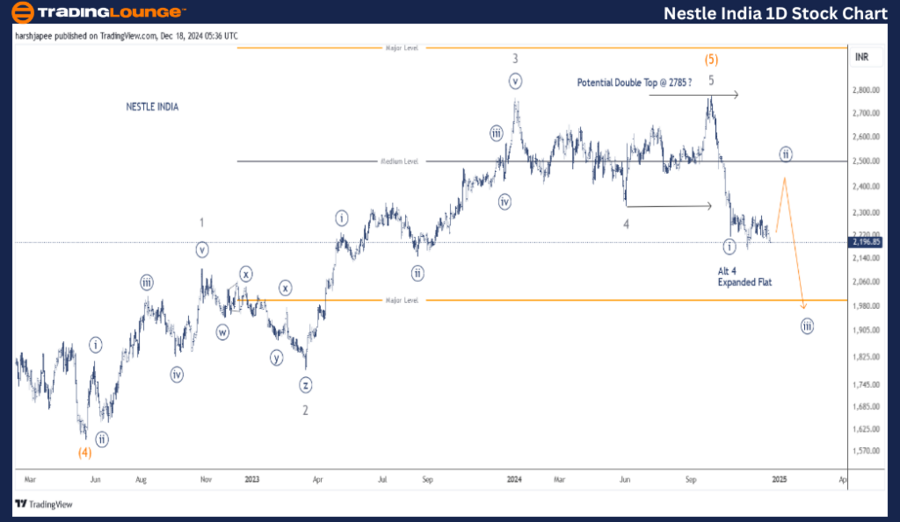

NESTLE INDIA Elliott Wave Analysis - TradingLounge (1D Chart)

NESTLEIND Elliott Wave Technical Analysis

Function: Counter Trend (Minute Degree, Navy)

Mode: Corrective

Structure: Potential impulse within larger degree corrective wave

Position: Minute Wave ((i)) Navy

Details:

- Minute Wave ((ii)) is advancing towards the 2500 levels, indicating a temporary upward movement before the prices potentially reverse lower.

- Alternatively, the structure might represent an expanded flat, signaling the termination of Minor Wave 4 within the broader degree uptrend.

Invalidation Point: 2785

NESTLE INDIA Daily Chart Technical Analysis and Elliott Wave Counts:

The daily chart for NESTLE INDIA highlights the likelihood of a double top near 2785, as the stock experienced a significant reversal near 2185. This movement could either represent:

- An initial impulsive decline marking the onset of a larger corrective wave.

- Or, part of an expanded flat, concluding Minor Wave 4.

Regardless of the scenario, the price action suggests a rally to 2450, signaling the conclusion of Minute Wave ((ii)) before another downward move. The 2785 resistance remains pivotal, allowing bears to maintain control.

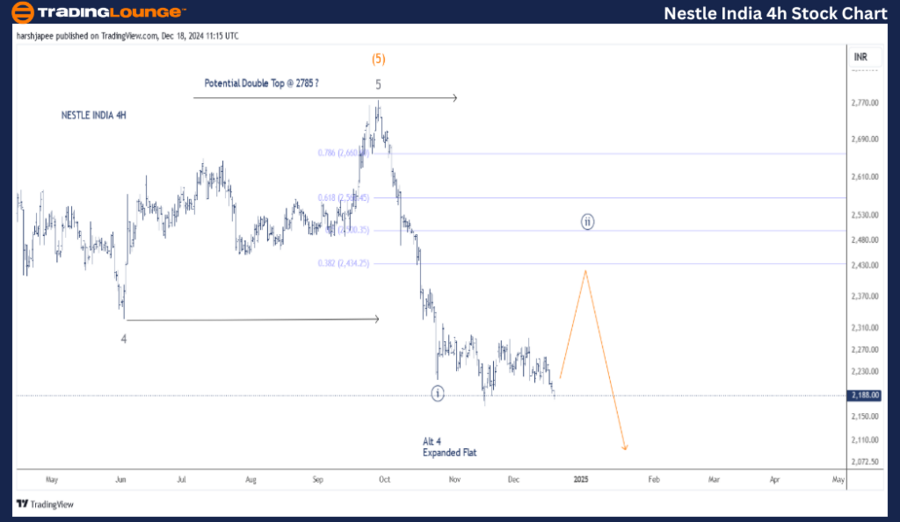

NESTLE INDIA – NESTLEIND Elliott Wave Technical Analysis (4H Chart)

TradingLounge NESTLEIND (4H Chart) Technical Analysis

Function: Counter Trend (Minute Degree, Navy)

Mode: Corrective

Structure: Potential impulse within larger degree corrective wave

Position: Minute Wave ((i)) Navy

Details:

- Minute Wave ((ii)) appears to be progressing towards 2500 levels, hinting at a corrective upward movement before the anticipated downward continuation.

- Alternatively, this movement could represent an expanded flat that terminates Minor Wave 4 within the broader degree uptrend.

Invalidation Point: 2785

NESTLE INDIA 4H Chart Technical Analysis and Elliott Wave Counts:

The 4H chart reveals sub-waves following the termination of Minor Wave 4 around 2325.

- Wave 5’s rally lacks a clear subdivision as an impulse, but the high-probability wave count suggests termination near 2782, indicating a potential double top.

- The subsequent decline through 2215 appears impulsive and is labeled as Minute Wave ((i)).

- Currently, an expanded flat Wave ((ii)) seems to be forming within the 2440-2450 zone before the prices resume their downward trend.

- Alternatively, the entire decline from 2785 could represent a corrective expanded flat concluding Minor Wave 4 (Grey) around 2185.

Technical Analyst: Harsh Japee

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: TATA STEEL Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

NESTLE INDIA is advancing within Minute Wave ((ii)), targeting the 2440-2450 zone, and remains within the framework of a larger downward impulsive wave. The 2785 resistance is crucial for maintaining bearish momentum.