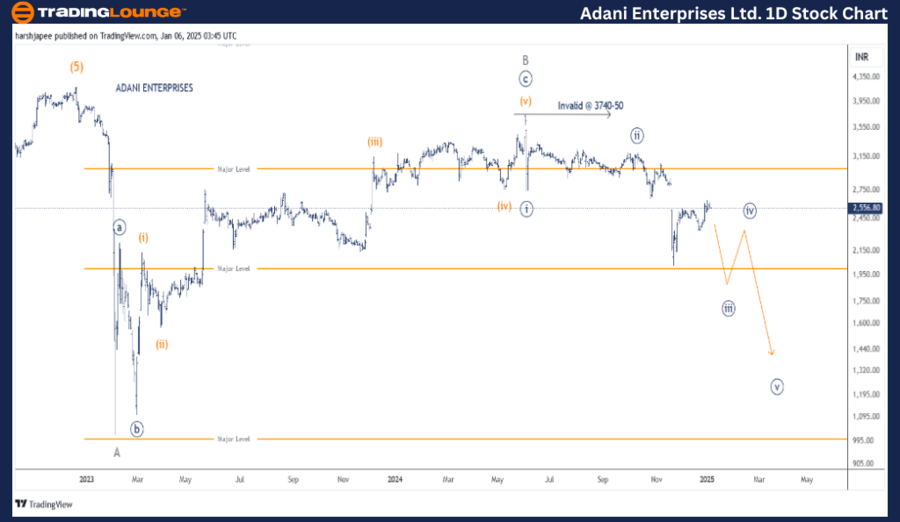

ADANI ENTERPRISES LTD – ADANIENT (1D Chart) Elliott Wave Technical Analysis

ADANIENT Elliott Wave Technical Analysis

Function: Counter Trend (Minor degree, Grey)

Mode: Corrective

Structure: Flat (3-3-5)

Position: Minute Wave ((iii)) Navy

Details:

- Minute Waves ((i)) and ((ii)) Navy of Wave C Grey are complete, with Wave ((iii)) currently in progress.

- Price action suggests prices should ideally remain below the 3200 mark.

- Invalidation Point: 3750

ADANI ENTERPRISES Daily Chart Technical Analysis and Potential Elliott Wave Counts

The daily chart of ADANI ENTERPRISES indicates a potential trend reversal after the stock hit the 4170–4180 range in December 2022. Intermediate Wave (5) Orange appears to have completed, marking the initiation of a Minor degree corrective wave sequence, A-B-C.

Key insights:

- Minor Wave A concluded near the 1020 level in February 2023.

- This was followed by a corrective rally consisting of Minute ((a))-((b))-((c)), marking the end of Minor Wave B Grey around the 3740–3750 range.

- Following this, bearish momentum has dominated, signaling the development of Minor Wave C lower.

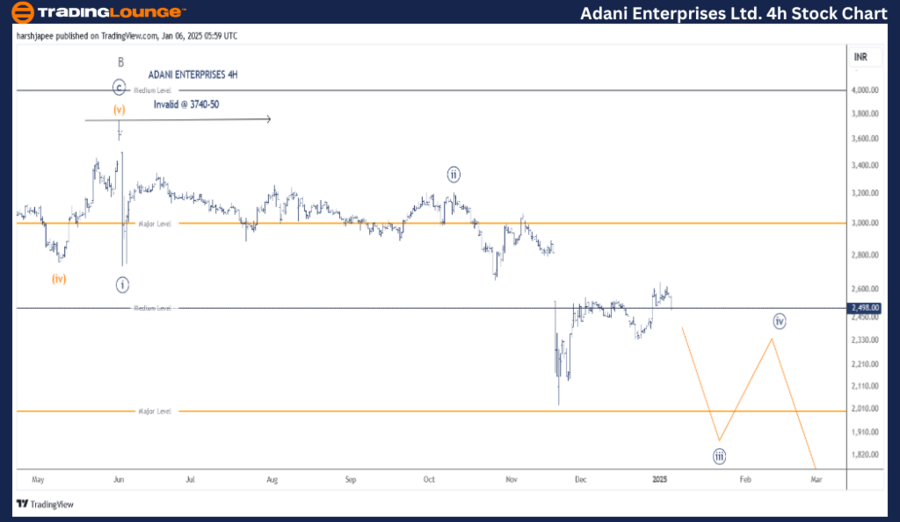

ADANI ENTERPRISES LTD – ADANIENT (4H Chart) Elliott Wave Technical Analysis

Function: Counter Trend (Minor degree, Grey)

Mode: Corrective

Structure: Flat (3-3-5)

Position: Minute Wave ((iii)) Navy

Details:

- Sub-waves ((i)) and ((ii)) Navy of Wave C Grey have been established, with Wave ((iii)) currently unfolding.

- It is likely that Minute Wave ((iii)) is extending downward.

- Price Outlook: Ideally, prices should remain below the 3200 mark.

- Invalidation Point: 3750

ADANI ENTERPRISES 4H Chart Technical Analysis and Potential Elliott Wave Counts

The 4H chart provides detailed insights into the sub-waves following the conclusion of Minor Wave B near the 3740–3750 range. Wave C appears to be developing as an impulse, a typical pattern for this structure.

Key observations:

- Minute Waves ((i)) and ((ii)) completed near the 2754 and 3214 levels, respectively.

- Minute Wave ((iii)) now seems to be extending, with a potential target near 1650.

- The bearish projection remains valid as long as prices stay below 3200.

Technical Analyst: Harsh Japee

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: NESTLE INDIA Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

ADANI ENTERPRISES is trending lower, currently within Minute Wave ((iii)) of Minor Wave C, targeting the 1650 mark. Investors should monitor key levels for potential invalidation or confirmation of the ongoing corrective structure.