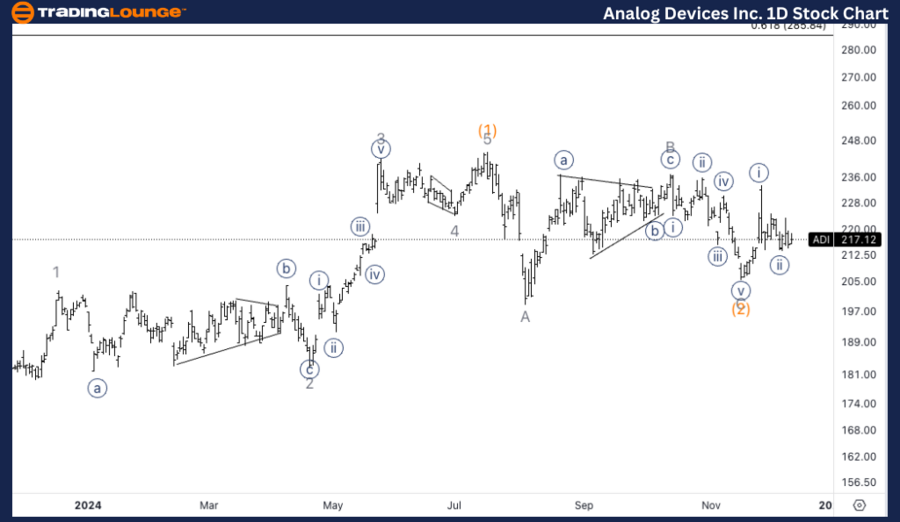

Analog Devices Inc. (ADI) Elliott Wave Analysis Trading Lounge Daily Chart

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave {ii} of 1

Direction: Upside into Wave {iii}

Details: The analysis focuses on identifying a potential bottom in Wave {ii}, which is anticipated to precede a significant upward movement into Wave {iii}. Currently, price action resides within the Minor Group 1 range of $210–$230, signaling that a bottom might be near.

Daily Chart Analysis Summary

The daily chart indicates that ADI is navigating Wave {ii} within a broader impulsive structure. Price movements are confined to the $210–$230 range, corresponding to Minor Group 1, suggesting the formation of a bottom. Following this correction, Wave {ii} is expected to complete, paving the way for a bullish surge into Wave {iii}.

Analog Devices Inc. (ADI) Elliott Wave Analysis Trading Lounge 1H Chart

ADI Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave (b) of {ii}

Direction: Bottom in Wave {ii}

Details: The 1-hour chart suggests that ADI is progressing within Wave (b) of {ii}, forming a corrective triangle. The likely next step is a downward move into Wave (c) of {ii}, signaling the end of this corrective phase. This sets the stage for a bullish reversal into Wave {iii}.

1H Chart Analysis Summary

The 1-hour chart highlights that ADI is in the middle of a corrective structure within Wave (b) of {ii}, characterized by a triangle formation. A drop into Wave (c) of {ii} is anticipated, which will likely conclude the corrective phase and trigger a strong upward movement into Wave {iii}.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: The Home Depot (HD) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

This Elliott Wave analysis of Analog Devices Inc. (ADI) evaluates both daily and 1-hour chart structures, offering insights into current trends and future price movements. The analysis suggests that the corrective phase in Wave {ii} is nearing completion, with an impending bullish breakout into Wave {iii}.