EICHER MOTORS Elliott Wave Analysis – Trading Lounge Day Chart

EICHER MOTORS Day Chart Analysis

EICHER MOTORS Elliott Wave Technical Analysis

FUNCTION: Bullish Market Trend

MODE: Impulsive Pattern

STRUCTURE: Developing Orange Wave 3

POSITION: Advancing Navy Blue Wave 5

DIRECTION NEXT LOWER DEGREES: Formation of Orange Wave 4

DETAILS:

Orange Wave 2 appears completed, initiating the upward move of Orange Wave 3 or the final phase of Navy Blue Wave 5.

The daily Elliott Wave analysis of EICHER MOTORS stock highlights a clear bullish trend. The chart displays an impulsive structure, supporting upward price momentum. Currently, Orange Wave 3 is evolving, embedded within the larger Navy Blue Wave 5. This structure suggests a sustained rally nearing the end phase of a long-term bullish cycle.

With Orange Wave 2 likely finalized, price action has entered the dynamic Orange Wave 3 – typically the strongest wave in Elliott theory. This wave often drives rapid price increases. Once Orange Wave 3 completes, a corrective Orange Wave 4 is expected before any further upward movement resumes.

This Elliott Wave pattern implies that EICHER MOTORS shares could extend their upward momentum. As Orange Wave 3 progresses, strong buying activity is anticipated. However, traders should monitor closely, as this third wave unfolds within a fifth wave, hinting at the nearing conclusion of Navy Blue Wave 5’s broader cycle.

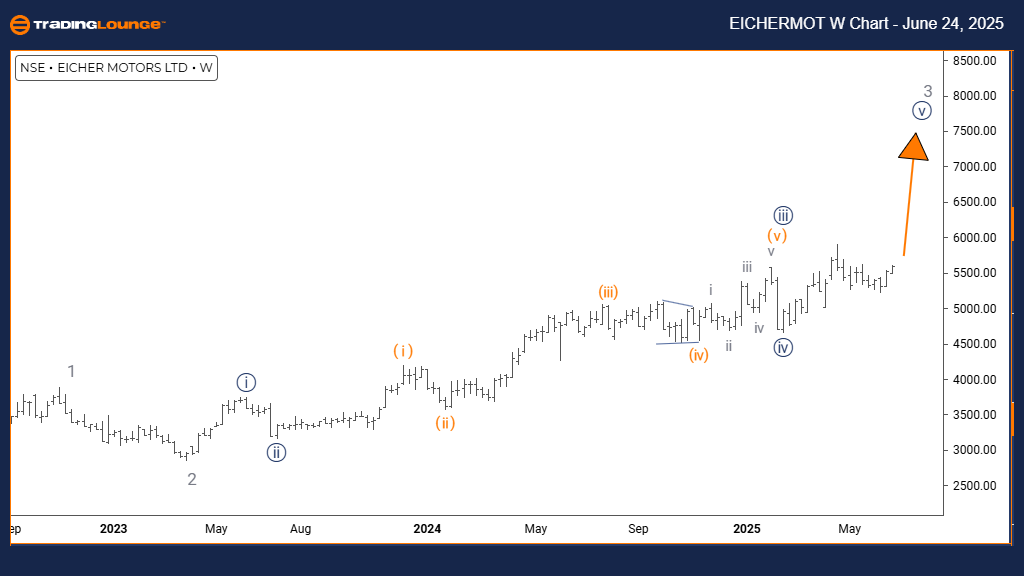

EICHER MOTORS Elliott Wave Analysis – Trading Lounge Weekly Chart

EICHER MOTORS Elliott Wave Technical Analysis

FUNCTION: Continued Bullish Trend

MODE: Impulsive Movement

STRUCTURE: Progressing Navy Blue Wave 5

POSITION: Active Gray Wave 3

DIRECTION NEXT HIGHER DEGREES: Navy Blue Wave 5 Continuation

DETAILS:

Navy Blue Wave 4 has concluded; Navy Blue Wave 5 of 3 is currently developing.

The weekly Elliott Wave chart of EICHER MOTORS confirms a long-term bullish trajectory. The price is moving impulsively, with the pattern showing the progression of Navy Blue Wave 5 within Gray Wave 3. This configuration signals the stock is advancing through the last leg of its upward cycle.

Navy Blue Wave 4’s correction appears complete, allowing for the start of Navy Blue Wave 5. Historically, this wave exhibits strong price action and marks the conclusion of an Elliott sequence. As this fifth wave develops under Gray Wave 3, potential price gains could remain, though a trend reversal may follow.

This technical structure indicates possible further upside for EICHER MOTORS stock. With Navy Blue Wave 5 gaining traction, buyer interest remains robust. Still, since this is the fifth wave of Gray Wave 3, caution is recommended as the stock may soon approach the end of its current bullish trend.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: AXIS BANK Elliott Wave Technical Analysis

VALUE Offer - $1 for 2 Weeks then $29 a month!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support