AMCOR PLC – AMC Elliott Wave Technical Analysis | TradingLounge

Greetings,

This Elliott Wave market update presents a current technical outlook for AMCOR PLC (ASX:AMC) listed on the Australian Stock Exchange (ASX). The price structure suggests a strong setup for a possible Wave 3 bullish advance. This report identifies essential target levels and key invalidation points supporting this wave scenario.

AMCOR PLC – AMC Elliott Wave Forecast and Technical Outlook 1D Chart Analysis (Semilog Scale)

Function: Major Trend (Intermediate Degree, Orange)

Mode: Motive

Structure: Impulse

Wave Position: Wave 3) – Orange

Details:

Wave 3) – Orange is forming upward. Starting from the recent low of 13.35, wave 3)) – Navy appears to be in an extended bullish formation. It subdivides into wave 1), 2) – Orange, which seem to have completed. From the low of 13.82, wave 3) – Orange is projected to continue higher, targeting a price range between 17.56 and 20.37.

To maintain this bullish momentum in wave 5)) – Navy, the price action must stay above 13.82.

Invalidation Point: 13.86

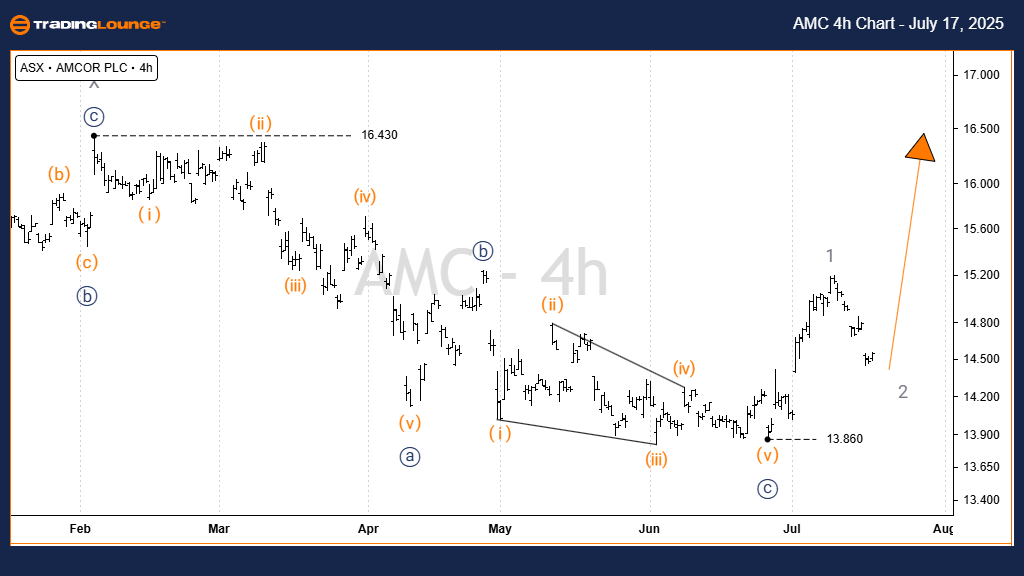

AMCOR PLC – AMC Elliott Wave Analysis | TradingLounge 4-Hour Chart Forecast

Function: Major Trend (Intermediate Degree, Orange)

Mode: Motive

Structure: Impulse

Wave Position: Wave 3) – Orange

Details:

The wave structure remains intact. Price action continues to trend upward, targeting the recent high of 16.43, with further upside potential.

Holding above the 13.86 support is essential for this bullish forecast to remain valid.

Invalidation Point: 13.86

Technical Analyst: Hua (Shane) Cuong, CEWA‑M (Certified Elliott Wave Analyst – Master Level)

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: MINERAL RESOURCES LIMITED Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

This Elliott Wave analysis on AMCOR PLC – AMC identifies key long-term price trends and short-term trading opportunities.

We highlight critical zones for wave validation and invalidation, enhancing the accuracy of our market outlook.

By combining structured technical insight with targeted price projections, our goal is to support traders with a consistent and professional market forecast.