ASX: MINERAL RESOURCES LIMITED - MIN Elliott Wave Technical Analysis – TradingLounge

Market Update:

In today’s Elliott Wave forecast, we examine the technical outlook for MINERAL RESOURCES LIMITED (ASX: MIN) listed on the Australian Securities Exchange. Based on current wave structure, the stock appears to have completed a significant Wave 4 correction, setting the stage for a potential Wave 5 rally. Our analysis includes specific price targets and invalidation thresholds, enhancing the confidence in the bullish scenario.

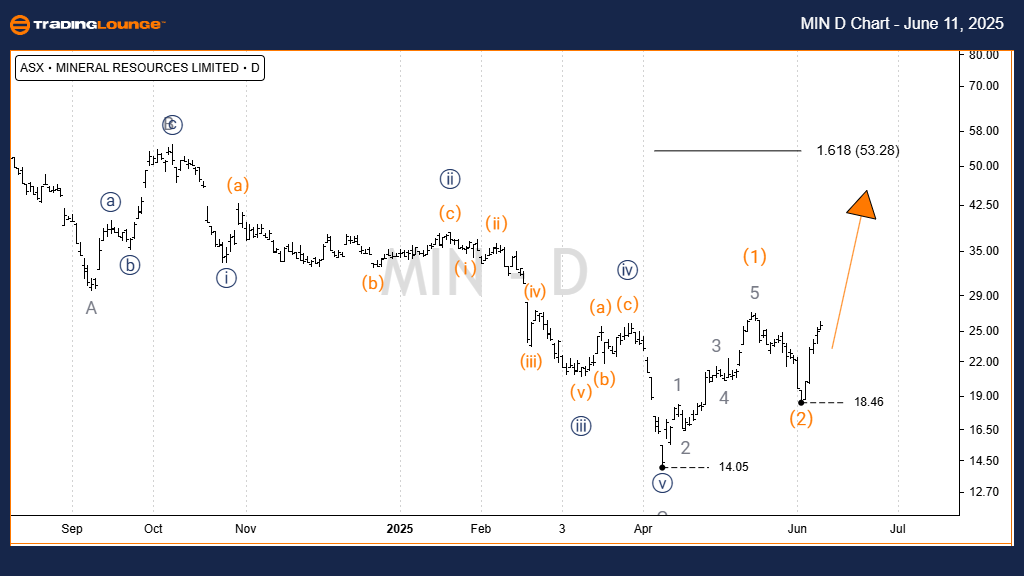

ASX: MINERAL RESOURCES LIMITED - MIN Elliott Wave Technical Analysis 1D Chart (Semilog Scale) Analysis

Function: Primary trend (Intermediate degree – orange)

Mode: Motive

Structure: Impulse

Wave Position: Wave 3) – orange, within Wave 5)) – navy

Analysis Insight:

The recent correction found support at $14.05, signaling the conclusion of the fourth wave. The bullish impulsive structure resumes from this base, with projected targets ranging between $50.00 and $80.00. Holding above $14.05 is critical to validate this upward trend. A decline below this level would negate the current bullish Elliott Wave setup.

Key Invalidation Level: $14.05

ASX: MINERAL RESOURCES LIMITED - MIN Elliott Wave Technical Analysis – TradingLounge (4-Hour Chart)

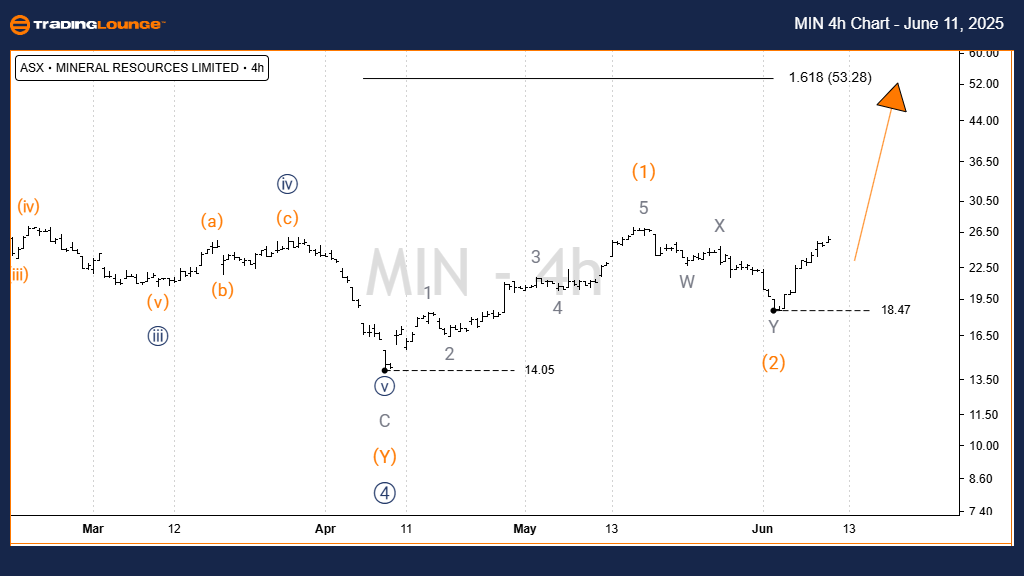

4-Hour Chart Analysis

Function: Intermediate trend (Intermediate degree – orange)

Mode: Motive

Structure: Impulse

Wave Position: Wave 3) – orange

Short-Term Outlook:

The 4-hour chart provides a detailed look into the start of Wave 3) – orange. Wave 1) – orange completed as a clear five-wave pattern from $14.05. Wave 2) – orange developed as a Double Zigzag corrective structure and concluded at $18.47. Currently, the market is positioned to advance in Wave 3) – orange, aiming to retest or break above the $53.28 resistance.

Key Invalidation Level: $18.47 (Bullish outlook invalidated if breached)

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: NORTHERN STAR RESOURCES LTD Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

This Elliott Wave review of ASX: MINERAL RESOURCES LIMITED (MIN) delivers a structured and data-driven approach to interpreting price action. With clear identification of wave counts and support/resistance thresholds, traders can make more informed decisions. Holding above key invalidation points is essential for sustaining the current bullish trend projection.