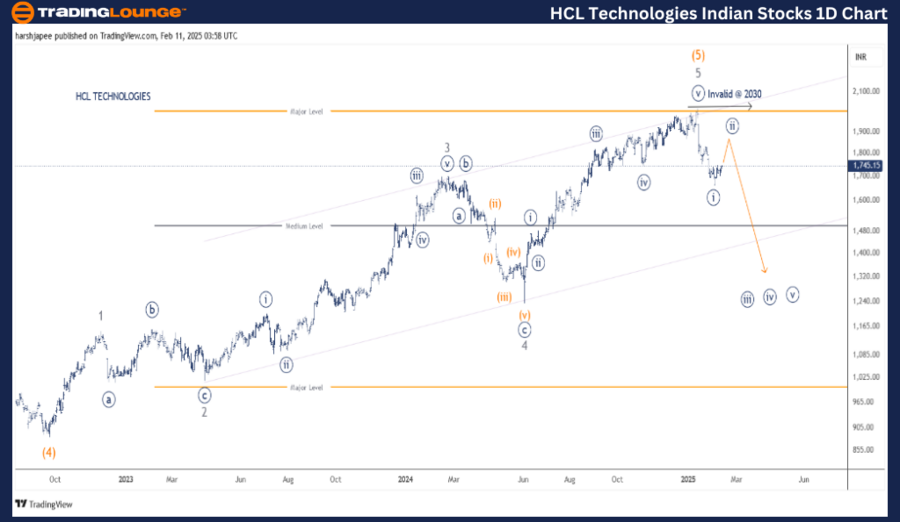

HCL TECHNOLOGIES – HCLTECH (1D Chart) Elliott Wave Technical Analysis

HCLTECH Elliott Wave Technical Analysis

Function: Counter Trend (Minor Degree, Grey)

Mode: Corrective

Structure: Impulse within Larger Degree Correction

Position: Minute Wave ((i)) Navy

Technical Overview:

- Current Wave Progression: Minute Wave ((i)) appears to have completed around the 1640-1650 range.

- Expected Price Movement: A corrective rally towards the 1900 zone is anticipated before bearish momentum resumes.

- Key Invalidation Point: If prices break above 2030, the current wave structure will be invalidated.

HCL TECHNOLOGIES Daily Chart – Elliott Wave Analysis & Forecast

HCL TECHNOLOGIES' daily chart suggests a potential top formation around 2030, marking the termination of Intermediate Wave (5) Orange. The stock has since reversed, breaking below the 1750 support level, confirming the completion of a Minute Wave ((i)) impulse and signaling a deeper correction ahead.

Key Observations:

- In September 2022, HCLTECH plunged to 890 lows alongside global tech declines.

- A subsequent five-wave rally at the Minor Degree, labeled Waves 1 through 5, culminated at 2030 in January 2025.

- Since then, bearish momentum has taken over, with sellers maintaining control as long as the stock remains below 2030.

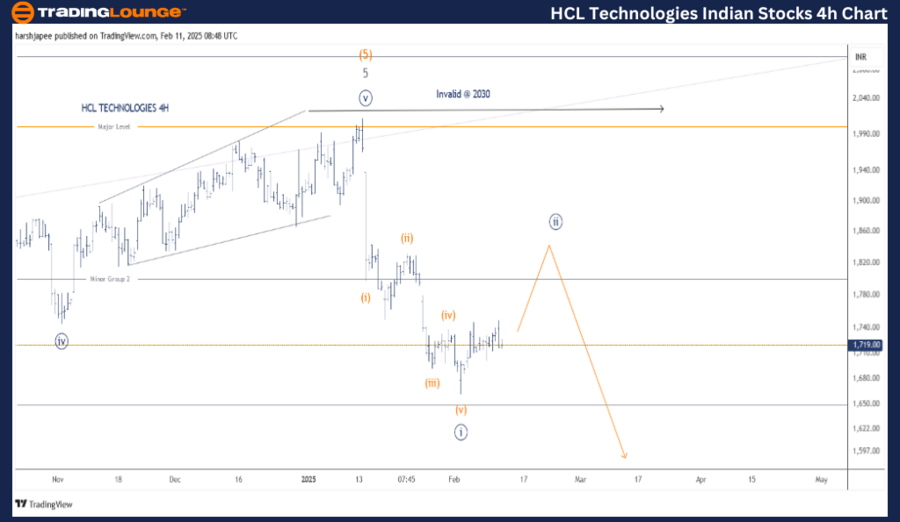

HCL TECHNOLOGIES – HCLTECH (4H Chart) Elliott Wave Technical Analysis

Function: Counter Trend (Minor Degree, Grey)

Mode: Corrective

Structure: Impulse within Larger Degree Correction

Position: Minute Wave ((i)) Navy

Technical Overview:

- Wave Completion: Minute Wave ((i)) seems to have finalized around 1640-1650, subdividing into five waves at the Minuette degree.

- Projected Movement: A corrective rally towards 1850-1900 before bearish dominance resumes.

- Invalidation Point: If the stock exceeds 2030, the Elliott Wave count will require reassessment.

HCL TECHNOLOGIES 4H Chart – Elliott Wave Analysis & Forecast

The 4-hour chart highlights the completion of Minute Wave ((iv)) within Minor Wave 5 Grey, which peaked at 1750 in November 2024. Subsequently, Minute Wave ((v)) developed as a diagonal, briefly pushing past 2030 before reversing.

Key Insights:

- The price has since dropped to 1665 lows, aligning with an impulsive Minute Wave ((i)) structure.

- If this count holds, Minute Wave ((ii)) is now unfolding, targeting 1850-1900, before the bearish trend resumes.

- Prices must stay below 2030 for this count to remain valid.

Technical Analyst: Harsh Japee

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: BAJAJ FINSRV Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

HCL TECHNOLOGIES appears to be forming a corrective Minute Wave ((ii)), expected to reach 1850 before resuming its downward trend. Investors should monitor key resistance levels and the 2030 invalidation point to validate the Elliott Wave structure.