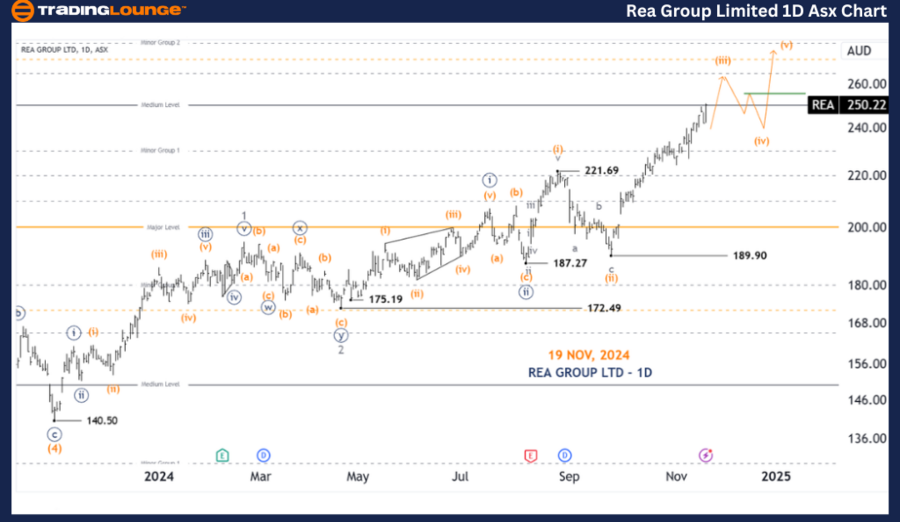

ASX: REA GROUP LTD – Elliott Wave Technical Analysis and Forecast

Introduction

Welcome to today's Elliott Wave analysis for ASX: REA GROUP LTD (REA). Our focus is on providing an updated technical analysis using the Elliott Wave framework. Current observations suggest that REA.ASX is progressing within wave (iii), preparing for a pullback in wave (iv), before advancing further with wave (v). Below, we detail the analysis for both the daily and 4-hour charts to offer comprehensive insights.

ASX: REA GROUP LTD – REA 1D Chart (Semilog Scale) Analysis

Key Observations

REA Elliott Wave Technical Analysis

Function: Major trend (Minor degree, gray)

Mode: Motive

Structure: Impulse

Position: Wave (iii)-orange of Wave ((iii))-navy

Analysis Details

Invalidation Point: 221.69

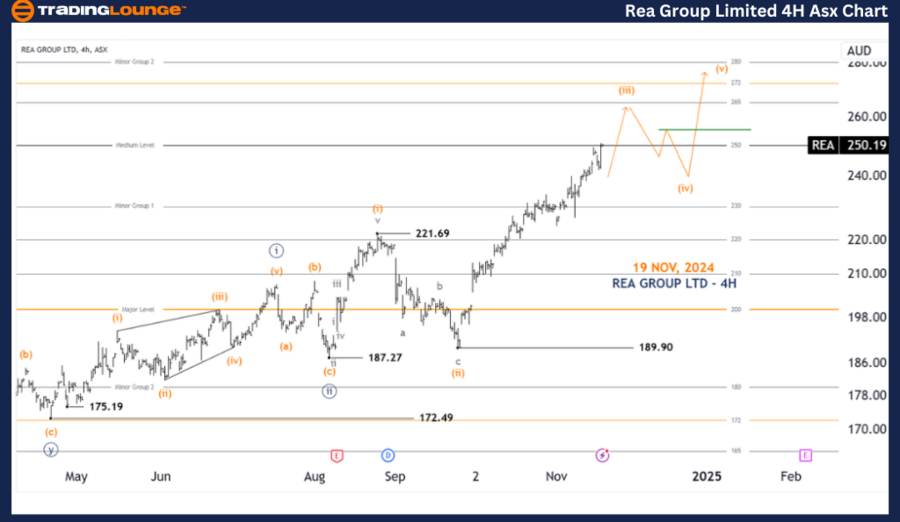

ASX: REA GROUP LTD – REA 4-Hour Chart Analysis

Key Observations

Function: Major trend (Minuette degree, orange)

Mode: Motive

Structure: Impulse

Position: Wave (iii)-orange

Analysis Details

Invalidation Point: 221.69

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: TELSTRA GROUP LIMITED (TLS) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

Our Elliott Wave analysis for ASX: REA GROUP LTD highlights the progression of the stock within wave (iii), with clear expectations for a pullback and subsequent advancement. Key price levels, including the invalidation point at 221.69 and the Medium Level at 250.00, offer critical guidance for traders. By leveraging these insights, investors can identify potential long trade setups and navigate market trends confidently. Our goal is to deliver precise and actionable forecasts to empower informed trading decisions.