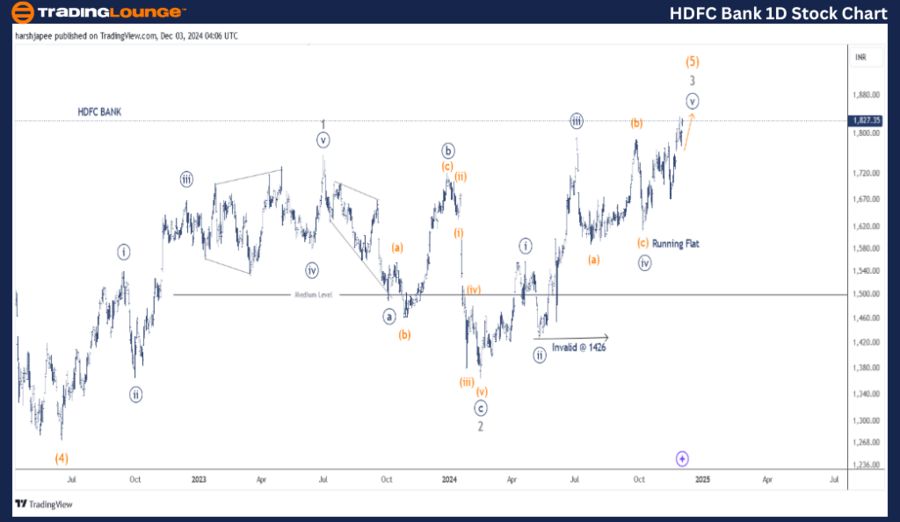

HDFC BANK – HDFCBANK (1D Chart) Elliott Wave Technical Analysis

HDFCBANK Elliott Wave Technical Analysis

Function: Larger Degree Trend Higher (Intermediate Degree, Orange)

Mode: Motive

Structure: Impulse

Position: Minute Wave ((iv)) Navy Flat

Details: Minute Wave ((v)) Navy is advancing within Minor Wave 3 Grey of Intermediate Wave (5) Orange against 1426. No change in invalidation point.

Invalidation Point: 1426

HDFC BANK Daily Chart Technical Analysis and Potential Elliott Wave Counts

The daily chart for HDFC BANK signals a continued rally within Minor Wave 3 Grey of Intermediate Wave (5) Orange against the critical 1426 level. The stock has surpassed the 1800 mark, clearing immediate resistance near 1795, which could trigger further acceleration.

In June 2022, the stock declined to 1275, marking the completion of Intermediate Wave (4). The wave structure since then appears overlapping, with likely counts showing Minor Waves 1 and 2 completed at approximately 1750 and 1365 levels, respectively.

Following this, Minor Wave 3 has been unfolding and shows signs of extension. An alternate count suggests that Minute Wave ((i)) of Minor Wave 3 may be developing against the invalidation level of 1426.

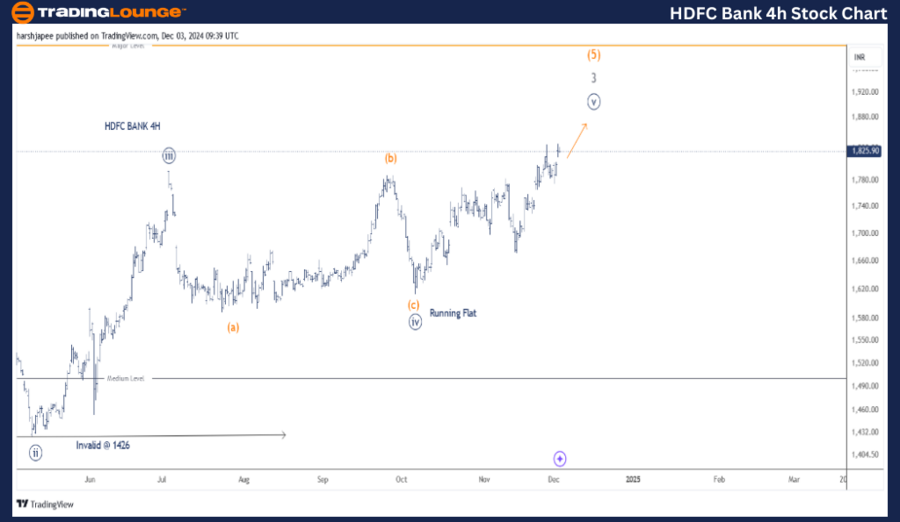

HDFC BANK – HDFCBANK (4H Chart) Elliott Wave Technical Analysis

HDFCBANK Elliott Wave Technical Analysis

Function: Larger Degree Trend Higher (Intermediate Degree, Orange)

Mode: Motive

Structure: Impulse

Position: Minute Wave ((iv)) Navy Flat

Details: Minute Wave ((v)) Navy is advancing within Minor Wave 3 Grey of Intermediate Wave (5) Orange against 1426. Aggressive traders may consider tightening their risk to the 1600-1610 range.

Invalidation Point: 1426

HDFC BANK 4H Chart Technical Analysis and Potential Elliott Wave Counts

The 4H chart for HDFC BANK outlines sub-waves from Minute Wave ((iii)), which culminated near 1495 in July 2024. Minute Wave ((iv)) followed as a running flat and concluded near the 1610 level. If this structure holds, Minute Wave ((v)) may currently be unfolding and could form either an impulse or a diagonal pattern.

Technical Analyst: Harsh Japee

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: BAJAJAUTO Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

HDFC BANK is advancing within Minute Wave ((v)) Navy of Minor Wave 3 Grey under Intermediate Wave (5) Orange against the invalidation point of 1426.