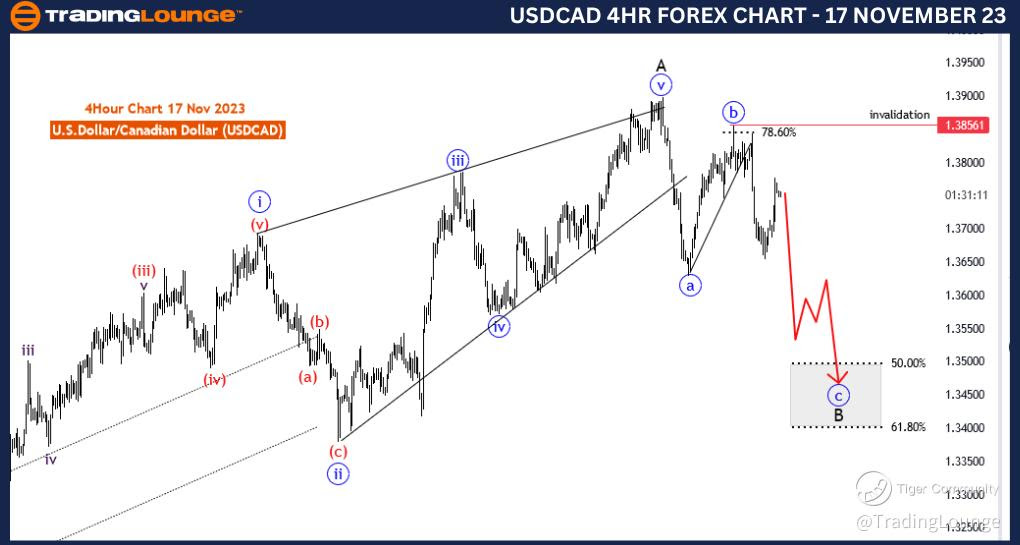

USD/CAD Elliott Wave Analysis Trading Lounge Day Chart, 17 November 23

U.S.Dollar /Canadian Dollar(USD/CAD) Day Chart

USD/CAD Elliott Wave Technical Analysis

Function: Counter Trend

Mode: corrective

Structure: blue wave C of black wave B

Position: black wave B

Direction Next Higher Degrees:black wave C

Details: Blue wave B looking completed at 1.38537 , now blue wave C of black wave B is in play . Wave Cancel invalid level:1.38561

The "USD/CAD Elliott Wave Analysis Trading Lounge Day Chart'' dated 17 November 23, provides a comprehensive examination of the U.S. Dollar/Canadian Dollar (USD/CAD) currency pair on a daily time frame, utilizing Elliott Wave theory. The purpose of this analysis is to offer traders insights into potential longer-term price movements.

The identified "Function" is labeled as "Counter Trend," indicating that the analysis is focused on a potential reversal or correction against the primary trend. In this scenario, it suggests that the current market dynamics are not in line with the broader trend and may represent a corrective phase.

The "Mode" is described as "Corrective," signifying that the market is undergoing a corrective phase. Corrective phases are characterized by price retracements or consolidations, providing traders with opportunities to assess potential entry or exit points.

The "Structure" is identified as "Blue wave C of black wave B." This implies that the ongoing corrective movement is part of a larger structure labeled as wave B, with the current internal movement being the third wave (C) of this corrective pattern.

The "Position" is specified as "Black wave B," suggesting that the current corrective structure is part of a broader wave count labeled as B.

Regarding the "Direction Next Higher Degrees," the analysis points to "Black wave C." This suggests that upon the completion of the current corrective structure (Black wave B), the expectation is for a new trend to emerge, labeled as Black wave C.

In terms of "Details," the report notes that "blue wave B looking completed at 1.38537, now blue wave C of black wave B is in play." This provides traders with information about the current phase of the corrective pattern and the anticipated direction of the next significant price movement.

The "Wave Cancel invalid level" is set at 1.38561, serving as a critical reference point. A breach of this level could invalidate the current wave count, prompting traders to reconsider their analysis and potential trading strategies.

In summary, the USD/CAD Elliott Wave Analysis on the daily chart indicates a corrective pattern, specifically Blue wave C of black wave B within the broader Black wave B structure. Traders are advised to monitor the completion of this corrective structure, with the expectation of a new trend labeled as Black wave C. The specified invalidation level provides a reference point for evaluating the validity of the current wave count.

Technical Analyst : Malik Awais

Source : Tradinglounge.com get trial here!

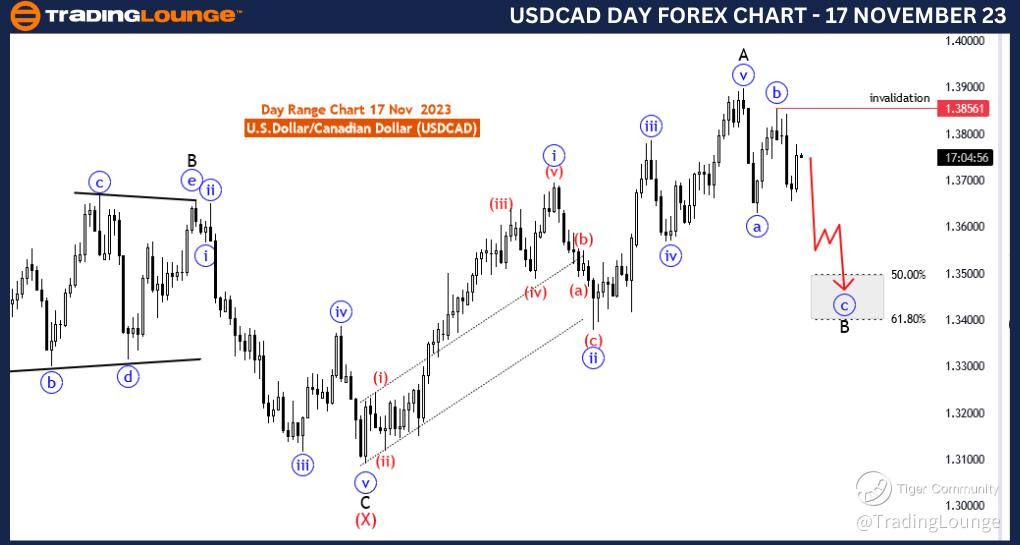

USD/CAD Elliott Wave Analysis Trading Lounge 4 Hour Chart, 17 November 23

U.S.Dollar /Canadian Dollar(USD/CAD) 4 Hour Chart

USD/CAD Elliott Wave Technical Analysis

Function: Counter Trend

Mode: corrective

Structure: blue wave C of black wave B

Position: black wave B

Direction Next Higher Degrees:black wave C

Details: Blue wave B looking completed at 1.38537 , now blue wave C of black wave B is in play . Wave Cancel invalid level:1.38561

The "USD/CAD Elliott Wave Analysis Trading Lounge 4 Hour Chart" dated 17 November 23, delves into the intricacies of the U.S. Dollar/Canadian Dollar (USD/CAD) currency pair using Elliott Wave theory on the 4-hour chart. This analysis aims to provide traders with insights into potential shorter-term price movements.

The identified "Function" is labeled as "Counter Trend," indicating that the analysis is focused on a potential reversal or correction in the market against the prevailing trend. In this context, it suggests that the current price action is not aligned with the larger trend and may be part of a corrective movement.

The "Mode" is described as "Corrective," signifying that the market is undergoing a corrective phase. Corrective phases are characterized by price retracements or consolidations, offering traders opportunities to assess potential entry or exit points.

The "Structure" is identified as "Blue wave C of black wave B." This indicates that the ongoing market dynamics are part of a larger corrective structure labeled as wave B, with the internal movement being the third wave (C) of this corrective pattern.

The "Position" is specified as "Black wave B," suggesting that the current corrective structure is part of a broader wave count labeled as B.

Regarding the "Direction Next Higher Degrees," the analysis points to "Black wave C." This implies that once the current corrective structure (Black wave B) is complete, the expectation is for a new trend to emerge, labeled as Black wave C.

In terms of "Details," the report notes that "blue wave B looking completed at 1.38537, now blue wave C of black wave B is in play." This provides traders with information about the current phase of the corrective pattern and the potential direction of the next price movement.

The "Wave Cancel invalid level" is set at 1.38561, serving as a critical reference point. A breach of this level could invalidate the current wave count, prompting traders to reassess their analysis and potential trading strategies.

In summary, the USD/CAD Elliott Wave Analysis on the 4-hour chart suggests a corrective pattern, specifically Blue wave C of black wave B within the larger Black wave B structure. Traders are advised to monitor the completion of this corrective structure, with the expectation of a new trend labeled as Black wave C. The specified invalidation level provides a reference point for evaluating the validity of the current wave count.

Technical Analyst : Malik Awais

Source : TradingLounge.com get trial here!