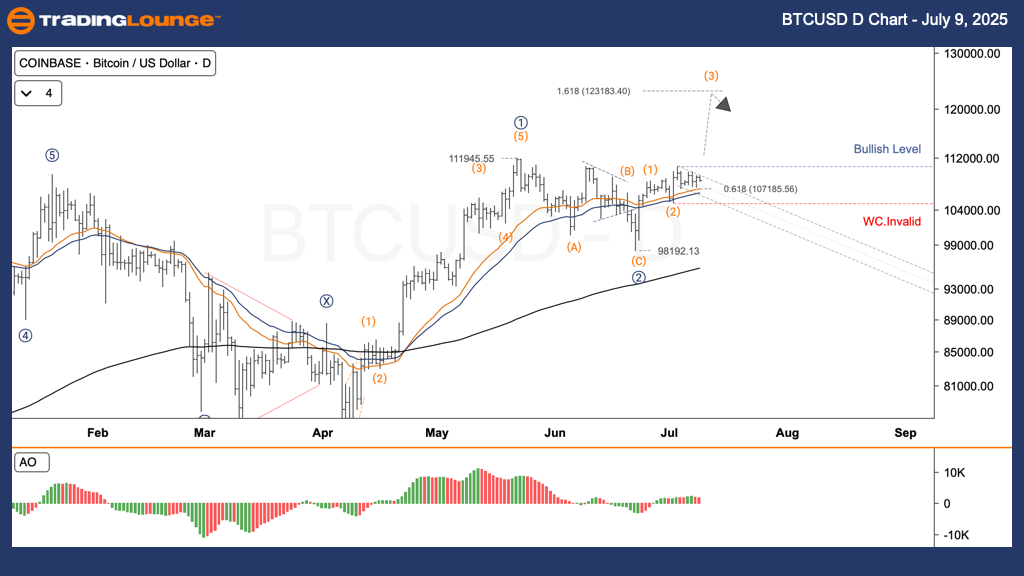

Bitcoin / U.S. Dollar (BTCUSD) Elliott Wave Analysis – TradingLounge – Daily Chart

BTCUSD Elliott Wave Technical Analysis

Function: Follow Trend

Mode: Motive

Structure: Impulse

Position: Wave 3

Direction: Anticipated continuation to the upside in the next higher wave degrees.

Bitcoin (BTCUSD) Trading Strategy

Bitcoin recently broke above the $110,590 level, completing wave (1). It is now undergoing a wave (2) ABC correction. Currently, sub-wave C is interacting with a major support zone, where a potential bullish reaction could initiate wave (3) upward movement.

Trading Strategies

✅ For Short-Term Traders (Swing Trade):

- Aggressive Entry: Monitor the $107,200–$106,300 range for bullish reversal indicators such as RSI divergence or bullish engulfing candlestick formations.

- Conservative Entry: Wait for a confirmed daily close above $110,600, signaling the beginning of wave (3).

🟥 Wave Count Invalidation:

- Key Level: $105,149.53

- A decline below this level would invalidate the current wave structure and require reevaluation.

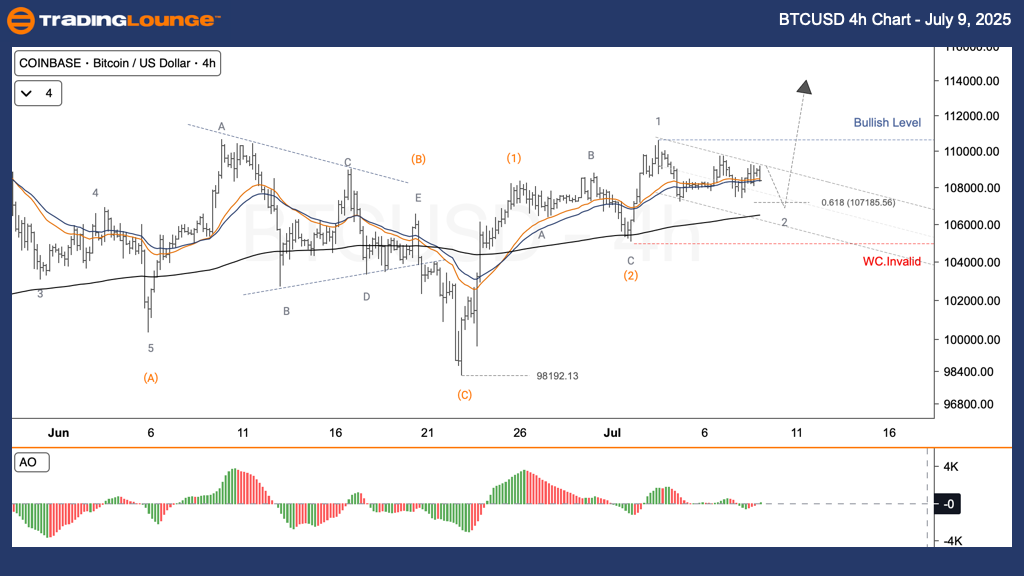

Bitcoin / U.S. Dollar (BTCUSD) Elliott Wave Analysis – TradingLounge – 4H Chart

Function: Follow Trend

Mode: Motive

Structure: Impulse

Position: Wave 3

BTC Price Forecast:

Following the breakout above $110,590, BTCUSD has entered an ABC corrective phase representing wave (2). Sub-wave C is currently testing a significant support level. A bullish rebound from this zone could mark the start of wave (3) moving higher.

Trading Strategies – Summary

✅ For Short-Term Traders (Swing Trade):

- Aggressive Entry: Enter within the $107,200–$106,300 area if bullish technical patterns are observed.

- Conservative Entry: Wait for confirmation with a close above $110,600 to initiate long positions.

🟥 Invalidation Point:

- Critical Price Level: $105,149.53

- Any drop below this price invalidates the current Elliott Wave outlook.

Technical Analyst: Kittiampon Somboonsod, CEWA

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: VETUSD Elliott Wave Technical Analysis

VALUE Offer - $1 for 2 Weeks then $29 a month!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support