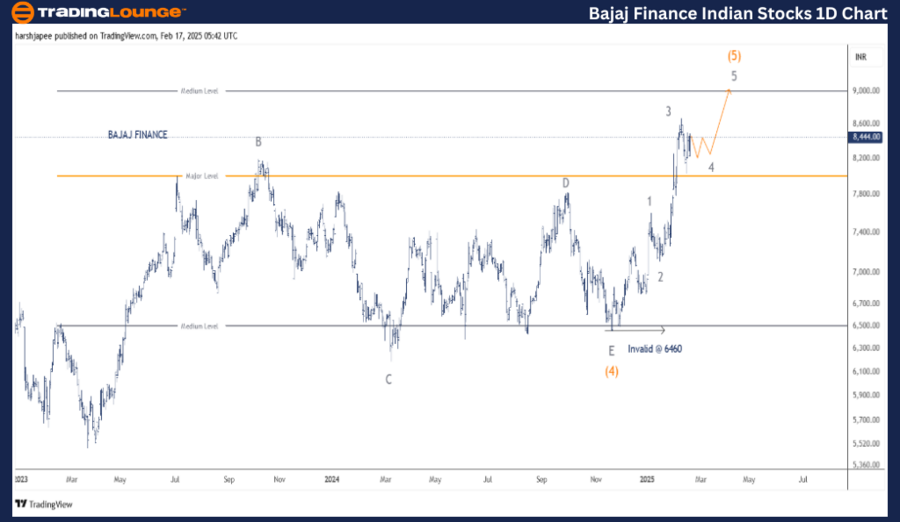

BAJAJ FINANCE Elliott Wave Technical Analysis – BAJFINANCE (1D Chart)

BAJFINANCE Elliott Wave Technical Analysis

Function: Larger Degree Trend Higher (Intermediate Degree Orange)

Mode: Motive

Structure: Impulse

Position: Minor Wave 3 Grey

Details: Minor Wave 3 Grey is advancing higher, targeting levels beyond 6460.

Invalidation Point: 6460

BAJAJ FINANCE Daily Chart Technical Analysis & Elliott Wave Projections

The BAJAJ FINANCE (BAJFINANCE) daily chart suggests a strong bullish momentum, pushing towards the 9000–9200 zone as the stock completes its larger degree uptrend (Intermediate Wave (5) Orange).

- A potential Minor Wave 4 could emerge as an expanded flat or a triangle before the final bullish wave unfolds.

- Previously, Intermediate Wave (4) concluded around 6460 in November 2024, following a multi-year triangle correction that began in March 2023.

- The ongoing Intermediate Wave (5) is unfolding as an impulsive structure, with one more bullish leg anticipated before the cycle completes.

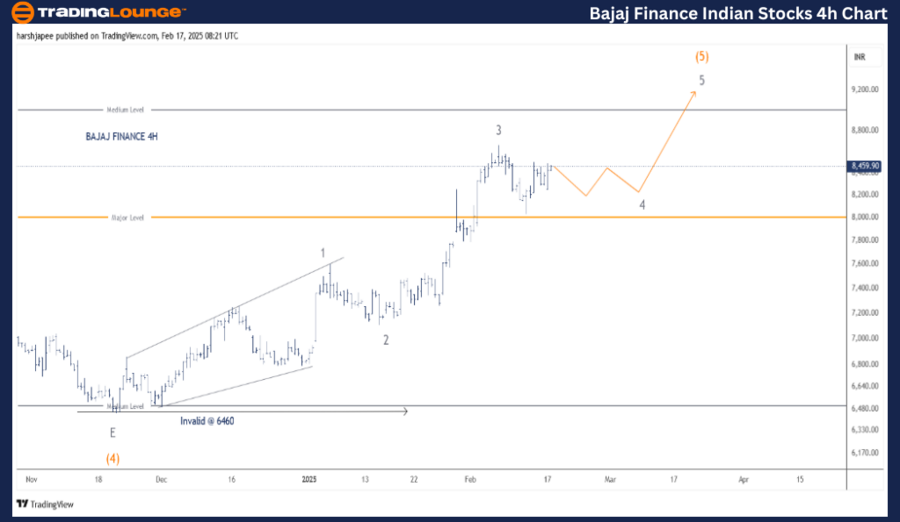

BAJAJ FINANCE Elliott Wave Technical Analysis – BAJFINANCE (4H Chart)

BAJFINANCE Elliott Wave Technical Analysis

-

Function: Larger Degree Trend Higher (Intermediate Degree Orange)

-

Mode: Motive

-

Structure: Impulse

-

Position: Minor Wave 3 Grey

-

Details: Minor Wave 3 Grey is advancing higher against 6460, with a potential target of 8665 before a Wave 4 consolidation.

-

Invalidation Point: 6460

BAJAJ FINANCE 4H Chart Technical Analysis & Elliott Wave Outlook

The 4H chart provides a detailed breakdown of the sub-waves within Intermediate Wave (5) Orange, which commenced after Wave (4) completed as a triangle around 6460 in November 2024.

- Wave (5) is progressing as an impulse, with a high probability of a bullish breakout above 9000 in the near term.

- Wave Structure So Far:

- Minor Wave 1: Formed as a leading diagonal, ending at 7600.

- Wave 2: A sharp correction, retracing to 7120.

- Wave 3: Surged higher, reaching 8665.

- Wave 4 (Potential Formation): Expected as a triangle consolidation before the final upward push.

A crucial support level remains at 7600—as long as prices hold above this, bulls can maintain the impulsive uptrend.

Technical Analyst: Harsh Japee

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: HCL TECHNOLOGIES – HCLTECH Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

BAJAJ FINANCE remains firmly bullish, advancing within Minor Wave 3 of Intermediate Wave (5), with 9000+ levels as the next major resistance zone. A potential short-term consolidation (Wave 4) may occur, but the larger trend remains upward in the coming sessions.