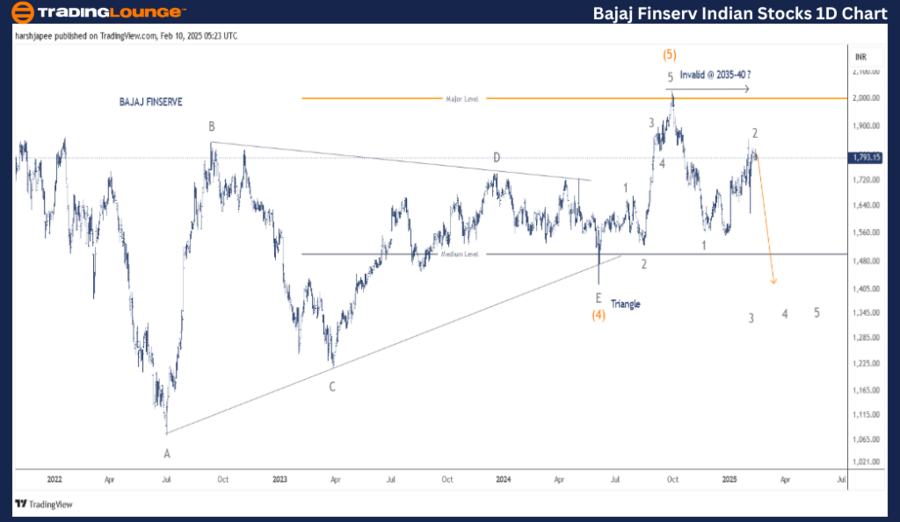

BAJAJFINSV Elliott Wave Analysis - TradingLounge 1D Chart

BAJAJ FINSERVE 1D Chart Analysis

BAJAJFINSV Elliott Wave Technical Analysis

Function: Counter Trend (Minor Degree – Grey)

Mode: Corrective

Structure: Impulse within Larger Degree Correction

Position: Minor Wave 3 – Grey

BAJAJ FINSERVE Technical Details:

Invalidation Point: ₹2,040

BAJAJ FINSRV Daily Chart Analysis & Elliott Wave Projections

The BAJAJ FINSRV daily chart suggests a potential top formation around the ₹2,035–₹2,040 zone, marking the end of Intermediate Wave (5) – Orange. Notably, Wave (4) developed as a triangle consolidation pattern, lasting approximately two years before terminating near ₹1,420 in June 2024.

Since touching the ₹2,035 level, the stock has reversed lower, indicating bearish control. The price structure and Elliott Wave counts since September 2024 hint at Minor Wave 1 ending around ₹1,560, followed by Minor Wave 2 near ₹1,900.

For bears to maintain dominance, prices should ideally stay below ₹1,850–₹1,860, reinforcing the unfolding of Minor Wave 3.

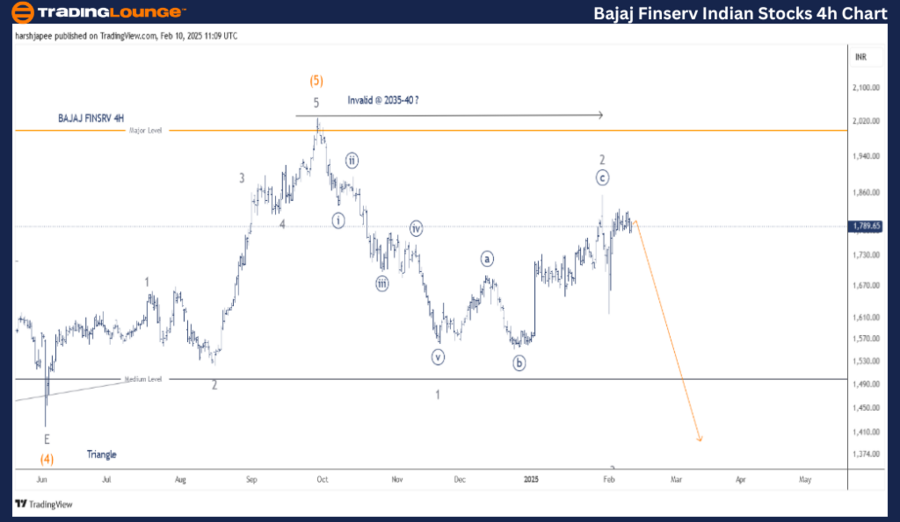

BAJAJ FINSERVE – BAJAJFINSV (4H Chart) Elliott Wave Technical Analysis

Function: Counter Trend (Minor Degree – Grey)

Mode: Corrective

Structure: Impulse within Larger Degree Correction

Position: Minor Wave 3 – Grey

BAJAJ FINSERVE Technical Details:

Invalidation Point: ₹2,040

BAJAJ FINSRV 4H Chart Analysis & Elliott Wave Projections

The 4H chart provides a clearer view of sub-waves following the completion of Intermediate Wave (4) – Orange, which terminated around ₹1,420 in June 2024. Intermediate Wave (5) rallied sharply towards the ₹2,035–₹2,040 range before reversing.

The stock then carved a Minor Wave 1 impulse, ending at ₹1,560. The subsequent corrective rally developed into an expanded flat, marking potential Minor Wave 2 around ₹1,850–₹1,860.

If this structure holds, Minor Wave 3 could already be unfolding, with a potential downside target of ₹1,075, aligning with the triangle consolidation zone.

Technical Analyst: Harsh Japee

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: ADANI GREEN ENERGY Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

BAJAJ FINSRV appears to be unfolding Minor Wave 3 lower, potentially targeting ₹1,420 and beyond, while maintaining resistance around the ₹2,035–₹2,040 highs. A confirmed break below ₹1,540 could further accelerate the decline.