ASX: Woolworths Group Limited - WOW Elliott Wave Technical Analysis TradingLounge (1D Chart)

Greetings,

Today's Elliott Wave analysis updates the Australian Stock Exchange (ASX) focusing on Woolworths Group Limited (WOW). Our current observation suggests that wave II (grey) may have concluded, signaling a potential resumption of the longer-term uptrend for WOW. We will monitor the 1D chart for Long Trade Setups.

ASX: Woolworths Group Limited - WOW Elliott Wave Technical Analysis

1D Chart (Semilog Scale)

Analysis Function:

Major trend (Intermediate degree, orange)

- Mode: Motive

- Structure: Impulse

- Position: Wave (1) - orange

Details:

- Wave II (grey) appears to have ended at 30.12.

- Wave III (grey) has started, pushing higher.

- Since the low of 30.12, wave (1) (orange) is unfolding.

- It is subdividing into wave ((iv)) (navy), expected to find support around 32.88.

- Then wave ((v)) (navy) will likely push higher.

- Invalidation point: 31.91

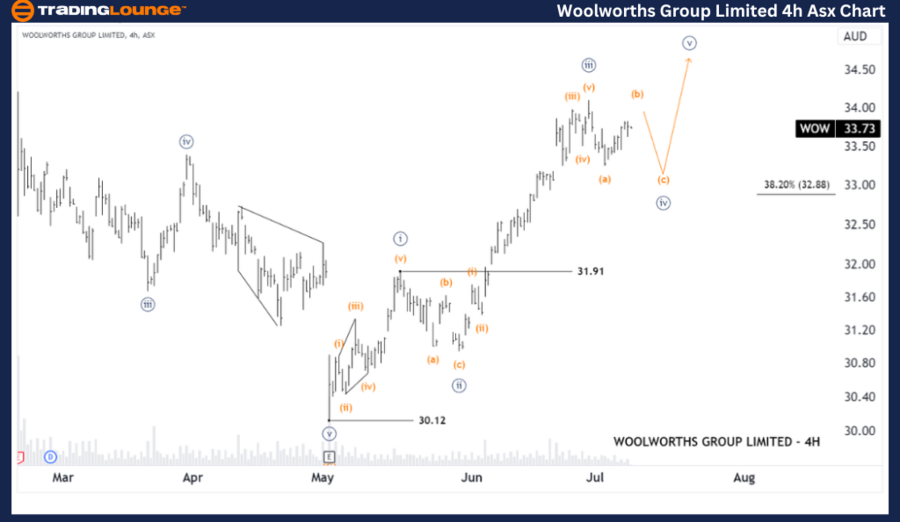

ASX: Woolworths Group Limited - WOW Elliott Wave Technical Analysis TradingLounge (4-Hour Chart)

ASX: Woolworths Group Limited - WOW Elliott Wave Technical Analysis

4-Hour Chart Analysis

Analysis Function:

Major trend (Minute degree, navy)

- Mode: Motive

- Structure: Impulse

- Position: Wave (b) - orange of Wave ((iv)) - navy

Details:

- Wave ((iii)) (navy) just ended.

- Wave ((iv)) (navy) has begun, pushing lower, potentially finding support around 32.88.

- Once wave ((iv)) is completed, wave ((v)) (navy) is expected to push higher.

- Invalidation point: 31.91

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: CBA Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support

Conclusion:

Our analysis provides insights into the current market trends for ASX: Woolworths Group Limited (WOW). By identifying specific price points as validation or invalidation signals for our wave count, we aim to enhance confidence in our perspective. Combining these factors allows us to offer an objective and professional view of market trends.