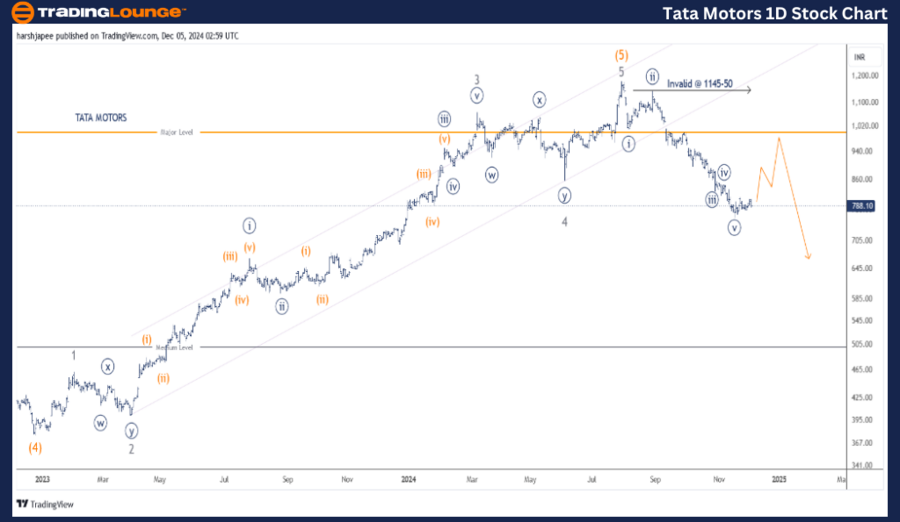

TATA MOTORS – TATAMOTORS (1D Chart) Elliott Wave Technical Analysis

TATAMOTORS Elliott Wave Technical Analysis

Function: Counter Trend (Minute degree, Navy)

Mode: Corrective

Structure: Potential Impulse within larger degree corrective wave

Position: Minute Wave ((v)) Navy

Details: Minute Wave ((v)) Navy appears to be complete around the 770 mark, signaling the possibility of a counter-trend rally in the near term.

Invalidation Point: 1145-50

TATA MOTORS Daily Chart Technical Analysis and Potential Elliott Wave Counts

The daily chart for TATA MOTORS suggests a potential trend reversal following the high of 1145-50, recorded in July 2024. The initial impulse drop may have concluded around the 770 level or is approaching completion, with the possibility of one more low. Alternatively, Minor Wave 4 might have concluded at 770, setting the stage for an upward move.

Previously, TATA MOTORS experienced a decline from the 380 level in December 2022, marking Intermediate Wave (5) Orange. The subsequent rally can be subdivided into five distinct waves, labeled as Minor Waves 1 through 5.

If this analysis holds, the price is likely to remain below the 1145-50 range, continuing to form lower highs and lower lows, indicating bearish control.

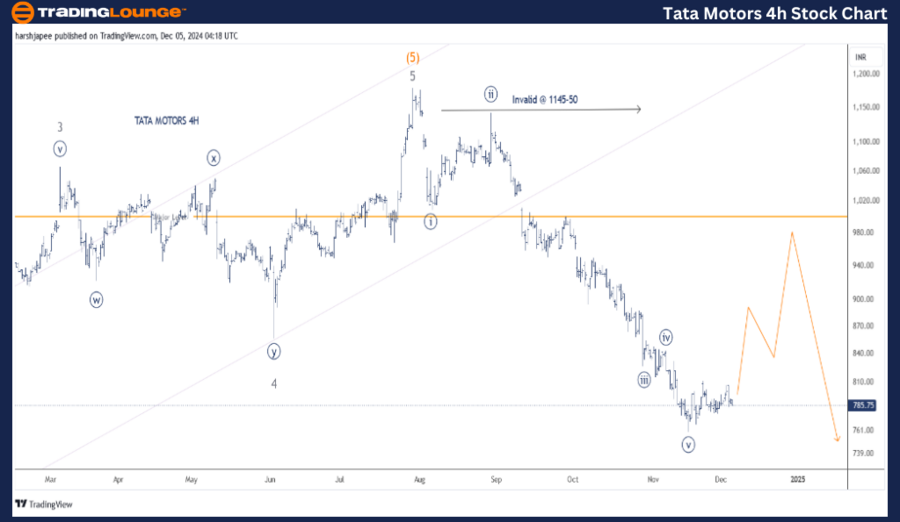

TATA MOTORS – TATAMOTORS (4H Chart) Elliott Wave Technical Analysis

Function: Counter Trend (Minute degree, Navy)

Mode: Corrective

Structure: Potential Impulse within larger degree corrective wave

Position: Minute Wave ((v)) Navy

Details: Minute Wave ((v)) Navy might have completed around the 770 level, paving the way for a counter-trend rally. Alternatively, the stock could reach another low below 770 before transitioning higher.

Invalidation Point: 1145-50

TATA MOTORS 4H Chart Technical Analysis and Potential Elliott Wave Counts

The 4H chart for TATA MOTORS highlights sub-waves following the termination of Minor Wave 3 Grey near the 1070 level in March 2024. Wave 4 appears to have been a combination pattern, followed by a potential impulse Wave 5 reaching the 1145-50 range.

The price action demonstrates an impulse drop from the 1145-50 high, suggesting a potential trend reversal. Alternatively, the entire structure from the Minor Wave 3 high might represent an expanded flat, now either completed or nearing completion around the 770 level.

If the expanded flat scenario is valid, the stock may soon pivot higher and push through the 1145-50 zone.

Technical Analyst: Harsh Japee

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: HDFCBANK Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

TATA MOTORS appears to have completed a potential impulse wave from the 1145-50 high down to the 770 level. A reversal or upward move is anticipated from the current levels shortly.