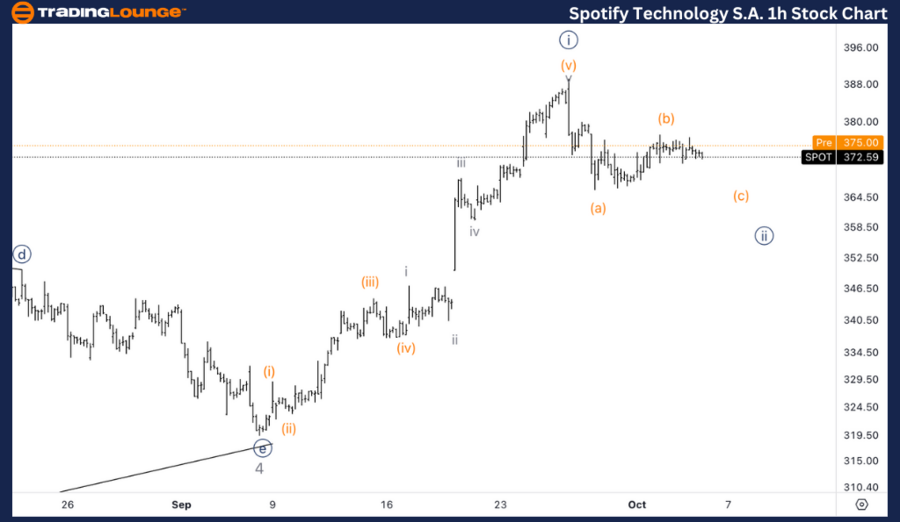

SPOT Elliott Wave Analysis – TradingLounge Daily Chart

Spotify Technology S.A. (SPOT) Daily Chart Overview

SPOT Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave 5

Direction: Completing Wave 5

Details: SPOT is currently trading within MinorGroup2 of the $300 level, specifically in the range between $372 and $380. The stock is expected to see further upward movement, targeting the next TradingLevel at $500 as it completes Wave 5.

SPOT Elliott Wave Technical Analysis – Daily Chart Overview

On the daily chart, SPOT is moving through Wave 5 of an impulsive structure. The stock is currently trading between $372 and $380 within MinorGroup2. The next key target is TradingLevel 500, indicating significant potential for further upside as SPOT progresses through the final stages of Wave 5.

Traders should monitor potential consolidations as SPOT approaches important psychological milestones like $400. Despite the possibility of pullbacks, the overall bullish momentum suggests continued upward potential, with $500 as the next major resistance level.

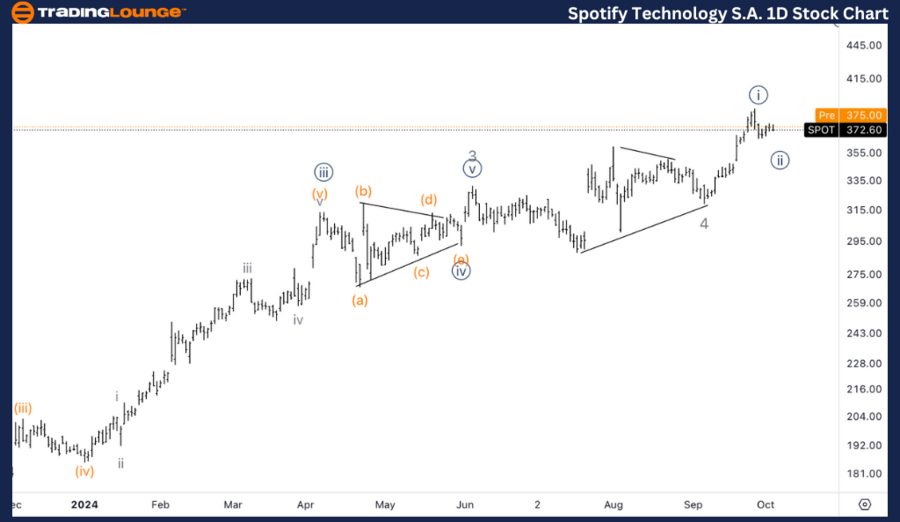

SPOT Elliott Wave Analysis – 1-Hour Chart

Spotify Technology S.A. (SPOT) 1-Hour Chart Overview

SPOT Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave {i} of 5

Direction: Seeking a bottom in Wave {ii}

Details: SPOT is currently seeking a bottom in Wave {ii} of 5, with expectations for a resumption of upward movement within Minor Wave 5 once Wave {ii} finds its bottom.

SPOT Elliott Wave Technical Analysis – 1-Hour Chart Overview

On the 1-hour chart, SPOT is in the early stages of Wave 5 and forming Wave {ii}. Once a bottom in Wave {ii} is confirmed, SPOT is expected to resume its upward trajectory within Wave 5, providing a potential buying opportunity for traders looking to capitalize on the next upward movement.

The immediate upside target is around $400, with a longer-term extension expected toward $500 as the stock completes Wave 5.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: NextEra Energy Inc Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support