ASX: CAR GROUP LIMITED – CAR Elliott Wave Technical Analysis | TradingLounge

Elliott Wave Analysis: ASX: CAR GROUP LIMITED – CAR

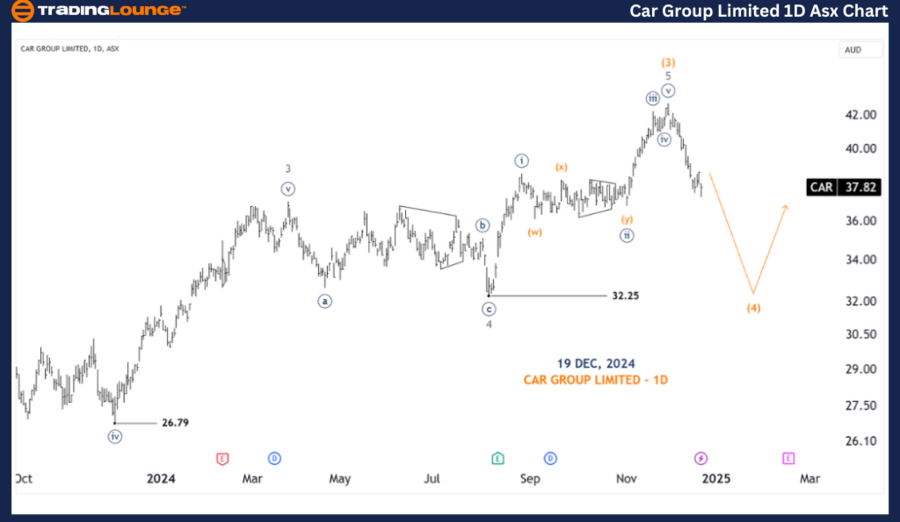

In this updated Elliott Wave analysis, we focus on the Australian Stock Exchange (ASX) CAR GROUP LIMITED – CAR. The projection suggests a continuation of a downward move with wave (4)-orange, followed by an upward movement with wave (5)-orange.

ASX: CAR GROUP LIMITED – CAR 1D Chart Analysis (Semilog Scale)

Function: Major Trend (Intermediate Degree, Grey)

Mode: Motive

Structure: Impulse

Position: Wave (4)-Orange

Details:

- Wave (3)-orange has likely concluded, completing the sequence from wave 1-grey through wave 5-grey. This signals the onset of wave (4)-orange, which is expected to push lower, targeting the 32.25 price level.

- After this corrective phase, wave (5)-orange is projected to resume its upward trajectory.

Invalidation Point: The termination of Wave (3)-orange serves as the invalidation benchmark.

ASX: CAR GROUP LIMITED – CAR 4-Hour Chart Analysis

Function: Major Trend (Minor Degree, Grey)

Mode: Motive

Structure: Impulse

Position: Wave A-Grey of Wave (4)-Orange

Details:

- Analyzing wave (4)-orange reveals a sharp and rapid decline, indicative of wave A in a Zigzag formation.

- The corrective wave pattern is expected to develop as a 5-3-5 structure.

- Wave B-grey will likely lead to a minor rebound, followed by wave C-grey continuing the downward trend.

Invalidation Point: The conclusion of Wave (3)-orange remains the critical invalidation level.

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: INSURANCE AUSTRALIA GROUP LIMITED Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

Our Elliott Wave analysis provides actionable insights into ASX: CAR GROUP LIMITED – CAR. The projected corrective and impulsive movements aim to guide traders toward effective decision-making by highlighting key price levels for validation or invalidation. By combining technical patterns and price targets, this analysis delivers an objective perspective on the current market dynamics.