ASX: INSURANCE AUSTRALIA GROUP LIMITED (IAG) Elliott Wave Technical Analysis | TradingLounge

Introduction

Welcome to today’s Elliott Wave analysis, focusing on the Australian Stock Exchange (ASX) and INSURANCE AUSTRALIA GROUP LIMITED (ASX:IAG). Our current wave analysis suggests that ASX:IAG may continue its downward trajectory with wave ((4))-navy in the near term. Below, we provide a detailed breakdown of our technical observations.

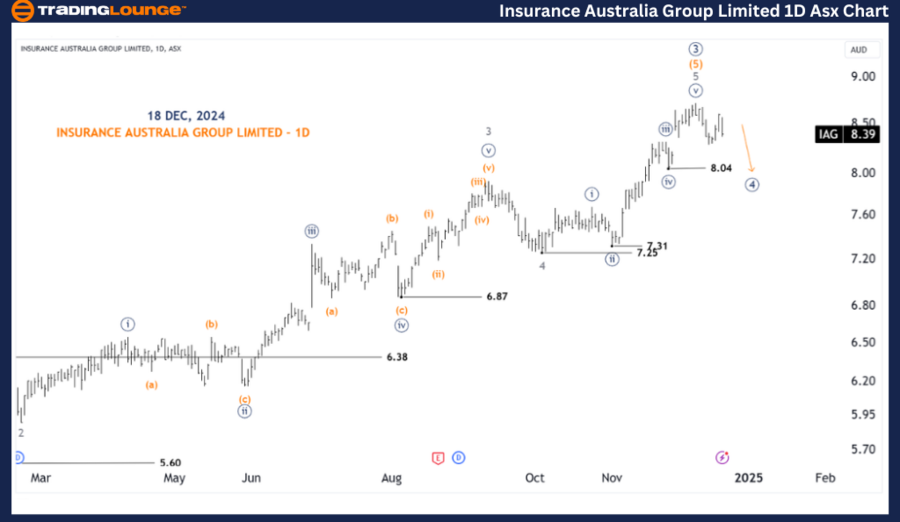

ASX: IAG 1D Chart Analysis (Semilog Scale)

IAG Elliott Wave Technical Analysis

Function: Major trend (Intermediate degree, orange)

Mode: Motive

Structure: Impulse

Position: Wave ((4))-navy

Details:

- Wave ((3))-navy has likely concluded as a five-wave sequence, progressing from (1)-orange to (5)-orange.

- Wave ((4))-navy appears to be moving lower, with a probable target near the 7.25 low.

- To maintain this view, prices must stay below the 8.60 high.

Invalidation Point: 8.60

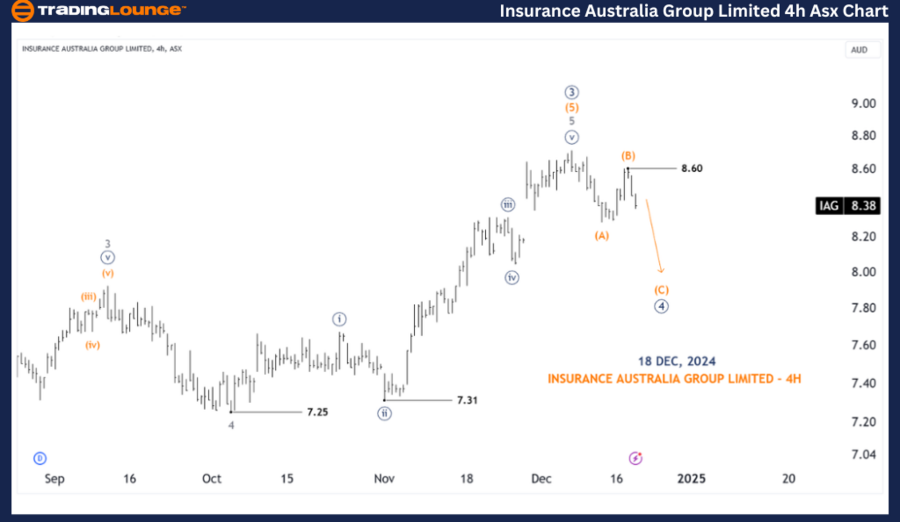

ASX:IAG 4-Hour Chart Analysis

Function: Major trend (Intermediate degree, orange)

Mode: Motive

Structure: Impulse

Position: Wave (C)-orange of Wave ((4))-navy

Details:

- A closer examination shows that wave ((4))-navy is unfolding as a Zigzag pattern labeled (A)(B)(C)-orange.

- Alternatively, it might develop as a (1)(2)(3)-orange structure, although this distinction does not significantly impact the expectation of further downward movement.

- The price action continues to suggest bearish momentum.

Invalidation Point: 8.60

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: BRAMBLES LIMITED - BXB Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

This Elliott Wave analysis for ASX: INSURANCE AUSTRALIA GROUP LIMITED (ASX:IAG) highlights current market dynamics and actionable insights. Our forecast includes specific price levels for validation and invalidation of the wave count, adding clarity and confidence to the analysis. By leveraging these structured observations, traders can better navigate the market trends with precision and objectivity.