ASX: NEWMONT CORPORATION - NEM Elliott Wave Technical Analysis

Greetings,

This Elliott Wave technical analysis focuses on NEWMONT CORPORATION (ASX:NEM), listed on the Australian Stock Exchange. According to the current wave structure, ASX:NEM is advancing in wave three, showing a motive pattern with a strong bullish trend. We include precise price targets and invalidation levels to support trading decisions and validate the Elliott Wave count.

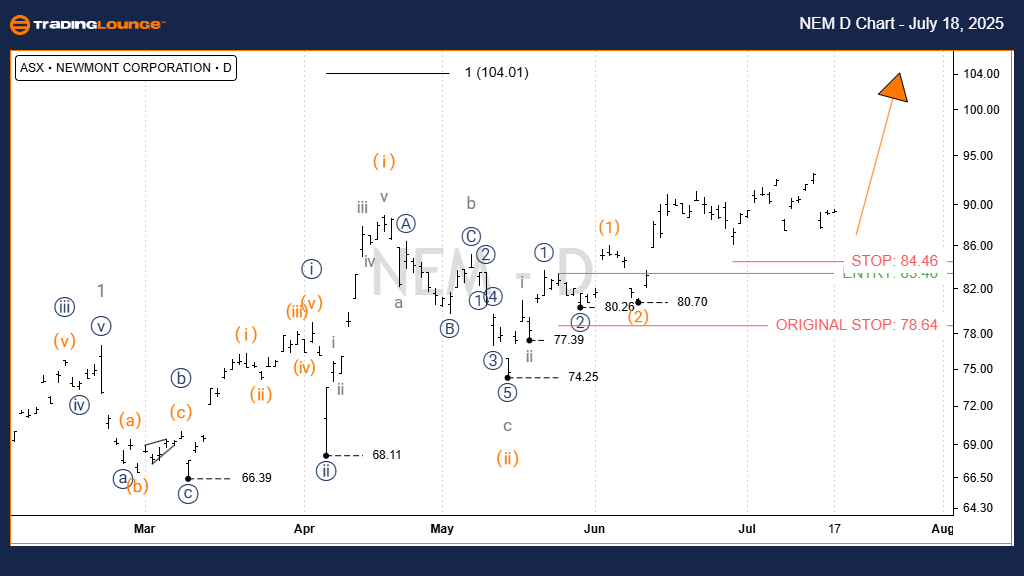

ASX: NEWMONT CORPORATION - NEM Elliott Wave Technical Analysis (1D Semilog Chart)

Function: Primary trend (Minor degree, grey)

Mode: Motive

Structure: Impulse

Current Position: Wave iii) orange of Wave iii)) navy of Wave 3 grey

Technical Overview:

Wave ii) orange most likely concluded around the 74.25 low, forming a classic a-b-c zigzag (grey).

Since then, Wave iii) orange has moved upward aggressively, aiming for a target near 100.00.

Invalidation Level: A decline below 74.25 would invalidate the current count.

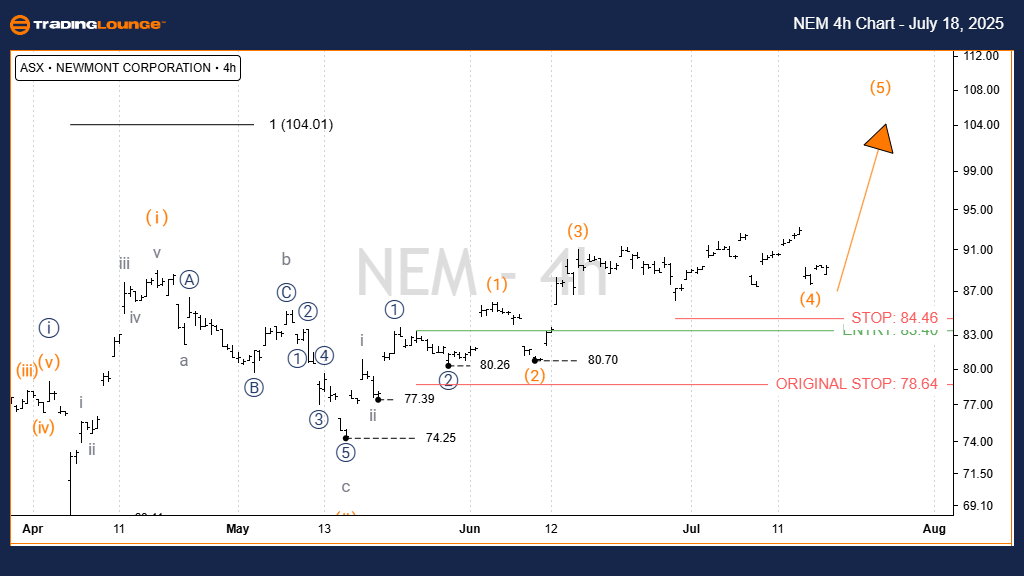

ASX: NEWMONT CORPORATION - NEM Elliott Wave Technical Analysis (4-Hour Chart)

Function: Primary trend (Minor degree, grey)

Mode: Motive

Structure: Impulse

Current Position: Wave iii) orange of Wave ((iii)) navy of Wave 3 grey

Technical Overview:

The 4-hour chart reinforces the daily analysis.

Wave iii) orange continues its upward move, with a near-term target of 100.00.

A smaller degree wave iii grey also projects toward 90.00.

Invalidation Level: Any drop below 74.25 would signal a potential change in the wave count.

Technical Analyst: Hua (Shane) Cuong, CEWA‑M (Certified Elliott Wave Analyst – Master Level)

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: AMCOR PLC – AMC Elliott Wave Technical Analysis

VALUE Offer - $1 for 2 Weeks then $29 a month!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

The Elliott Wave count on ASX:NEM supports both long-term and short-term trend analysis. With price validation and invalidation zones clearly defined, traders can confidently interpret potential market moves. Monitoring levels near 90.00 and 100.00 remains critical for managing risk and capitalizing on upward momentum in NEWMONT CORPORATION's share price.